A Guide to Understanding and Improving Your Balance Sheet

Understanding and managing your business’s balance sheet is an essential part of any successful company. A balance sheet is a financial statement that provides a snapshot of what you own (assets) and what you owe (liabilities). It's important to keep track of this information so that you can stay within your budget, pay off debt, and make sure your cash flow is healthy. Let's take a look at how to understand and improve your balance sheet.

Understanding and managing your business’s balance sheet is an essential part of any successful company. A balance sheet is a financial statement that provides a snapshot of what you own (assets) and what you owe (liabilities). It's important to keep track of this information so that you can stay within your budget, pay off debt, and make sure your cash flow is healthy. Let's take a look at how to understand and improve your balance sheet.

Components of a balance sheet

A balance sheet is a financial document that provides an overview of the company’s assets, liabilities, and equity. It shows the business’s net worth and provides detailed information about the company’s assets (what it owns) and liabilities (what it owes).

A balance sheet is made up of three components: assets, liabilities, and equity. Assets are anything that has value for the company and can be used to generate income or pay expenses. Examples include cash, accounts receivable (money owed to the company from customers), inventory, buildings, equipment, investments, or trademarks. Liabilities are any debts or obligations that the company owes money on. These can include loans, mortgages, credit cards, accounts payable (money owed by the company), accrued expenses (like wages or taxes), or other debts that need to be paid off in the future. Equity is the difference between all the assets and liabilities, it's what's left over after all debts are paid off. This includes any profits that have been retained by the business rather than distributed as dividends to shareholders.

Tips for improving your balance sheet

Once you have an understanding of what makes up your balance sheet, you can start making improvements. Start by looking for ways to reduce expenses; for example, renegotiating contracts with suppliers or seeking out cheaper sources for materials or services. You can also look for ways to increase profit; for example, expanding into new markets or offering new products/services. Finally, review your debt level; if they are high then consider refinancing them through lower interest loans which could save you money in the long run.

- Monitor Cash Flow: Monitoring your cash flow will help you ensure that you have enough money on hand to cover expenses. This will also help you avoid overdrawing from accounts or taking out unnecessary loans.

- Utilise Loans Wisely: Use any loans you take out wisely by paying them back on time and using them for their intended purpose only. Taking out more than necessary in loans can increase interest payments over time, which can affect your bottom line negatively.

- Consider Investing: Investing in stocks, bonds, mutual funds, or other investments can help grow your business’s asset portfolio over time, meaning more money available for future projects or expansion opportunities down the road. However, be sure to do research before investing so that you know exactly where your money is going.

- Reevaluate Expenses: Take some time to regularly review expenses for any unnecessary items that could be cut back on or eliminated altogether in order to save money in the long run. This could include things such as subscriptions or memberships that may not be used often enough to justify their cost each month.

How to read your balance sheet

The best way to read a balance sheet is to start with understanding its structure. The left side of the balance sheet should contain all assets listed in order from most liquid (cash) to least liquid (tangible assets like buildings). The right side should contain all liabilities listed from most current (accounts payable) to least current (long-term debt). Once you understand how a balance sheet is organised you can begin reading it more thoroughly looking at each asset and liability individually. This will give you an idea of how much money is coming into your business versus how much money is going out, and if there’s enough left over for profit!

- Cash: Cash on hand plus any short-term investments in marketable securities

- Accounts Receivable: Money owed by customers for goods or services provided

- Inventory: Goods held for sale by the business

- Buildings: Long-term real estate investments owned by the company

- Equipment: Tools used for production or office use owned by the company

- Investments: Securities such as stocks and bonds owned by the company

- Trademarks: Intellectual property owned by the company

- Loans: Loans taken out by the business from banks or investors

- Mortgages: Long-term loans taken out from lenders secured against real estate investments

- Credit Cards: Credit card balances owed to creditors

- Accounts Payable: Money owed by businesses to vendors/suppliers

- Accrued Expenses: Expenses incurred but not yet paid such as wages/taxes

- Long Term Debt: Debt obligations due more than 12 months in future

- Equity: Difference between total assets & total liabilities; retained earnings plus capital stock issued minus dividends paid out

Being aware of what goes on with your business’s balance sheet is essential if you want to succeed in managing finances effectively and staying within budget constraints while still growing financially over time. By monitoring cash flow carefully, utilising loans wisely when needed, investing strategically when possible, reevaluating expenses regularly, businesses will be well equipped with the knowledge they need to maintain a healthy balance sheet year after year!

Also, your balance sheet is an essential component of your management reporting. It gives you clear insight into your business’s financial health, providing instant access to the essential financial data required to make smart management decisions. From recording cash payments and invoices to reconciling cloud accounting transactions, the balance sheet can help you benchmark performance and position yourself for future growth. With easy-to-read insights, however complex your management report may be, the balance sheet clearly displays key performance indicators that reveal the true picture of your finances.

Choose TaxAgility as your accounting services provider

With these tips in mind, understanding and improving your balance sheet should become easier, allowing your business to achieve success without compromising its financial health!

Naturally, with TaxAgility as your accounting services provider, we can help you improve the financial strength of your company and lessen the burden of managing balance sheets and management reporting through our cloud based accounting solutions. Just call us today on 020 8108 0092 and find out how.

2023 trends businesses can embrace in the search for competitiveness

Developing or adjusting your business plan for the coming year, will likely take into account many of the broader economic factors that may affect you, such as the economic outlook, inflation, interest rates, supply chain issues and money supply. However, businesses are also affected by trends, such as customer expectations, enabling or disruptive technologies, working patterns, and societal values. These are more intangible, but nevertheless can have a significant impact on a business’s success. In this article we will look at some of the prominent trends in 2023.

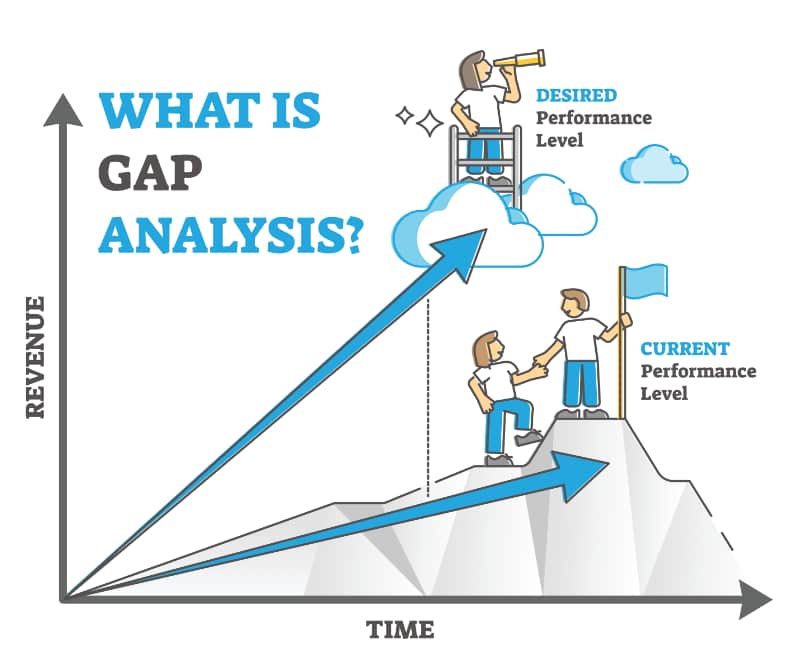

Identifying trends and revisiting the GAP Analysis

Trends are powerful market signals that shouldn’t be ignored. However, understanding exactly how they may apply to your business can be a little more difficult to interpret, as they may or may not have an impact on many areas of your product or service, or even how your business operates or is perceived from a brand perspective by your customers and market in general. This is where a little bit of analysis and a tool called GAP analysis comes in handy.

A GAP analysis is a simple tool that takes data and observations from your customers, market and competitors and makes sense of where others may be focused or not. It allows a business manager to spot where competition is especially strong and why, and therefore probably best to avoid. It also shows where competitors may be weak, perhaps from the perspective of a whole product or down to specific features. Weakness may be because of a lack of customer interest or market demand, but for the savvy business person, it might be because the area or niche may not have been explored or developed yet. This is where monitoring trends is especially powerful, as it may point to an opportunity to leverage a trend to develop an area of business others may have ignored because of market weakness.

A GAP analysis is a simple tool that takes data and observations from your customers, market and competitors and makes sense of where others may be focused or not. It allows a business manager to spot where competition is especially strong and why, and therefore probably best to avoid. It also shows where competitors may be weak, perhaps from the perspective of a whole product or down to specific features. Weakness may be because of a lack of customer interest or market demand, but for the savvy business person, it might be because the area or niche may not have been explored or developed yet. This is where monitoring trends is especially powerful, as it may point to an opportunity to leverage a trend to develop an area of business others may have ignored because of market weakness.

Performing a GAP analysis in concert with a regular review of your market and competitors, is a powerful way to spot opportunities that others may have missed. Smaller businesses simply can’t be everywhere at once and so tend to focus on specific areas of their market or certain features of a product that customers really like. As time goes by, trends will likely force small businesses to shift focus, sometimes subtly, other times though, quite significantly. As with the impact of Covid, some businesses had to fundamentally change the way they managed and engaged with the clients. This showed a lot of businesses new ways to be successful. However, many couldn’t meet the challenge and closed.

Where does the data to power a GAP Analysis come from?

There are different ways to conduct a gap analysis, one is to look at your business strategy and goals and where you’d like to be in the future, then identify the aspects of the business that you need to achieve your goal that currently are not in place. Another is to examine the strengths and weaknesses of a product and service compared to your competition and perceived market demand, or more importantly when considering trends - future market demand.

Essentially though, the analysis requires you to break down your product or service’s main features, pricing, distribution capabilities and other aspects of your business that contribute to market success. Then do the same for each of the main competition products. As you do this, rate them from 1 to 10 in terms of strength or attractiveness.

It requires some pretty extensive research, even maybe a little covertly as you try and peer into your competitor’s operation. Eventually though, you’ll start to see aspects of your product or service that either outperform, under perform or are completely missing from your’s or their offering. Add in the consideration for current and upcoming trends, and you’ll start to see areas where maybe you could outperform your competitor (or market), by acting early. You may even realise that your competitor is already doing this!

There are many sources of data for this research, examples are:

- Search engine searches around products, features, and capabilities will yield a fair amount of information.

- Independent market analysis reports that highlight company and product capabilities.

- Product comparison sites set products or services against each other and may also tear down products to examine how they are built.

- Annual reports, shareholder reports, investor analysis.

- Buy some of your competition’s products and test them yourself.

What are some of the trends small businesses will likely experience in the company year that businesses can explore and potentially plug into a GAP analysis?

Sustainability and brand responsibility

Consumers are becoming more sensitive to sustainability issues in their purchasing habits. While many are seeking to minimise the purchase of products that employ single use plastic, others are looking deep at the products themselves, for instance, once they have outlived their useful life, can they be reused for something else. Or, if they break, can they be repaired? Many products are simply not worth sending back to a manufacturer for repair, but just like used cars, some products can find repair solutions from third party providers.

As time marches forward, more and more consumers will give more credence to the reliability and durability of products. While affordability must remain a priority for businesses, the old adage of ‘cheap and cheerful’ is less likely to apply. However, given the economic hardship many are experiencing, the challenge for businesses is to deliver affordable sustainability.

Sustainability also requires businesses to look at where their product components originate from. Are those manufactures using materials that have been sustainably sourced?

In short, consumers, or indeed other businesses (B2B), increasingly expect a business to demonstrate responsibility throughout their business practices, for environmental issues.

Immersive experiences

As technology delivers new ways to experience and interact in our daily lives, expectations on the consumer front also grow. Introducing new ways for your customers to experience your products or services before buying is a growing trend. Technologies such as augmented reality and virtual reality, provide ways for businesses and clients to interact in new ways, whether that be at the customer service level, or in being able to experience or examine a product without actually being in contact with it, or even in the store.

As technology delivers new ways to experience and interact in our daily lives, expectations on the consumer front also grow. Introducing new ways for your customers to experience your products or services before buying is a growing trend. Technologies such as augmented reality and virtual reality, provide ways for businesses and clients to interact in new ways, whether that be at the customer service level, or in being able to experience or examine a product without actually being in contact with it, or even in the store.

As sustainability concerns grow, more customers will want to know a lot more about your product and the processes and materials used to bring it to market. The use of augmented or virtual visualisation technologies, will enable customers to ‘up close and personal’ to a product in the comfort of their own homes or at their leisure in a store.

A fully immersive experience, such as through virtual reality headsets, will enable a business to personalise their customer’s experience of their brand. This is especially important for higher value purchases, such as homes, cars, investments, leisure, travel, hospitality, design services, etc.

Ethical consumer spending and your ESG strategy

Consumer ethics have been shifting for some time, but over the past couple of years concern for the environment has accelerated. The pressure is now considerable for brands to do more than just talk about the ethical issues, they now have to live and breathe them.

Enter the subject of ‘Environmental, Social, and Governance’ strategy. An ESG strategy sets out your understanding as to how your business impacts the world it operates within and how your business is responding to help mitigate any negative consequences, or to eliminate them altogether.

By focusing on ESG, one also becomes aware of the potential for a growing raft of legislation around sustainability issues to impact the business. One can therefore put better plans in place to embrace these changes, and even identify new opportunities.

Popular terms have arisen that cast doubt on a brand’s commitment to ecologically sensitive practices, workforce welfare and labour exploitation in overseas supply chains. No brand is above this and one only has to look at a huge list of companies called out for ‘greenwashing’: Volkswagen, BP, ExxonMobil, Coca-cola, Nestlé, IKEA, Starbucks . . . the list goes on.

Popular terms have arisen that cast doubt on a brand’s commitment to ecologically sensitive practices, workforce welfare and labour exploitation in overseas supply chains. No brand is above this and one only has to look at a huge list of companies called out for ‘greenwashing’: Volkswagen, BP, ExxonMobil, Coca-cola, Nestlé, IKEA, Starbucks . . . the list goes on.

While this sounds like a problem for the big brands, it actually affects all businesses. If a smaller business wants to attract clientele from its local community, one way to stand out is through promoting the ethicality and sustainability aspects of the business. Most communities want to support the local businesses amongst them, but full support falters when the business can’t tell customers the source of their products and services, or provide inaccurate information in doing so. As an example, fresh produce providers, such as one’s local butcher or baker go to great lengths to promote factors such as ‘locally’ sourced, organic feed, hormone free, etc. But many others either don’t go to such length, or simply don’t understand or care.

The same ethical standards apply to any business, even if it’s a matter of the working practices, from where basic materials are sourced, employee welfare, recycling, energy use, outsourcing strategy and controls, etc.

Having a well documented and publicised ESG strategy is becoming crucial to even smaller firms and will help businesses in highly competitive markets to differentiate. It shows that your business is not just ‘talking-the-talk’, but is also ‘walking-the-walk’.

ECO sensitive supply channels

Given the discussion in this article’s previous two topics, ensuring your business adopts the same principles with your supply chain would appear obvious. However, ‘greening’ the supply chain can be seen by businesses as “somebody else’s problem”. While you can’t dictate how the businesses in your supply chain go about their business, it is still your problem, as you have a choice as to the companies you work with.

It’s important then, not to overlook the greening issue when reviewing your suppliers, whether this is simply office supplies or a more extensive supply issue within a manufacturing process. Put simply, any ESG strategy you have needs to audit those upon whom you rely on to complete your product or service offering.

The plus side of working with other firms committed to greener businesses, is that you know they are committed to providing a more sustainable service to you. This helps you future proof your own business!

Ongoing digital transformation

Streamlining your business processes through the use of new technologies that integrate and automate multiple areas of your business’s processes, creates a wealth of ways to enhance efficiency. Much of this is discussed on our services page on Digital Enablement and some benefits further discussed in our article on how digital enablement can help reduce fraud.

Digital enablement activities within businesses are set to accelerate over the coming year. For larger firms this may be part of a broader digital transformation strategy. For smaller firms, the activity may centre around consolidating functional areas and applications, and creating greater integration between previously disparate systems. On the simplest level, digital enablement may just mean adopting more online applications as a way to improve financial management information, for example Xero, or increase connectivity and communication around job functions or customer management.

Digital enablement activities within businesses are set to accelerate over the coming year. For larger firms this may be part of a broader digital transformation strategy. For smaller firms, the activity may centre around consolidating functional areas and applications, and creating greater integration between previously disparate systems. On the simplest level, digital enablement may just mean adopting more online applications as a way to improve financial management information, for example Xero, or increase connectivity and communication around job functions or customer management.

One thing is for sure though; successful businesses in the future are going to be using the digital applications and services available to improve their own efficiency so as to maintain competitiveness. And, such efficiencies also play a strong role in supporting and achieving a company’s ESG goals.

Spend a little time considering how these and, no doubt a host of other trends, could be used in concert with a GAP Analysis, to look at new ways to not only build a stronger form sustainable business, but to find new ways in which to differentiate your business longer term.

Working with TaxAgility can improve the chances of your business’s long term success

As a firm of accountants and business professionals, we’ve had the privilege of working with many clients, helping them grow and understand how to make their business operate more efficiently. The challenges facing businesses today seem endless and often quite daunting. The crises businesses have faced recently haven’t helped either. Your business can benefit greatly by having a partner, like TaxAgility, both advise and support in helping your business become more efficient and grow successfully over the coming years.

Why not give us a call today and see how we can help you. Just call 020 8108 0090