Employment tax

The mechanisms and how you meet your Government requirements to pay over tax, PAYE and PRSI, deducted from Employees at source are modus operandi that every new and expanding business has had to consider at one point or another. Given the refusal of the likes of Apple and Mr Green of where’s my BHS pension gone fame to pay their fair share of tax then the good news is that the UK Government puts a great deal of effort into making the system to administer and collect such taxes to be as simple as possible – it’s clearly in their financial interest to do so! JDWeatherspoon are a great champion for the positive contribution that the Pub, food and Hotel Sectors make to the economy declaring in their 2016 accounts that they paid a total of £632m in tax in the previous 12 months. Almost what Mr Green pays for a yacht to cruise around the Mediterranean in.

Payroll Calculations

You can carry out your own payroll calculations and almost everyone these days does so via a particular software package that facilitates this. Such software should do at least two things – firstly it should carry out the calculations that you require. Simple it may seem but when you consider the different types of employee and the various types of deduction that need to be carried out from salary this is not quite a one size fits all problem – you have Maternity pay and Statutory calculations, rules for the Taxation of Redundancy payments, cash bonuses, bonuses via non-cash methods, Apprentices have their own methodology of working out taxation, pension contributions can be taxed or exempted from Tax, new employees are taxed under what are known as Emergency Tax codes, there are state-backed Childcare vouchers to consider and there are any number of deductions that can take place from salaries from subsidised Gym membership to Private Healthcare schemes. The second consideration is that any Software solution must be linked to the Government’s system in order for the Government to record this payroll information such that it can keep track of who is or should be paying what for Employment Taxes.

HMRC

HMRC tests payroll software to check it can report PAYE information online and in real-time (RTI). In addition, it recommends both free payroll software (if you have fewer than 10 employees) and paid-for software that has been tested and recognised by HMRC.

You should consider which features you need. For example, some software won’t let you:

- produce payslips

- record pension deductions

- make pension payments

- pay different people over different periods (e.g. both weekly and monthly)

https://www.gov.uk/payroll-software/paid-for-software

https://www.gov.uk/payroll-software/free-software

There are some additional points to consider:

- if you’re a small employer that expects to pay less than £1,500 a month, you can arrange to pay quarterly.

- you must be aware of and be able to make certain reports to HM Revenue and Customs (HMRC) and these must be made within specific timescales. For example, you must be able to produce a summary report on the previous tax year (which ends on 5 April) and give your employees a P60 summarising their own payroll tax dealings for the year, and prepare for the new tax year, which starts on 6 April, such that you have all employee records up to date and accurately recorded before the new tax year calculations begin.

- all of these reporting requirements and system set up steps must take place within certain tight deadlines post 6 April each year.

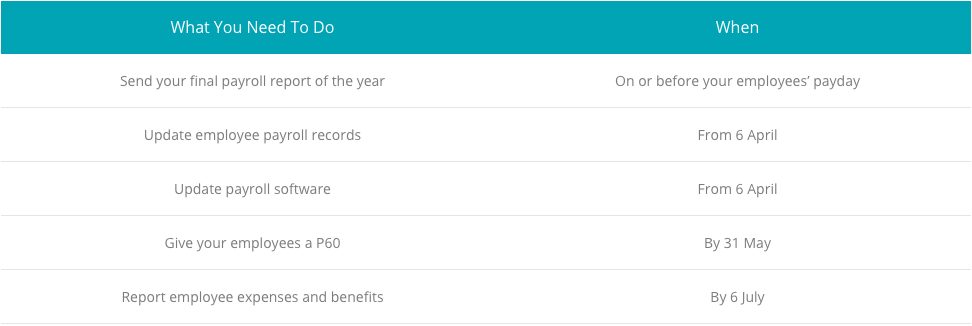

- a summary of what needs to take place and when is provided below with a link to the Government’s own notes on what is required (see TABLE 2 below)

- the Government take different approaches when information has been provided to them incorrectly or not at all. If HMRC discovers careless or deliberate errors, the penalties that could apply will be based on the behaviour that led to the error and the amount of potential lost revenue for that return (see TABLE 2 below). Errors that arise, despite taking reasonable care attract no fine.

- the Government may initially impose a fine on an organisation where they believe that there had been wrongdoing but such a fine or penalty can be appealed. It is often wise to bring in an Accountant, if you have not done so already, to assist with drafting such a defence.

Table 1

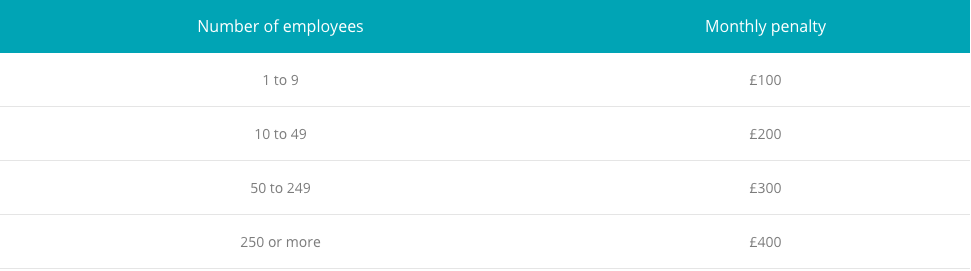

Table 2

How much you’re charged depends on how many employees you have.

If you’re over 3 months late you can be charged an additional penalty of 5% of the tax and National Insurance that you should have reported.

Are you interested in any of the above, or just want to find out a little more?

Call us now, regarding these services in the London area and how we can help, on 020 8108 0090or complete the enquiry form and we will call you back.