Today Chancellor of the Exchequer George Osborne delivered his annual Autumn Statement before members of parliament in the House of Commons; the last before next year’s General Election.

Today Chancellor of the Exchequer George Osborne delivered his annual Autumn Statement before members of parliament in the House of Commons; the last before next year’s General Election.

In keeping with previous years the Chancellor’s Statement covered a wide range of topics. Below we’ve concentrated on key points from this year’s Autumn Statement that directly affect the financial situation of individuals and small business owners.

If you’re a small business owner or you’re looking to maximise your individual savings, the key points you should take away from Autumn Statement 2014 are as follows:

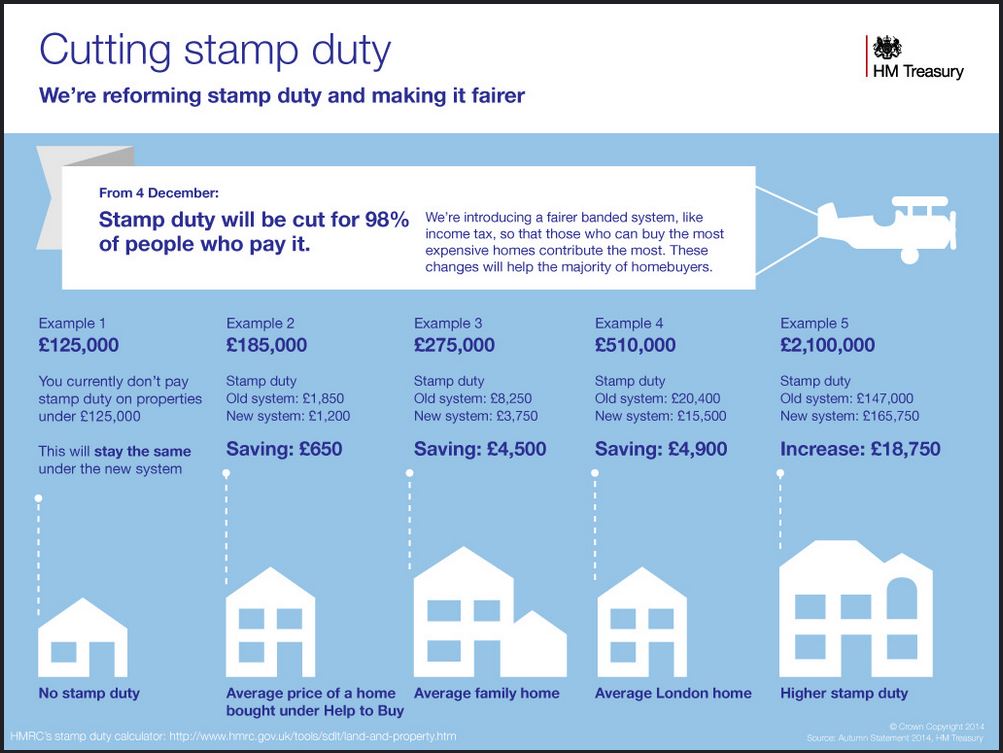

Stamp Duty Cut for 98% of Individuals

Perhaps the most unexpected announcement of this year’s Autumn Statement was the Chancellor’s complete overhaul of stamp duty, with 98% of individuals now looking to pay nothing at all when purchasing a home.

By removing the “slab” system; whereby if your home was sold for a price that fell a penny over into a new tax band you’d have to pay that percentage on the whole sale, Stamp Duty Land Tax (SDLT) has been changed to a progressive tax rate (similar to income tax) whereby you only pay higher tax on the portion of a property’s price that falls into the higher band.

For example, under the new system when you purchase a property for £125,000 or under you pay zero stamp duty, then you’ll pay:

- 2% on the portion between £125,000 and £250,000,

- 5% on the portion between £250,000 and £925,000,

- 10% on the portion between £925,000 and £1.5million,

- 12% on anything above £1.5 million.

The Government estimate that this new policy will save £4,500 on an average priced home across the country.

Applying to residential sales completed after midnight tonight (Wednesday 3 December), it’s been estimated that the point in which homebuyers start paying more stamp duty lies at £935,000; therefore the vast, vast majority of the population purchasing homes below this price will be better off under the new system.

HMRC have a simple graphic to illustrate these changes:

Tax-Free Personal Allowance Increased to £10,600

The tax-free personal allowance has once again increased for the incoming tax year (2015-16), rising from £10,000 to £10,600.

This figure is higher than most estimated, with the Government having previously announced an increase of just £500.00. The higher rate income tax threshold will see a rise from £41,865 to £42,385 over the same period.

Spouses to Inherit Partner’s ISA Benefits

In a surprise move by the Government, the Chancellor announced during Autumn Statement 2014 that any amount of money held in an ISA at the time of an individual’s death will now be able to be transferred across to the surviving spouse to invest into their own ISA.

Under the current system the surviving spouse (or civil partner) would have inherited their spouse’s ISA without having to pay Inheritance Tax (IHT). Under the new system, however, now only will the surviving spouse be able to inherit their spouse’s ISA tax-free, they’ll also inherit its tax-free status, which they’ll then be able to combine with their own.

The new tax-free annual ISA limit is set to increase from £15,000 to £15,240.

Pensions

Having covered pensions fairly conclusively during Budget 2014, during today’s Autumn Statement Mr. Osborne focused on the Government’s plans to allow individuals to pass their unused pension pots on to their loved ones tax-free:

In this Autumn Statement, I confirm that the 55% death tax that currently applies when you pass an unused pension pot on to your loved ones will be abolished. People will be able to pass on their pensions to their loved ones tax-free.

The Chancellor also noted that anybody who dies under the age of seventy-five will be allowed to pass on their annuities tax-free; and the beneficiaries of anybody who dies under the age of seventy-five owning a joint life or guaranteed term annuity will receive future payments from these policies tax-free.

Small Business Rates to be Cut and Capped

Moving on to the key takeaway points of this year’s Autumn Statement for small business owners; the Government have made a plan to cut and cap business rates across the board.

This includes an increase in the current high street discount from £1,000 to £1,500 between April 2015 and March 2016, a discount that currently benefits over 300,000 high street businesses (such as restaurants, shops, and pubs) across the country.

The Government also plan on doubling Small Business Rate Relief for another year; allowing over 380,000 small businesses to not pay any rates at all; significantly improving their bottom line. The annual increase in business rates for small business owners who do pay will be capped for another year, between April 2015 and March 2016, benefiting small business owners across the board.

Small Business Research and Development Tax Credits Increased

Research and development tax credits can be a lifesaver for small businesses attempting to innovate and move into new areas on a tight budget.

To help small business owners along on their way, today the Chancellor announced the Government is to increase research and development tax credits for SME (small to medium-sized) businesses from 125% to 130% for all qualifying expenditure that’s incurred after 1 April 2015. For more on research and development relief, see the detailed article we wrote on the topic earlier in the year.

Employer NICs on Apprentices Under-25 Abolished

If you’re a small business owner looking to take on an apprentice you’ll be heartened to know that the Government have decided to abolish employer National Insurance Contributions (NICs) for apprentices under 21 from April 2015, and apprentices under 25 from April 2016 (assuming they earn less than £42,000 per annum).

For more information on the Autumn Statement, you can read Chancellor George Osborne’s speech on the full Autumn Statement 2014.

Understanding Autumn Statement 2014

To speak with a professional to discuss the implications of Autumn Statement 2014 on your small business or personal finances, contact us today on 020 7129 1199 or get in touch with us via our contact page to arrange a complimentary, no obligation meeting.

This blog is a general summary. It should not replace professional advice tailored to your specific circumstance.