A Guide to Understanding and Improving Your Balance Sheet

Understanding and managing your business’s balance sheet is an essential part of any successful company. A balance sheet is a financial statement that provides a snapshot of what you own (assets) and what you owe (liabilities). It's important to keep track of this information so that you can stay within your budget, pay off debt, and make sure your cash flow is healthy. Let's take a look at how to understand and improve your balance sheet.

Understanding and managing your business’s balance sheet is an essential part of any successful company. A balance sheet is a financial statement that provides a snapshot of what you own (assets) and what you owe (liabilities). It's important to keep track of this information so that you can stay within your budget, pay off debt, and make sure your cash flow is healthy. Let's take a look at how to understand and improve your balance sheet.

Components of a balance sheet

A balance sheet is a financial document that provides an overview of the company’s assets, liabilities, and equity. It shows the business’s net worth and provides detailed information about the company’s assets (what it owns) and liabilities (what it owes).

A balance sheet is made up of three components: assets, liabilities, and equity. Assets are anything that has value for the company and can be used to generate income or pay expenses. Examples include cash, accounts receivable (money owed to the company from customers), inventory, buildings, equipment, investments, or trademarks. Liabilities are any debts or obligations that the company owes money on. These can include loans, mortgages, credit cards, accounts payable (money owed by the company), accrued expenses (like wages or taxes), or other debts that need to be paid off in the future. Equity is the difference between all the assets and liabilities, it's what's left over after all debts are paid off. This includes any profits that have been retained by the business rather than distributed as dividends to shareholders.

Tips for improving your balance sheet

Once you have an understanding of what makes up your balance sheet, you can start making improvements. Start by looking for ways to reduce expenses; for example, renegotiating contracts with suppliers or seeking out cheaper sources for materials or services. You can also look for ways to increase profit; for example, expanding into new markets or offering new products/services. Finally, review your debt level; if they are high then consider refinancing them through lower interest loans which could save you money in the long run.

- Monitor Cash Flow: Monitoring your cash flow will help you ensure that you have enough money on hand to cover expenses. This will also help you avoid overdrawing from accounts or taking out unnecessary loans.

- Utilise Loans Wisely: Use any loans you take out wisely by paying them back on time and using them for their intended purpose only. Taking out more than necessary in loans can increase interest payments over time, which can affect your bottom line negatively.

- Consider Investing: Investing in stocks, bonds, mutual funds, or other investments can help grow your business’s asset portfolio over time, meaning more money available for future projects or expansion opportunities down the road. However, be sure to do research before investing so that you know exactly where your money is going.

- Reevaluate Expenses: Take some time to regularly review expenses for any unnecessary items that could be cut back on or eliminated altogether in order to save money in the long run. This could include things such as subscriptions or memberships that may not be used often enough to justify their cost each month.

How to read your balance sheet

The best way to read a balance sheet is to start with understanding its structure. The left side of the balance sheet should contain all assets listed in order from most liquid (cash) to least liquid (tangible assets like buildings). The right side should contain all liabilities listed from most current (accounts payable) to least current (long-term debt). Once you understand how a balance sheet is organised you can begin reading it more thoroughly looking at each asset and liability individually. This will give you an idea of how much money is coming into your business versus how much money is going out, and if there’s enough left over for profit!

- Cash: Cash on hand plus any short-term investments in marketable securities

- Accounts Receivable: Money owed by customers for goods or services provided

- Inventory: Goods held for sale by the business

- Buildings: Long-term real estate investments owned by the company

- Equipment: Tools used for production or office use owned by the company

- Investments: Securities such as stocks and bonds owned by the company

- Trademarks: Intellectual property owned by the company

- Loans: Loans taken out by the business from banks or investors

- Mortgages: Long-term loans taken out from lenders secured against real estate investments

- Credit Cards: Credit card balances owed to creditors

- Accounts Payable: Money owed by businesses to vendors/suppliers

- Accrued Expenses: Expenses incurred but not yet paid such as wages/taxes

- Long Term Debt: Debt obligations due more than 12 months in future

- Equity: Difference between total assets & total liabilities; retained earnings plus capital stock issued minus dividends paid out

Being aware of what goes on with your business’s balance sheet is essential if you want to succeed in managing finances effectively and staying within budget constraints while still growing financially over time. By monitoring cash flow carefully, utilising loans wisely when needed, investing strategically when possible, reevaluating expenses regularly, businesses will be well equipped with the knowledge they need to maintain a healthy balance sheet year after year!

Also, your balance sheet is an essential component of your management reporting. It gives you clear insight into your business’s financial health, providing instant access to the essential financial data required to make smart management decisions. From recording cash payments and invoices to reconciling cloud accounting transactions, the balance sheet can help you benchmark performance and position yourself for future growth. With easy-to-read insights, however complex your management report may be, the balance sheet clearly displays key performance indicators that reveal the true picture of your finances.

Choose TaxAgility as your accounting services provider

With these tips in mind, understanding and improving your balance sheet should become easier, allowing your business to achieve success without compromising its financial health!

Naturally, with TaxAgility as your accounting services provider, we can help you improve the financial strength of your company and lessen the burden of managing balance sheets and management reporting through our cloud based accounting solutions. Just call us today on 020 8108 0092 and find out how.

2023 trends businesses can embrace in the search for competitiveness

Developing or adjusting your business plan for the coming year, will likely take into account many of the broader economic factors that may affect you, such as the economic outlook, inflation, interest rates, supply chain issues and money supply. However, businesses are also affected by trends, such as customer expectations, enabling or disruptive technologies, working patterns, and societal values. These are more intangible, but nevertheless can have a significant impact on a business’s success. In this article we will look at some of the prominent trends in 2023.

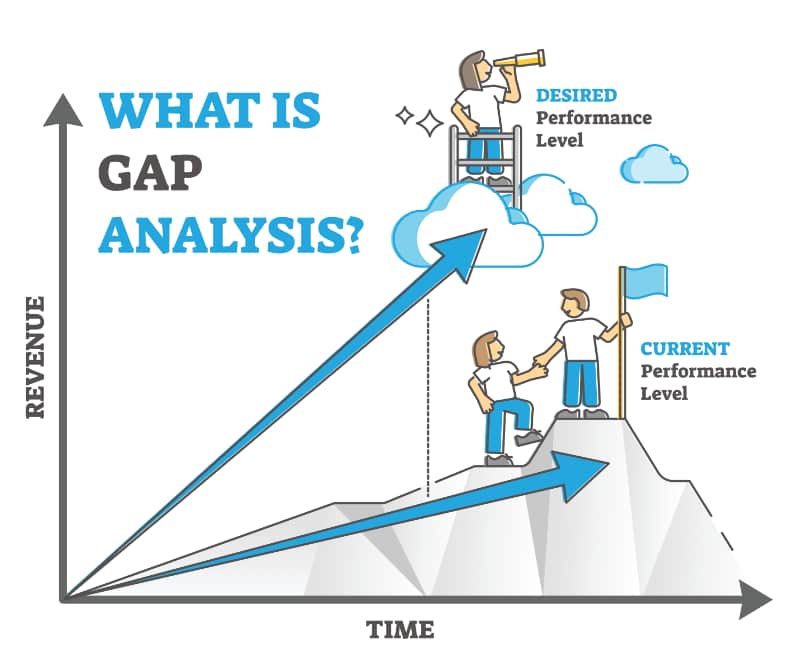

Identifying trends and revisiting the GAP Analysis

Trends are powerful market signals that shouldn’t be ignored. However, understanding exactly how they may apply to your business can be a little more difficult to interpret, as they may or may not have an impact on many areas of your product or service, or even how your business operates or is perceived from a brand perspective by your customers and market in general. This is where a little bit of analysis and a tool called GAP analysis comes in handy.

A GAP analysis is a simple tool that takes data and observations from your customers, market and competitors and makes sense of where others may be focused or not. It allows a business manager to spot where competition is especially strong and why, and therefore probably best to avoid. It also shows where competitors may be weak, perhaps from the perspective of a whole product or down to specific features. Weakness may be because of a lack of customer interest or market demand, but for the savvy business person, it might be because the area or niche may not have been explored or developed yet. This is where monitoring trends is especially powerful, as it may point to an opportunity to leverage a trend to develop an area of business others may have ignored because of market weakness.

A GAP analysis is a simple tool that takes data and observations from your customers, market and competitors and makes sense of where others may be focused or not. It allows a business manager to spot where competition is especially strong and why, and therefore probably best to avoid. It also shows where competitors may be weak, perhaps from the perspective of a whole product or down to specific features. Weakness may be because of a lack of customer interest or market demand, but for the savvy business person, it might be because the area or niche may not have been explored or developed yet. This is where monitoring trends is especially powerful, as it may point to an opportunity to leverage a trend to develop an area of business others may have ignored because of market weakness.

Performing a GAP analysis in concert with a regular review of your market and competitors, is a powerful way to spot opportunities that others may have missed. Smaller businesses simply can’t be everywhere at once and so tend to focus on specific areas of their market or certain features of a product that customers really like. As time goes by, trends will likely force small businesses to shift focus, sometimes subtly, other times though, quite significantly. As with the impact of Covid, some businesses had to fundamentally change the way they managed and engaged with the clients. This showed a lot of businesses new ways to be successful. However, many couldn’t meet the challenge and closed.

Where does the data to power a GAP Analysis come from?

There are different ways to conduct a gap analysis, one is to look at your business strategy and goals and where you’d like to be in the future, then identify the aspects of the business that you need to achieve your goal that currently are not in place. Another is to examine the strengths and weaknesses of a product and service compared to your competition and perceived market demand, or more importantly when considering trends - future market demand.

Essentially though, the analysis requires you to break down your product or service’s main features, pricing, distribution capabilities and other aspects of your business that contribute to market success. Then do the same for each of the main competition products. As you do this, rate them from 1 to 10 in terms of strength or attractiveness.

It requires some pretty extensive research, even maybe a little covertly as you try and peer into your competitor’s operation. Eventually though, you’ll start to see aspects of your product or service that either outperform, under perform or are completely missing from your’s or their offering. Add in the consideration for current and upcoming trends, and you’ll start to see areas where maybe you could outperform your competitor (or market), by acting early. You may even realise that your competitor is already doing this!

There are many sources of data for this research, examples are:

- Search engine searches around products, features, and capabilities will yield a fair amount of information.

- Independent market analysis reports that highlight company and product capabilities.

- Product comparison sites set products or services against each other and may also tear down products to examine how they are built.

- Annual reports, shareholder reports, investor analysis.

- Buy some of your competition’s products and test them yourself.

What are some of the trends small businesses will likely experience in the company year that businesses can explore and potentially plug into a GAP analysis?

Sustainability and brand responsibility

Consumers are becoming more sensitive to sustainability issues in their purchasing habits. While many are seeking to minimise the purchase of products that employ single use plastic, others are looking deep at the products themselves, for instance, once they have outlived their useful life, can they be reused for something else. Or, if they break, can they be repaired? Many products are simply not worth sending back to a manufacturer for repair, but just like used cars, some products can find repair solutions from third party providers.

As time marches forward, more and more consumers will give more credence to the reliability and durability of products. While affordability must remain a priority for businesses, the old adage of ‘cheap and cheerful’ is less likely to apply. However, given the economic hardship many are experiencing, the challenge for businesses is to deliver affordable sustainability.

Sustainability also requires businesses to look at where their product components originate from. Are those manufactures using materials that have been sustainably sourced?

In short, consumers, or indeed other businesses (B2B), increasingly expect a business to demonstrate responsibility throughout their business practices, for environmental issues.

Immersive experiences

As technology delivers new ways to experience and interact in our daily lives, expectations on the consumer front also grow. Introducing new ways for your customers to experience your products or services before buying is a growing trend. Technologies such as augmented reality and virtual reality, provide ways for businesses and clients to interact in new ways, whether that be at the customer service level, or in being able to experience or examine a product without actually being in contact with it, or even in the store.

As technology delivers new ways to experience and interact in our daily lives, expectations on the consumer front also grow. Introducing new ways for your customers to experience your products or services before buying is a growing trend. Technologies such as augmented reality and virtual reality, provide ways for businesses and clients to interact in new ways, whether that be at the customer service level, or in being able to experience or examine a product without actually being in contact with it, or even in the store.

As sustainability concerns grow, more customers will want to know a lot more about your product and the processes and materials used to bring it to market. The use of augmented or virtual visualisation technologies, will enable customers to ‘up close and personal’ to a product in the comfort of their own homes or at their leisure in a store.

A fully immersive experience, such as through virtual reality headsets, will enable a business to personalise their customer’s experience of their brand. This is especially important for higher value purchases, such as homes, cars, investments, leisure, travel, hospitality, design services, etc.

Ethical consumer spending and your ESG strategy

Consumer ethics have been shifting for some time, but over the past couple of years concern for the environment has accelerated. The pressure is now considerable for brands to do more than just talk about the ethical issues, they now have to live and breathe them.

Enter the subject of ‘Environmental, Social, and Governance’ strategy. An ESG strategy sets out your understanding as to how your business impacts the world it operates within and how your business is responding to help mitigate any negative consequences, or to eliminate them altogether.

By focusing on ESG, one also becomes aware of the potential for a growing raft of legislation around sustainability issues to impact the business. One can therefore put better plans in place to embrace these changes, and even identify new opportunities.

Popular terms have arisen that cast doubt on a brand’s commitment to ecologically sensitive practices, workforce welfare and labour exploitation in overseas supply chains. No brand is above this and one only has to look at a huge list of companies called out for ‘greenwashing’: Volkswagen, BP, ExxonMobil, Coca-cola, Nestlé, IKEA, Starbucks . . . the list goes on.

Popular terms have arisen that cast doubt on a brand’s commitment to ecologically sensitive practices, workforce welfare and labour exploitation in overseas supply chains. No brand is above this and one only has to look at a huge list of companies called out for ‘greenwashing’: Volkswagen, BP, ExxonMobil, Coca-cola, Nestlé, IKEA, Starbucks . . . the list goes on.

While this sounds like a problem for the big brands, it actually affects all businesses. If a smaller business wants to attract clientele from its local community, one way to stand out is through promoting the ethicality and sustainability aspects of the business. Most communities want to support the local businesses amongst them, but full support falters when the business can’t tell customers the source of their products and services, or provide inaccurate information in doing so. As an example, fresh produce providers, such as one’s local butcher or baker go to great lengths to promote factors such as ‘locally’ sourced, organic feed, hormone free, etc. But many others either don’t go to such length, or simply don’t understand or care.

The same ethical standards apply to any business, even if it’s a matter of the working practices, from where basic materials are sourced, employee welfare, recycling, energy use, outsourcing strategy and controls, etc.

Having a well documented and publicised ESG strategy is becoming crucial to even smaller firms and will help businesses in highly competitive markets to differentiate. It shows that your business is not just ‘talking-the-talk’, but is also ‘walking-the-walk’.

ECO sensitive supply channels

Given the discussion in this article’s previous two topics, ensuring your business adopts the same principles with your supply chain would appear obvious. However, ‘greening’ the supply chain can be seen by businesses as “somebody else’s problem”. While you can’t dictate how the businesses in your supply chain go about their business, it is still your problem, as you have a choice as to the companies you work with.

It’s important then, not to overlook the greening issue when reviewing your suppliers, whether this is simply office supplies or a more extensive supply issue within a manufacturing process. Put simply, any ESG strategy you have needs to audit those upon whom you rely on to complete your product or service offering.

The plus side of working with other firms committed to greener businesses, is that you know they are committed to providing a more sustainable service to you. This helps you future proof your own business!

Ongoing digital transformation

Streamlining your business processes through the use of new technologies that integrate and automate multiple areas of your business’s processes, creates a wealth of ways to enhance efficiency. Much of this is discussed on our services page on Digital Enablement and some benefits further discussed in our article on how digital enablement can help reduce fraud.

Digital enablement activities within businesses are set to accelerate over the coming year. For larger firms this may be part of a broader digital transformation strategy. For smaller firms, the activity may centre around consolidating functional areas and applications, and creating greater integration between previously disparate systems. On the simplest level, digital enablement may just mean adopting more online applications as a way to improve financial management information, for example Xero, or increase connectivity and communication around job functions or customer management.

Digital enablement activities within businesses are set to accelerate over the coming year. For larger firms this may be part of a broader digital transformation strategy. For smaller firms, the activity may centre around consolidating functional areas and applications, and creating greater integration between previously disparate systems. On the simplest level, digital enablement may just mean adopting more online applications as a way to improve financial management information, for example Xero, or increase connectivity and communication around job functions or customer management.

One thing is for sure though; successful businesses in the future are going to be using the digital applications and services available to improve their own efficiency so as to maintain competitiveness. And, such efficiencies also play a strong role in supporting and achieving a company’s ESG goals.

Spend a little time considering how these and, no doubt a host of other trends, could be used in concert with a GAP Analysis, to look at new ways to not only build a stronger form sustainable business, but to find new ways in which to differentiate your business longer term.

Working with TaxAgility can improve the chances of your business’s long term success

As a firm of accountants and business professionals, we’ve had the privilege of working with many clients, helping them grow and understand how to make their business operate more efficiently. The challenges facing businesses today seem endless and often quite daunting. The crises businesses have faced recently haven’t helped either. Your business can benefit greatly by having a partner, like TaxAgility, both advise and support in helping your business become more efficient and grow successfully over the coming years.

Why not give us a call today and see how we can help you. Just call 020 8108 0090

How do CGT Transfers between separating spouses work?

The government recently announced plans to give separating couples a longer period in which to consider and transfer their assets and avoid Capital Gains Tax, as currently, depending when the planned separation takes place, time may be very limited and impractical. This is known as ‘no gain or no loss’ transfers.

From April 6th 2023, separating spouses or civil partners, will be allowed up to three years to make any agreed split in assets transferred between each other, after they have split up.

From April 6th 2023, separating spouses or civil partners, will be allowed up to three years to make any agreed split in assets transferred between each other, after they have split up.

NOTE: These plans are currently only draft legislation, so given how fluid government seems these days, this may or may not happen.

Separating from a spouse or civil partner is one of those events where those involved often fail to consider the immediate tax implications of the event. The overarching financial implication for those involved, i.e. who gets what and in what proportions, can be all consuming. If they are fortunate, their lawyers may suggest that they obtain independent financial advice and tax guidance, which may help them realise that simply dividing assets may not be that simple.

The current CGT position for separating couples

A normal part of being married or in a civil partnership is that you are allowed to transfer assets to one another without consequences and without incurring Capital Gains Tax. This can be cash, investments or any other asset, such as the family home or even rental property. The main consequence is that the transferee becomes responsible for any tax liabilities upon disposal of the asset. For example, if a rental property owned by one partner is transferred legally to the other and they decide to sell at some point in the future, the receiving partner will be required to make the declaration to HMRC.

The cost basis for the transfer while married or in a civil partnership is that of the original purchase, including fees. So if a home was purchased for £200,000 20 years ago and is now worth £500,000, it makes no difference, the transfer is based on the original £200,000. However, if the recipient of the transfer then decides to sell at some point in the future, the actual capital gain is realised (£300,000) and CGT becomes due.

How does the sale of the matrimonial home impacted by CGT?

Sometimes in divorce or separation cases, the family home may remain jointly owned, while the other partner moves out. This might be the case where children are involved and rather than upset their lives further, one parent stays in the family home.

If the family home is sold at a later date, the partner who remained in the home and treated it as their main residence will not be liable for CGT. However, if the sale was made more than nine months after they moved out, the partner who did leave will likely face a CGT bill for the proceeds of the sale of their portion of the home. If it was before the nine months, they will be exempt.

There is still relief available to the leaving spouse after nine months though. This is when the spouse transfers their share of the jointly owned property to the other, prior to the property being sold. However, there are conditions, these are:

The property continues to be the other spouse's main residence.

A Consent Order governs the transfer and a claim is made within two years to HMRC.

The spouse who left does not yet have a new principle residence.

Meeting these conditions will allow the leaving spouse to enjoy relief from CGT for the period of moving out to the point of the asset transfer.

Be mindful of the tax year end date - April 5th

Under current legislation, it’s very important to keep in mind the end of the tax year, i.e. April 5th. Separating couples can continue to transfer assets under a ‘no gain no loss’ basis up to the end of the tax year of separation. After that, the transfer is considered in the same way as if it were a straight property sale and capital gains tax is payable if it is applicable.

Not all separations are straight forward. It may take many months to negotiate and finalise details of an assets new ownership, and for the transfers to actually take place. As April 5th approaches, an unreasonable level of pressure may come to bear on the parties to resolve the issue quickly, possibly in a manner detrimental to one or both parties.

It is for this reason and others that the government has proposed the introduction of the new scheme; essentially to allow a reasonable period of time in which to settle the affairs for the separation and reduce the stress involved.

What are the new rules being proposed for April 6th 2023?

This is what the government have said:

- Separating spouses or civil partners be given up to three years after the year they cease to live together in which to make no gain or no loss transfers

- No gain or no loss treatment will also apply to assets that separating spouses or civil partners transfer between themselves as part of a formal divorce agreement

- A spouse or civil partner who retains an interest in the former matrimonial home be given an option to claim Private Residence Relief (PRR) when it is sold

- Individuals who have transferred their interest in the former matrimonial home to their ex-spouse or civil partner and are entitled to receive a percentage of the proceeds when that home is eventually sold, be able to apply the same tax treatment to those proceeds when received that applied when they transferred their original interest in the home to their ex-spouse or civil partner

What does this mean in practice?

Year end deadline is no longer a problem. There’s no pressure to complete transfers for separations in a tax year by the end of that tax year.

This applies equally to separating or divorcing for earlier years, so in this case 2019/20 and 202/21. Furthermore, if asset transfers are part of a formal divorce or court separation agreement, it may be possible for the ‘no gain no loss’ treatment to be applied for even earlier years.

Tax implications can be quite complex and require expert guidance

Many divorces or separations are relatively simple because not many assets are involved and may have a simple remedy and tax treatment. However, some divorcing or separating couples have quite complex assets involving not just a family home, but often rental properties, company ownership, income from stocks and shares, pensions, to name a few. In these circumstances, you’re best to proceed under the guidance of a professional tax advisor familiar with such circumstances.

At TaxAgility, we’ve assisted numerous individuals navigate the potential mine field divorce, separation and tax represents. Why not give us a call on 020 8108 0090 and find out how we can assist you.

Planning for a challenging 2023 and beyond

As we reach the end of another year, business owners turn their attention to their goals and objectives for the following year. In this article we will review the challenges ahead and some of the issues businesses will face and need to fully consider in their business planning for 2023 (and beyond).

Next year, businesses continue to face an unprecedented set of challenges. Globally, economies are highly unsettled, at home we face the significant challenges presented by high inflation rates and a looming economic recession. So how should business owners approach business planning in 2023?

Next year, businesses continue to face an unprecedented set of challenges. Globally, economies are highly unsettled, at home we face the significant challenges presented by high inflation rates and a looming economic recession. So how should business owners approach business planning in 2023?

The purpose of this post isn’t to teach you how to write a business plan. Its intention is to help you look at the implications of what has happened over the past few years and some issues you might need to consider in more detail as you set out your plan for 2023.

With that in mind, let’s recap the events of the past year or two, as this has a fundamental impact on the scope of planning and the considerations that need to be made.

What are the principal events that have occurred recently that will likely shape your business in 2023?

Over past year we have and continue to experience the impact of five major events:

Covid 19

Covid has had and continues to have an impact on not just business but also on the attitudes of employees and consumer trends. Whether you run a business or not, you were affected in some way, and for many, this changed their outlook on life. This can’t be underestimated when considering how your business may have to change in the next year.

Covid also shut down or severely impacted many global supply chains, especially with those in the east.

Russia’s invasion of Ukraine

Just like Covid, this was somewhat of a surprise event. Its main impact has been on energy markets. As energy underpins just about everything we do in life, it has affected everyone, from everyday fuel costs, home heating bills, office energy bills, manufacturing, transportation, the list goes on. As for many businesses, energy is a basic cost, it impacts the bottom line. In a bid to maintain profit margins, suppliers and manufacturers have had to increase prices. Along with this and the rise in energy prices, we have seen inflation rise to near historic levels, leaving many homes and businesses alike wondering how they can simply stay afloat.

So, simply put, the impact of Russia’s invasion of Ukraine has been on inflation.

Liz Trust’s disastrous budget

In an attempt to win the hearts and minds of her party and the people, her actions which included tax cuts and new spending had the opposite effect. A crisis in bond markets and lack of global confidence sent the pound falling against the Dollar and Euro, pushing the UK towards a recession.

This has made importing raw materials more expensive, adding to the cost pressures businesses face.

Inflation & industrial action

Although we have already mentioned inflation as an outcome of Russia’s actions, it stands as an event on its own. Inflation hits everyone's pockets. This has led to a wave of industrial action in recent months, particularly transportation, as workers seek to balance income and costs.

We all need to get around to either go to work or do business, and so transport strikes hit the hardest. Covid, has in many respects, toughened our ability to cope with this issue, largely because businesses had to adapt to new working practices through the lockdowns. Working from home is now widely practiced and so many companies have just learned to adjust to this.

However, many businesses rely on foot traffic. Retail, hospitality, travel and many service industries rely on people being able to get to them. So while it’s easy to say “we’ll just work from home”, the pubs, bars, cafes, restaurants, hotels, and shops in the major cities that benefit from the large influx of office workers, will suffer. And, given the pressures they are already under, many may still fail.

Brexit

We’ll not say much on this much maligned subject, but needless to say, while some insist ‘Brexit is done’, it really isn’t. Many businesses that regularly trade with the EU are still suffering from the impact of legal changes and the heaps of new administration (or lack of) required to continue as ‘normal’.

Furthermore, for some businesses, it has caused a crisis in staffing, because of a heavy reliance on foreign workers.

What is the economic outlook for 2023

Faced with the challenges above, we need to consider the economic environment our businesses will have to cope with in 2023. Several government and government aligned organisations and independent think tanks have commented on the outlook for 2023, here are some of the soundbites coming out of the Government, the Office for Budget Responsibility (OBR), the CBI and the Bank of England.

- With the OBR forecasting a contraction of 1.4% over 2023, the UK is expected to be the first major economy to enter recession.

- Recently The Bank of England warned that the U.K. is now headed for its longest recession since records began a century ago.

- It’s expected that Britain's economy will shrink 0.4% next year as inflation remains high and companies put investment on hold.

- Unemployment is projected to peak at 5.0% in late 2023 and early 2024, up from 3.6% currently.

- In October, British inflation hit a 41-year high of 11.1%, sharply squeezing consumer demand. The CBI predicts it will be slow to fall, averaging 6.7% next year and 2.9% in 2024.

- The U.K.’s hospitality sector is in trouble, again. More than a third (35%) of members say they are at risk of closure early next year due to higher costs, soaring energy bills and weakened consumer spending.

Again, it’s not a pretty picture and so any company reviewing their business plan has a lot to take into account, especially the cost of borrowing and a general increase in costs across the board.

Review your business performance for 2022

Before you can make any planning considerations for 2023, you must review your business’s performance for 2022. There are a number of fundamental aspects of business planning that need to be covered whatever the challenges faced. These include:

- Performance of the company to the current plan.

- Internal challenges that affected your ability to meet the plan.

- External challenges that affect your ability to meet the plan.

Performance

- How did the business perform in relation to the plan for 2022?

- Did you make a profit?

- Did you find you had adequate cash to fund day to day operations?

- Did any operational issues arise that were not planned for and how might these be considered in the future?

- Regardless of whether you made a profit or not, did your sales receipts perform according to plan? If they didn't, what exceptions contributed to this?

- If you made a loss, why? Did competitive price pressures result in price reductions? Was the cost of sales higher than expected, and if so, is this a trend that’s set to continue?

- If sales didn’t perform as expected, what reasons do you attribute to this, such as ‘lack of demand, competitive alternatives, failing brand awareness or poor perceptions, or perhaps a market contraction?

- Have your accounts receivables increased excessively and did this adversely affect your cash flow?

- Did you take advantage of any tax advantages your business may have been entitled to?

Internal Factors

- How did your workforce perform?

- Were there any increases in sick leave, pay demands, etc., that increased your overall costs?

- Are you aware of ongoing inefficiencies that contribute to fluctuations in operations costs, such as legacy systems, poor communication or lack of digital enablement?

- How did your marketing and PR campaigns perform? How might they be improved in the future?

- Did you have to make use of any government or other loans and are the repayments being met?

External Factors

- Did your supply chain perform as expected? I.e. costs held, no disruptions in raw materials or supplies that may have affected product deliveries and sales income.

- Has your market audience’s expectations changed significantly in terms of the products they expect or the messages that support them.

- Have your competitors adjusted their positioning recently in a way that may warrant a response?

- How is your firm responding to the growing expectations from consumers for sustainably produced products and an environmentally friendly organisation?

Every business is different, so one must pick and choose the factors that apply to your business, but for the most part the points above are a checklist most businesses can follow.

It’s a good idea to actually sit and write out answers to these, rather than make a mental check of each, as the answers to these questions are fundamental to modifying or even creating a new plan for 2023.

Setting out the plan for 2023

In this part of the article, we’ll look at some of the key areas of your plan and how the above issues may have an impact.

Scope - take nothing for granted and make no assumptions - the world has changed

While doom and gloom has run riot in the news recently, such downturns may yield opportunities for some. Companies that have acted prudently over the past few years and weathered the storm, may be able to take advantage of those that didn’t.

Competitors, for instance, may have gone out of business. Some however, may be ripe for acquisition, as owners may have decided they have had enough. We mentioned earlier that Covid made people reflect quite harshly on their own individual realities and quality of life. This has led to more than a few walking away from their businesses and looking for a complete change. These businesses are still out there and owners are going through similar thoughts in the face of inflationary issues and significantly higher costs.

One of the first tasks to perform, which may be out of the ordinary for the usual year end planning, is to conduct a new audit of your business. For instance:

- How have the events of the past year or so affected your target market?

- Are your target customers still looking for the same products and services or have their attitudes and expectations changed in some way that may mean your products and services are not as enticing as they were, or simply don’t hit the mark any more?

- Have price points changed?

- Which of your main competitors are still there? How have they been affected? Have their recent actions exposed any changes in their strategy you should take note of?

- Have any new competitors arrived on the scene? Often, dramatic changes in markets see new competitors entering the fray, taking advantage of more mature companies' inability to change quickly enough. Sometimes, these competitors introduce disruptive technologies, products or services, sensing that consumer attitudes and needs have shifted.

- Attention to customer care has featured highly since Covid and it’s a key area for businesses to differentiate. How does your customer care and support services stand up to more critical reviews by your intended customer base?

- How are your systems and processes holding up? Are you burdened by legacy systems that lack integration with other, newer, company systems? How could digitally transforming your company help improve efficiency and ultimately increase profits, or, in the face of higher cost pressures, maintain your profit margins?

Overall goals and objectives for 2023

In light of the changes we have highlighted and those that you may have experienced, think about the goals you set in the next year and how you may logically expand upon them with the knowledge and experience you have now.

You may have an opportunity to expand far beyond your original plan’s expectations, simply because the business landscape you are in may have changed significantly too. It’s rather like looking back at stock market drops; one often laments upon not buying certain stocks when they were at historic lows. Hindsight is a wonderful thing, but today, you really might have an opportunity to grow in ways you didn’t expect. Make sure you seriously consider these as they may not present themselves again.

Conversely, you may realise that the time now is for consolidation and improving the operation you have, rather than any dramatic growth. You may want to consider your business’s progress towards digital transformation and the significant improvements in productivity, performance and security it can offer.

In short, ‘don’t be normal’, because there is no normal, at least for the foreseeable future.

Creating the business plan

Your business plan will comprise several sections, including the financial plan, operational plan, and the sales and marketing plan. Each of these will be unique to your business, shaped by the industry you operate within, the types of products and services you offer, and your approach to competition and pricing, etc. Our concern here relates again to the larger picture, the factors that help you shape your plan. We believe there are some key areas you should consider when drawing up the new plan for 2023. These relate to:

- The economic environment

- Rapidly accelerating business technologies

- Competition for resources

- Customer expectations

- Sustainability

The economic environment

Answering the question outlined earlier in this article will help you gauge your operational capabilities in the face of the challenges we believe you will face. The critical point here is to ensure you fully appreciate how your business has been affected by events to date and its ability to perform in the face of what economic experts believe will occur during 2023.

For many businesses the chief concerns in times of economic turmoil lie with costs, availability and cash flow:

- The costs associated with borrowing money and finance availability

- Costs and availability of supplies

- Cost and availability of labour

- The ability for your client base to pay on time to fund cash flow

Ultimately, you’ll come to a determination that will lead you to either grow aggressively, because:

- You’ve maintained your financial strength and are able to exploit gaps left by competitors who may have suffered.

- Found new niches that have opened because your customer base has evolved over the past few years as they have had to adapt.

Or, you may decide to manage growth more conservatively, by:

- Consolidating your market position.

- Refining and improving your systems and processes to help improve margins and operational effectiveness.

- Focusing on core product and service areas to increase your competitive strength.

- Improving your customer service performance to retain existing and attract more clients.

Of course, for some, a third option is that you may decide that enough is enough and look to exit from the business, which is beyond the scope of this article.

Rapidly accelerating business technologies

The pace of change in the world of technology has been breathtaking in recent years. Many business owners are still struggling to get their heads around the implications of new payment technologies such as blockchain (eCurrencies such as BitCoin) and how artificial intelligence could apply to their systems and processes.

Digital transformation has been a key buzz word for business for quite a few years now, but has accelerated in the past two years, to some extent because of the changes brought about by Covid and the need for remote working, but also because of the surge in online fraud and general criminality associated with business. A business that has successfully integrated its core systems and processes with the remote endpoints of its work forces, and supply chain, is far more resilient to these external forces.

All businesses, big or small, need to embrace digital transformation, have a core digital strategy, and the ensuing digital enablement of key services and processes. The impact of doing this cannot be overstated as it will likely provide the basis for a more competitive business in the coming years.

Competition for resources

Employee attitudes have changed over the past few years. Again, much can be attributed to the trials and tribulations we have all experienced over the Covid years. people’s attitude to the work / life balance has hardened too. It’s made people think about how they want to work and who they want to work for.

It is becoming much harder to attract and retain good talent. Brexit has added its own set of complications where foreign talent is concerned, but needless to say, the process of hiring the right people for the right job is not as it was. You’ll likely find your business competing for talent in areas other than how much you pay, for instance, how much flexibility you’ll allow employees to manage their work/life balance, the facilities you offer them and any benefits associated with the job package.

Customer expectations

In a digital world, instant gratification becomes a de-facto standard. Consumers are now very used to ordering and receiving goods quickly, sometimes even on the same day. Within this world, customer service is not a by-word, it’s a way of life. Many businesses caught out by Covid survived because they reacted quickly to the changes and quickly evolving needs of their clients. Part of this was in having a customer relationship led strategy.

Another rapidly evolving trend is the need to offer immersive and experiential buying processes. The digital world has evolved into a world of augmented reality and virtual reality, that enables customers to experience your brand and products virtually.

Even walk-in stores are not immune to this. Customers want to have memorable and immersive in-store experiences. Here too, augmented or ‘extended’ reality experiences can be incorporated into the in-store experience.

Sustainability

No matter what your buying experience is, whether it’s a basic consumable or booking a holiday, the issue of sustainability and eco-friendly businesses is ever present.

Your business plan absolutely must have a section that outlines your approach to operating a sustainable business; from how you buy your energy, your purchasing processes, the attitude in your business and the expectation on your supply chain.

It’s no good ‘greenwashing’ - the act of talking the talk, but not walking the walk. You must show your customers that you are sincere in your approach and that sustainability is a core tenet of your business plan and corporate philosophy.

Conclusions

It is without doubt that 2023 and probably a few years more will present considerable challenges to business, especially small to medium sized businesses(SMEs). However, by making wise planning decisions based on a sound understanding of the specific issues your business will face, you may find that a surprising number of opportunities reveal themselves.

The main point of this article was to help SME business owners to think in broader terms, specifically because the range of issues facing the world’s economies is so broad.

Years ago, there was a phrase used to captivate thinking around global businesses: “Think global, act local”. This can be applied within the context of issues faced today. Think about the factors affecting your business globally - but not global in a world context, think about the ‘macro’ issues that affect your business - such as customer attitudes, evolving technologies, changing employee behaviour, higher costs affecting supply and demand and sustainability, rather than just the day-to-day uses of running your business. Then consider how these can be adopted at a local level, i.e. within your business and its day-to-day operations.

Those businesses that are creative and flexible enough, typically in thinking and will power, will likely be those that build a successful, competitive and sustainable business long after 2023.

TaxAgility growth advisors

While TaxAgility is a well known and recognised firm of chartered accountants operating in the South London (Putney, Richmond, Wimbledon, Fulham) and Surrey areas, we are intimately involved in the running of client’s businesses. As such we are uniquely positioned to assist businesses like yours meet the growth challenges faced over the coming years.

For TaxAgility, it’s not enough to simply assist clients with their day-to-day accounting requirement, we want to help our client’s businesses grow and succeed.

If you feel your business needs assistance in coping with the challenges outlined in this article, do not hesitate to call and talk to one of our advisors. Call 020 8108 0090 today and find out how we can help.

DIY Self Assessment Tax Return - a good idea?

As we approach the end of the year there’s the inevitable scramble, for those that have to complete an SA100 Self Assessment Tax Return, to either beat the October 31st deadline for paper SA100 returns or the January 31st deadline for electronically submitted returns. The question we ask is: “Should you let an accountant complete the self assessment tax return for you?”. We’ll explore that question in this article.

Completing a tax return is something that can be planned for, especially if you are required to do so, such as those with supplementary income, sole traders, directors, etc. However, as an accounting firm, our busiest time always seems to be in the last few weeks before the January 31st deadline.

Completing a tax return is something that can be planned for, especially if you are required to do so, such as those with supplementary income, sole traders, directors, etc. However, as an accounting firm, our busiest time always seems to be in the last few weeks before the January 31st deadline.

For some, completing an SA100 is a new experience, and often over trivialised, as reporting additional income from a second job or interest from investments appears straightforward. However, one quickly realises that SA100 actually comprises 18 supplementary pages, around 10 of which may apply to many people.

Tempus fugit - time flies, especially when tax deadlines are concerned

Faced with filling out a supplementary page and pressed for time due to the looming deadline, a degree of panic often sets in. The one thing many of these supplementary pages have in common is lots of boxes to tick, amounts to fill out and somewhat confusing descriptions, although HMRC does provide guidance notes as to how to fill this in. Still, it’s a lot to take on board.

The outcome is fairly typical in these circumstances; mistakes are made, sometimes costly ones.

What are the common SA100 supplementary pages you are likely to encounter?

Here, we will quickly list some of the typical supplementary pages you may come across given your personal circumstances.

SA101 Supplementary Income.

This is used to report less common sources of income, although these days they appear more often than in the past. Examples include:

- Interest from different types of securities

- Gains from life insurance policies, annuity contracts, etc

- Stock dividends, securities issued as bonuses and redeemable shares.

- Business receipts as income from previous years

- A range of other tax reliefs, such as venture Capital Trusts shares, EIS share subscriptions, maintenance payments and many others.

- Married couple’s allowance

- Income tax losses

- Pension savings tax charges

SA102 Employment

You’ll want to complete this form to list each of your jobs, including your main job. You'll also report what benefits you have received and the expenses you have incurred as part of the job.

SA103 Self Employment

There are two forms here, ‘short’ and ‘full’, and you’ll need to decide which one applies to you. Essentially, it depends on whether you received £85, 000 or more in income.

The short form asks for basic details as to your income source, the business details, expenses, profits etc. It helps you calculate your profits and tax payable.

The long form version is similar in many ways to that experienced if you ran a private limited company and had an accountant prepare your full company accounts. It’s a complex form.

SA104 Business Partnerships

Again, there are short and long form versions of this. Which one you use will depend upon the Partnership Statement your tax advisor gave you.

SA105 UK Property Income.

In recent years, with the popularity of buy-to-let ownership and more people becoming landlords, this form has become more prevalent.

You’ll need to provide full details about the property, whether it’s furnished or not, the types of income - i.e. income from services provided vs actual rental income. Your expenses and you’ll calculate your taxable profit or loss.

SA106 Foreign income or gains

With an increasingly globally mobile population and more foreign or naturalised residents required to complete a self assessment, many people have investments and income bearing assets overseas that must be reported as part of their ‘world-wide income’.

Use SA106 to report income from:

- Interest from overseas saving

- Dividends from foreign companieS

- Remitted foreign savings income

- Remitted foreign dividend income

- Income from overseas pensions

- Income from land and property abroad

- Foreign tax paid on employment, self-employment and other income

SA108 Capital gains summary

If you own a second home, whether in the UK or overseas, and decide to sell, you’ll incur capital gains on the profits of the sale. If the property is overseas, then you may have to declare the sale in that country too. SA108 is used to report capital gains on property. Also, if you’ve made gains or losses on shares and securities (listed or unlisted), report them here.

There’s a section for ‘non-residents’ to report capital gains on UK property too.

SA108 Residence, remittance basis etc

Residence and domicile are two fairly complex subjects and you should fully understand your obligations to HMRC in this regard. Your UK tax liability depends on where you’re ‘resident’ and ‘domiciled’ in a tax year. The notes to SA108 help you understand your requirements here.

It applies to UK nationals too, particularly if they are working overseas for extended periods.

Should you complete your own self assessment tax return or let an accountant do it for you?

As we have seen, completing an SA100 is not necessarily a walk in the park. It’s definitely not a task to leave to the last minute, especially if you may have more complex income sources.

More often or not, when clients come to TaxAgility seeking us to complete their returns for them, we hear the words “I wish I hadn’t left this so late”, and “I didn’t realise it was that complicated” or “I underestimated the effort involved”.

From our perspective, having seen and assisted countless clients with last minute returns, the cost of having a professional assess and complete your SA100 Self Assessment Tax Return, is by far outweighed by the potential to make mistakes and be penalised by HMRC for under reporting or miss out on things you could have claimed for. Then of course, there’s the reduction in stress knowing it is being handled by a professional.

What happens if I do make a mistake?

Here’s a list of the most common mistakes we see clients that eventually come to us make.

- Reporting the wrong NI or UTI number

- Failing to report all your income

- Not claiming all your expenses

- Claiming the wrong expenses

- Over-claiming expenses

- Failing to use the appropriate supplementary pages

- Poorly understanding their tax status and liabilities

- Not fully grasping the implications of residency and domicile

- Ticking the wrong boxes

- Missing the deadlines

- Poor record keeping

- Miscalculated or incomplete information

If you’ve made simple honest mistakes, HMRC may just correct them for you and update your return accordingly, and not penalise you.

However, if the mistakes are not so simple and those which may lead HMRC to suspect some form of avoidance or deliberate under reporting, you could find yourself the subject of a tax investigation and stiff penalties.

You can make corrections if you discover honest mistakes after you have filed your return. There is a three days window after the deadline in which to do this. The process to do this depends on how your SA100 was submitted. If you submitted online, you can sign in to your government Gateway and correct it through your online account. If it was a paper return, send the corrected pages to HMRC, but make sure you clearly note on each page that this is an ‘amended page’.

In summary, we do believe it is worth the extra cost to have a professional quickly review your personal tax circumstances and prepare your SA100 Self Assessment Tax Return (and supplementary pages) for you. While you might expect us to say that, we just know from the experience of others how beneficial this is, as you may have underestimated your tax liability or worse still, missed out on an opportunity.

Call TaxAgility today on 020 8108 0090 and tell us about your circumstances and we’ll see how we can assist. The earlier you do this, the less stress there will be for you.

The 2022 Autumn statement impact on small businesses

For many, the contents of the Chancellor’s Autumn statement cum budget, came as no surprise. The country has suffered many significant setbacks over the past 2 years, as indeed have most countries. However, at some point, all the assistance and support that has been handed out over these years needs to be paid for. As small to mid sized business accountants, here’s how we see this budget impacting your business.

Before we look at the impact on small businesses, let’s remember that small businesses represent 95% of all businesses in this country. Most are run by ordinary hard-working people. Home-owning, family centric people.

Before we look at the impact on small businesses, let’s remember that small businesses represent 95% of all businesses in this country. Most are run by ordinary hard-working people. Home-owning, family centric people.

A quick review of the events of 2020 to 2022 that have ultimately led to the contents of this budget

Covid had a major impact on all of us. That is probably an understatement, but to put it into perspective along with this budget, consider the following.

The Covid-19 pandemic resulted in exceedingly high levels of public spending. This included the furlough scheme and assistance packages to businesses and healthcare. In all, it is estimated that between £310 and £410 billion was spent. That needs to be paid for and equates to around £4,600 to £6,100 per person (Commons Library).

Covid related issues saw global trade significantly impacted which resulted in supply shortages across many industries. This began to have an inflationary impact as the costs of numerous imported items started to rise affecting retail prices in the UK.

If that wasn’t enough, 2022 though saw another unexpected development; Russia’s invasion of Ukraine. The impact on European energy supplies and to a degree global food prices, has been unprecedented, both practically and politically. Prices at the pumps for regular unleaded petrol rose around 66% from Early 2020 to September 2022. Meanwhile 2022 has seen wholesale energy prices heading for an increase of over 80%, with many homes experiencing energy bills that will more than triple.

Such economic pressures have resulted in an inflation rate that is now at over 11%. To control inflation, governments increase interest rates. Ordinarily, higher interest rates are good for savers. However, few home owners will have cash to save because of the economic pressures they are now facing. Many homeowners are now feeling considerable financial pressure, with mortgage payments and interest rates rising considerably above the historic lows we’ve seen in recent years. The relatively short space of time over which rates have risen has caught many off-guard, with few having the financial reserve to cope with such trends. In short, many ordinary people are now facing a severe cash flow shortage. Having enjoyed mortgage interest rates as low as one or two percent, some home owners are facing rates of over 5%. For many, this is unsustainable.

What can business expect over the next year?

In many respects small businesses are unique in how they are affected by such conditions and the measures imposed by the budget, even though they constitute 95% of all UK businesses. This is because small businesses are run by people directly connected to the business. This opposed to regular employees or directors of larger firms often with the resources to weather such storms out. Small changes to smaller businesses can have a significant impact. Large changes, such as we are seeing, can have a traumatic impact.

Here’s why.

Measures that impact the tax paid by a small business and its owner

Corporation tax. This was already set to rise from 19% to 25% in April 2023. However, businesses with profits below £50,000 will continue to pay the current 19% rate. Those between £50,000 and £250,000 will pay 25% but with a rate relief deduction. As dividends are taken net of tax paid, increased corporation tax will lessen dividends payable.

Dividend tax relief. Currently £2000, this will reduce to £1000 in 2023 and then further to £500 in 2024. When added to current personal allowances, a director could expect their tax payment threshold (20%) to start at £14,570, this will now be £13,570 from April 2023. Given the current inflation rate and the freeze on personal allowances, this constitutes an overall reduction in income in real terms.

Capital gains tax exemption is currently at 18% for residential property gains and 10% for all other gains, such as investments, for basic rate payers, and 28% and 20% respectively for higher rate payers. The threshold for this in 2021 to 2022 is £12,300. However, from April 2023 this will drop to £6000 and to £3000 from April 2024.

Other measures that directly affect tax payments and operational costs, include:

The national minimum wage will increase by 9.7% for employees aged 23 or older. As many smaller businesses with employees paid at this level may struggle to increase their revenues by 10% this coming year, and hampered by a raft of other costs spiralling upwards, this will further pressure small business’s finances.

Class 2 National Insurance for self-employed to increase to £3.45 per week from April 2023.

Income and National Insurance thresholds for both employers and employees will be frozen until 2028. In a similar way to personal allowances, if these don’t rise in-line with inflation and other costs, they have a negative impact in real terms.

The VAT registration threshold has been frozen at £85,000 until 2026. This means that many more small businesses may have to register for VAT in the next few years if their profits increase.

Businesses are major energy users too. So while the Chancellor announced that the Energy Price Guarantee will stay in place for households until April 2024 at a higher rate, he didn’t mention support with energy bills for businesses after April 2023.

Since October this year, non-domestic energy users can get a discount to bring the price of gas and electricity in line with the government supported price. So if a business had to pay more than this, they could claim a discount for the difference from the energy provider. No information has been given to say what happens after April 2023, leaving small businesses concerned about this.

Was there any good news for smaller businesses?

In short, not much. The Chancellor did announce the following measures:

The Employment Allowance, which reduces the amount of National Insurance Contributions an employer has to pay, will remain at £5,000.

The smallest businesses impacted by measures that change their eligibility for small business rate relief or rural rate relief, will see their increase in bills capped at £600 per year from April 2023.

A plan to increase business rates by 10.1% will not go ahead in 2023, instead this has been frozen. If it had gone ahead, it would have represented the biggest hike in business rates in 32 years.

The hospitality, retail and leisure sectors will see their business rates discount go up to 75%, which will also be extended for another year.

Final thoughts

Many small businesses who successfully weathered the Covid storm, were looking forward to calmer seas ahead during 2022 and beyond. However a catalogue on global issues have resulted in increased pressures at home. For the next few years, as Brexit continues to play out, combined with the ongoing energy crisis, high inflation and interest rates, businesses need to run a tight ship.

Maintaining a healthy cash flow and building a small reserve to help weather the uncertainty ahead is going to be very important. A firm grip on costs through a plan that makes allowances for much wider variability in base assumptions, such as the cost of borrowing, fluctuations in the costs of raw materials and pressures on employee’s own financial circumstances is a key part of this.

Let’s not forget the struggling company owner who, years ago, decided that it would be a great idea to take the risk and run their own business, given what at the time were some reasonable incentives to do so. TaxAgility can help them through this tough time, navigating a path through the tax changes and streamlining the financial aspects of their business efficiently and hopefully, surviving the worst that is thrown at them over the next couple of years.

Call us today on 020 8108 0090 and find out how.

How digital enablement can help reduce cyber crime and fraud

While most business owners understand the risks they face from fraud, whether that be threats from cyber attacks or as we will consider here, internally from white collar crime, a surprising number lack the systems and controls to mitigate these threats. TaxAgility Accountants can help you fight these threats through digital enablement.

For instance, a report by Symantec, the antivirus software firm, highlights that 43% of cyber attacks target small businesses. Why? Because the fraudsters know that these firms haven’t invested in the security, control systems and processes that they ought to have.

For instance, a report by Symantec, the antivirus software firm, highlights that 43% of cyber attacks target small businesses. Why? Because the fraudsters know that these firms haven’t invested in the security, control systems and processes that they ought to have.

In this article, we’ll look at how the process of digitally enabling your firm can help mitigate a lot of the threats facing your business today.

Fraud isn’t just a problem faced by larger firms

When hearing about the problems faced by large firms caused by fraud, often internal fraud, smaller business owners may not relate to them. Often, owners feel that their firms are unlikely to suffer the same issues, the - “we’re a small fish, why would fraudsters bother with us?” syndrome. What these owners fail to realise is that often, external attacks are not perpetrated by people, but by bots. Only when a bot breaks through, do the real fraudsters get involved. Then they’ll take what they can get.

While the technology challenges of doing business in a digital world expose businesses to online attacks, another threat vector that smaller business owners overlook is the people they employ. Owners may feel that their staff are entirely trustworthy. Many may have been with the firm for years. However, when someone’s circumstances change, whether because they run into personal issues or whether they are being coerced by external forces, a trusted person can often cause more long term damage than a direct external threat, especially if such an event leaks out to customers and suppliers. This is one of the main reasons a large number of such fraud incidents go unreported.

Many factors may drive employees to commit fraud within their employment, also known as white collar crime. The most common scenario is when an employee gets into dire personal financial stress. If the employee is able to manipulate or embezzle small amounts of cash unnoticed, and that eases their pain, they may well be tempted into stealing larger sums. When somebody is under significant financial stress, it becomes easier for them to self justify, even telling themselves that what they are doing is justified and that they will pay it back before anyone notices. Unfortunately, that seldom happens, and the employer eventually finds out. Trust is then eroded, not just with the individual concerned, but suspicion may fall on others which will likely upset harmony in the company.

With threat vectors originating both internal and externally, what can a small to medium sized business do, and what do potential solutions have to do with digital enablement.

The role of digital enablement in reducing fraud

Cynics may suggest that it’s because we are communicating more and our company’s operations have become more complex digitally, that being digital is the problem. There is of course an element of truth to this, as new technologies and automated processes can lead to data exposure, as indeed we’ve seen in the news.

Digital transformation though, is unavoidable, largely because it is mainstream and those your firm does business with are in the same boat. Financial systems are almost entirely digital now, your customers and suppliers are transforming. Failure to transform and enable digital service connections will mean that your business will not be able to compete and will suffer severe performance issues.

So, the question therefore centres on how digital enablement technologies not only increase your business’s efficiency, through process automation and service connectivity, but also increase your firm’s resilience to the threats we have seen?

Common types of fraud in the workplace

To see how digitisation of a company’s systems and processes may help with fraud, it is useful to summarise some of the most common types of workplace fraud, these include:

- Holiday and sick leave manipulation.

- Theft of cash or equivalent - such as, inventory/equipment/office and raw materials.

- Falsified overtime, fictitious employees.

- Unauthorised corporate credit card purchases.

- Fabricated receipts.

- Fictitious travel vouchers or purchase orders - i.e. non-existent vendors.

- Forgery of official document approval .

- Falsification of transaction details such as false mileage expense claims.

- Entertainment without a legitimate business purpose.

Most often these examples of fraud can only happen because of lack of management oversight, poor controls, poor ledger and reconciliation reviews and, in busy companies with tight resources, poor separation of duties that allow the same individual to raise and approve purchases, work orders and payments to suppliers - typical in smaller businesses.

How can digital technologies assist in reducing and even preventing fraud?

Most fraud in businesses originates from the lack of oversight and process integration. Fragmented and dissimilar accounting and reporting systems, such as those used to track sales, expenses, payroll, purchases, accounts receivables and accounts payables, provide a wealth of opportunities for an internal fraudster to hide their tracks.

We are continually surprised to find smaller businesses that still track many of these processes using Excel spreadsheets. They’ve used them for years, many are customised using complicated macros developed by external consultants, and so they have been reluctant to drop them. Such systems hide multiple opportunities for manipulation.

The key aspect to reducing fraud in such systems is by reducing manual entry complexities and through automation and oversight. Digital systems and applications target key functional aspects of a business, such as payroll, accounts receivables, sales and purchasing. Such systems provide enhanced visibility, tracking, reporting and authorisation through the creation of process rules, making it very difficult for an employee or external threat to commit fraud without an alarm being generated.

Historically, it’s not been that easy for a manager to gain a detailed look at cash flows without having to deep dive into the back end accounting systems. The reports generated are simple summaries and hide the real issues that may be lurking behind the scenes. Today’s digital applications, though, allow the full detail and authorisation change of transactions to be revealed with a click of a button. Xero, is a great example of this, providing easy to understand management information, but an equally easy audit trail to pursue if things don’t look quite right. There’s no need these days to wade through reams of paper statements looking for problems, cloud based systems can be accessed from your mobile devices wherever you are.

Improving and integrating your business processes through the use of advanced digital applications and services increases transaction transparency and accountability, and improves the overall efficiency of your business. Here are some examples as to how this may work in your business.

1. Decoupling the old and the new

It helps to maintain a dose of realism when tackling process improvement. Smaller businesses are limited by resource and budget. There may be legacy systems, perhaps an inventory system, that can’t be replaced immediately. Identifying the slower systems from those that need to be faster paced, helps a business focus on what can be achieved shorter term. Often the greatest improvements to a business can be realised by improving the customer facing systems and processes. Decoupling these systems from the legacy systems helps, as it compartmentalises potential fraud opportunities and increases the number of your business’s processes that have greater transparency.

2. Automating basic accounting functions.

This is where the latest generation of cloud based services excel. If processes such as accounts payable, accounts receivable, payroll, etc. are automated to a high degree, it’s very difficult for them to be tampered with without triggering some form of alert.

3. Streamlining and automating aspects of customer facing systems.

Companies that use e-commerce extensively in their business, perhaps because they operate an online store, understand this very well. Such systems are highly automated and provide a high degree of customer satisfaction. They minimise the need for staff to be involved in the processes of sales, order fulfilment and inventory control. By thoroughly examining your business processes, especially those that are customer facing and choosing to digitise them through the use of sales or customer service portals, again reduces the opportunity for fraud.

4. Use the cloud

Long gone are the days where there’s a need to update critical software on a PC. Of course, such software still exists, but for the most part applications focused on the basic operations of a company, particularly the financial operations, are available in the cloud. This means they are accessed through a secure web browser connection. Using cloud based ERP & CPM systems (for larger businesses) and cloud based accounting software suites, can drastically cut costs and increase the time people have to focus on the core of their business. Not only that, but many cloud based accounting services have a multitude of plugin additions that can be used to customise your operations through functional additions (e.g. payroll, financial controls, enhanced AR, online payment tools), further increasing efficiency. Many are available on an industry related basis too.

Integrated cloud based systems decrease the number of exposed end points often used by fraudsters to gain access to sensitive financial operations, such as through hacking office based systems, exploiting employee based phishing schemes, accounts payable fraud, etc.

5. Analytics and reporting