Capital Gains on UK Property for Non-Residents

Capital Gains Tax (CGT) is a critical consideration for non-residents owning property in the UK. Given the evolving nature of tax regulations, staying informed is essential for making sound investment decisions. This article aims to provide an up-to-date overview of the CGT landscape for non-residents in 2024, offering practical advice and highlighting potential changes under a new government.

Historical Context

In April 2015, the UK government introduced CGT for non-residents to address disparities in the tax system. Initially, this change targeted residential properties, requiring non-residents to pay CGT on the gains made from selling these properties. The legislation aimed to create a fairer tax environment and increase government revenue.

Current Regulations (2024 Update)

As of 2024, non-residents are subject to CGT on both residential and commercial properties in the UK. The tax rates and thresholds vary depending on the type of property and the individual’s total taxable income.

- Residential Properties: Non-residents pay CGT at 18% (basic rate taxpayers) or 28% (higher rate taxpayers).

- Commercial Properties: The CGT rate is typically 20%, irrespective of the taxpayer’s income bracket.

- Annual Exempt Amount: Non-residents benefit from an annual CGT allowance, which currently stands at £12,300.

Non-residents must report and pay any CGT due within 30 days of completing the sale of a property.

Key Changes and Updates

Since the introduction of CGT for non-residents in 2015, there have been several significant updates:

- 2019 Extension: The tax was extended to include commercial properties.

- Post-Brexit Adjustments: Changes following Brexit have affected cross-border tax implications, particularly for EU residents.

- Current Government Proposals: Recent years have seen various tweaks to rates and exemptions, reflecting broader economic and political changes.

Practical Implications

Calculating CGT involves determining the gain (selling price minus purchase price and allowable expenses). Non-residents should also be aware of potential reliefs, such as Private Residence Relief (PRR), which can reduce the CGT liability for properties that were once the owner’s main residence.

Example Calculation:

- Selling Price: £500,000

- Purchase Price: £350,000

- Allowable Expenses: £20,000

- Gain: £500,000 – £350,000 – £20,000 = £130,000

- CGT: If a higher rate taxpayer, 28% of £130,000 = £36,400

Non-residents must file a Non-Resident CGT Return within 30 days of the property sale and pay any CGT due within the same period.

Common Questions and Concerns

- Properties Held by Companies: Gains made by non-resident companies are taxed differently, often under corporation tax rules.

- Gains Accrued Before 2015: Only gains accrued since April 2015 are subject to CGT, though valuations may be required to establish the property’s value at that date.

- Example Scenario: If a non-resident sold a UK property in 2024 but had owned it since 2010, only the gain from 2015 to 2024 would be taxable.

What Happens if a Property Owner Becomes a Non-Resident?

If you were a UK tax resident when you bought a property but have since become a non-resident, you are still subject to CGT on the property’s sale. The calculation will consider the property’s value as of April 2015 (or the purchase date if later) to determine the taxable gain.

Example Scenario:

- Purchase Date: 2010

- Non-Resident Since: 2020

- Sale Date: 2024

- Value in April 2015: £300,000

- Selling Price: £450,000

- Allowable Expenses: £20,000

Gain: £450,000 – £300,000 – £20,000 = £130,000 CGT: Higher rate taxpayer (28% of £130,000) = £36,400

What Happens if a Property Was Your Principal Place of Residence?

If a property was your principal place of residence (PPR), you might be eligible for Private Residence Relief (PRR), which can significantly reduce your CGT liability. PRR exempts the gain for the period you lived in the property as your main home, plus an additional 9 months.

Example Scenario:

- Principal Residence: 2010-2020

- Non-Resident Since: 2020

- Sale Date: 2024

In this case, the gain attributable to the period you lived in the property (plus 9 months) is exempt from CGT, and only the gain from the period when the property was not your main residence is taxable.

Calculating PRR:

- Total Period of Ownership: 14 years (2010-2024)

- Period as Principal Residence: 11 years (2010-2020) + 9 months

- Exempt Gain: 11.75 / 14 of the total gain

- Taxable Gain: Remaining portion of the gain

Example Calculation:

- Gain: £130,000

- Exempt Gain: (11.75 / 14) * £130,000 = £109,107

- Taxable Gain: £130,000 – £109,107 = £20,893

Private Residence Relief can greatly reduce your CGT liability if the property was your principal residence. It’s essential to keep detailed records of your residence periods to accurately calculate the relief. For precise calculations and advice, consulting with a tax professional is recommended.

Potential Changes Under a New Government

With a likely change in government, there could be significant shifts in CGT policy, especially if the Labour Party, known for its progressive tax policies, takes power. Labour has hinted at increasing taxes on property and wealth to fund public services. Investors should stay alert to policy announcements and consider potential tax increases when planning their investments.

Professional Advice and Resources

Given the complexity of CGT regulations and the potential for significant financial impact, non-residents should seek professional tax advice. Consulting with tax experts like those at TaxAgility can ensure compliance and help optimize tax liabilities.

Conclusion

Understanding the current CGT rules for non-residents and anticipating potential changes is crucial for property investors. Staying informed and seeking professional advice can help navigate the complexities and minimise tax liabilities.

Wy not have a friendly no-obligation chat with our experts at TaxAgility?

For personalized advice and support on navigating CGT as a non-resident, contact TaxAgility’s team of expert accountants. We are here to help you make the most informed decisions and manage your tax obligations effectively.

Discover the latest Capital Gains Tax (CGT) regulations for non-residents owning UK property in 2024, along with practical advice and potential future changes.

Key Takeaways

- Overview of CGT regulations for non-residents in the UK as of 2024.

- Key updates since the introduction of CGT for non-residents in 2015.

- Practical implications of CGT, including calculation and reporting.

- Specific scenarios: properties held by companies and gains accrued before 2015.

- Impact of becoming a non-resident on CGT obligations.

- Private Residence Relief and its application for principal residences.

- Potential changes under a new government and Labour Party policies.

- Importance of seeking professional tax advice.

How can businesses stay ahead of the curve when it comes to inflation?

In short, planning, foresight and common sense. By taking a proactive approach to inflationary pressures, businesses can ensure that they are well-prepared for any possible changes in the economy. They should be prepared for various scenarios and have contingency plans in place to address them. This includes developing the strategies mentioned above for hedging currency fluctuations or investing in different asset classes that can provide some protection from inflationary pressures. Businesses should also consider ways to reduce their operational costs, such as utilising energy efficiency measures or outsourcing services that would otherwise be costly in house. Taking these steps can help businesses stay afloat during periods of economic volatility caused by inflation and remain competitive in the long run.

How TaxAgility can help your business fight inflation

At TaxAgility, we don’t just provide an accounting service, we’re an extension of your financial team. We are here to help you identify the ways best suited to your unique business to fight the impact of inflation. We can help you do this by ensuring you maintain proper up to date management accounting information which allows you day-by-day to track income and expenses and the impact of rising costs on profit margins and cash flow.

We’re here to assist and advise as problems and opportunities arise. Call us today to discuss how we can help you keep a lid on the inflation’s impact on your business. Call today on: 020 8108 0090.

Note: This article is not intended to provide financial advice or guidance, it is for interest only.

What is the Register of Overseas Entities (ROE) and how does it affect me as an overseas investor in UK property

The new Register of Overseas Entities (ROE) is a public register of beneficial ownership information for overseas entities that own land or property in the UK. The ROE was created under the Economic Crime (Transparency and Enforcement) Act 2022, which was passed in response to the Russian invasion of Ukraine. The ROE is intended to make it more difficult for criminals to launder money through UK property by making it easier for law enforcement to identify the true owners of overseas entities.

The ROE came into force on 1 August 2022. All overseas entities that own land or property in the UK must register with the ROE. The information that must be registered includes the name and address of the beneficial owner of the entity, as well as the date on which the entity acquired the property.

The ROE came into force on 1 August 2022. All overseas entities that own land or property in the UK must register with the ROE. The information that must be registered includes the name and address of the beneficial owner of the entity, as well as the date on which the entity acquired the property.

The ROE is a valuable tool for law enforcement and other agencies that are working to combat economic crime. By making it easier to identify the true owners of overseas entities, the ROE can help to deter criminals from using UK property to launder money.

In this article we will cover the following:

- The extent of crime related to property investment in the UK

- A brief overview of the ROE

- An explanation of why the ROE was created

- A description of the information that must be registered on the ROE

- A discussion of the benefits of the ROE

So how big is the problem?

To highlight how big of an issue money laundering through property is in the UK, here are some statistics for 2022 on money laundering related to UK property investment by overseas individuals:

- Total value of UK property investment by overseas individuals: £6.7 billion

- Value of UK property investment by Russians accused of corruption or links to the Kremlin: £1.5 billion

- Percentage of UK property investment by Russians accused of corruption or links to the Kremlin in the City of Westminster: 28.3%

- Percentage of UK property investment by Russians accused of corruption or links to the Kremlin in Kensington and Chelsea: 18.8%

Such statistics highlight the extent of money laundering related to UK property investment by overseas individuals. The UK has long been a target for money launderers, and the property market is a particularly attractive option as it is relatively easy to hide the source of funds. The recent sanctions against Russia have increased the focus on money laundering in the UK, and it is likely that these statistics will only increase in the coming years.

How do criminals achieve their goals? Here are some of the ways that money launderers use UK property investment to launder their money:

Buying property in cash: This is the most common way to launder money through property investment. Criminals can simply buy property in cash, without having to provide any evidence of where the money came from.

Using shell companies: Criminals can set up shell companies to buy property on their behalf. This makes it difficult to trace the ownership of the property, and therefore the source of the funds.

Using trusts: Criminals can set up trusts to own property. This can also make it difficult to trace the ownership of the property, and therefore the source of the funds

This is why the UK government has taken steps to combat money laundering in the property market. These include introducing new regulations for property transactions, increasing the powers of law enforcement agencies to investigate suspected money laundering and recently, the introduction of the ROE.

The creation of the ROE

The ROE is a public register that lists the beneficial owners of overseas entities that own land or property in the UK. The register was created as part of the Economic Crime (Transparency and Enforcement) Act 2022, which was passed in response to the Russian invasion of Ukraine. The aim of the ROE is to increase transparency and make it more difficult for criminals to launder money through UK property. The ROE has been welcomed by anti-corruption campaigners, who believe that it will make it more difficult for criminals to hide their assets. However, some critics have argued that the ROE is too complex and that it will be difficult to enforce.

Are you looking to invest in UK property, or perhaps you already own property here?

If you are an overseas investor who owns property in the UK, or if you are considering buying property in the UK, you will need to be aware of the ROE. The following are some of the key things you need to know:

Who is required to register?

The ROE applies to all overseas entities that own land or property in the UK. An overseas entity is any entity that is not incorporated or registered in the UK. This includes companies, trusts, partnerships, and individuals.

What information must be registered?

- The ROE requires overseas entities to register the following information about their beneficial owners:

- Name

- Date of birth

- Nationality

- Residential address

- Occupation

How do I register?

You can register your beneficial ownership information on the ROE website. The registration process is free.

What are the penalties for non-compliance?

If you fail to register your beneficial ownership information on the ROE, you could face a fine of up to £2,500.

Benefits of registering on the ROE

There are a number of benefits to registering on the ROE, including:

Increased transparency: The ROE makes it easier for law enforcement agencies to track down criminals who use UK property to launder money.

Reduced risk of fraud: The ROE makes it more difficult for criminals to steal your identity and take control of your property.

Improved market reputation: By registering on the ROE, you are demonstrating that you are a responsible investor and that you are committed to compliance with the law.

The ROE system may seem like a lot of additional paperwork, but it is important to remember that it is designed to protect you and your investment. By registering your beneficial ownership information on the ROE, you are helping to make the UK property market a more transparent and secure place.

Final thoughts

The ROE is a new initiative that is designed to increase transparency and reduce the risk of financial crime in the UK property market. If you are an overseas investor who owns property in the UK, or if you are considering buying property in the UK, we strongly suggest that you register your beneficial ownership information on the ROE. By doing so, you are helping to make the UK property market a safer and more secure place for everyone.

All you need to know about transferring a property portfolio into a limited company

If you already have a property portfolio or are considering building one, should you do this in your name or within a company. Also, if you have a portfolio, is it worth transferring it into a company rather than holding it in your own name?

Professional and amateur landlords are finding themselves entering stormy waters. Recent press headlines tell stories of long time landlords with sizable property portfolios considering calling it a day. Why?

Enter Section 24. This has gradually been phased in since 2015, but was in full force by 2020. Section 24 of the Finance Act 2015 restricts mortgage interest relief at whatever tax bracket you found yourself in - say 40%, to the basic rate of 20%. This means that for some BTL landlords, their tax bills have doubled. For some, in higher tax brackets, it’s significantly more.

While Section 24 reduces tax relief on mortgage interest payments, it still allows a raft of other ’operational’ expenses to be set against profits before tax.

Furthermore, recent changes in Section 21 laws mean that landlords can no longer simply evict tenants for ‘no-fault’. This makes renting much more risky.

Naturally, these changes are making many landlords think twice about either continuing with their portfolios or entering the market. However, for those more hardy landlords or still aspiring investors still looking to build a property empire, one incorporating all the legal challenges currently surfacing, this may represent a great opportunity to pick up rentals other landlords are looking to dispose of. The question arises - should a property portfolio be held in an individual’s name or within a corporate entity?

Should I transfer my rental property portfolio in to a company?

Why does this question arise? Quite simply - because of personal tax issues and potential benefits of lower corporation tax.

Landlords who run a property rental business, perhaps built through buy-to-let mortgage schemes, report income from their lettings business in their own personal tax return - the SA100, more specifically the SA105 Supplementary pages. In other words, a landlord could find themselves in a higher tax bracket - 40% or 45%.

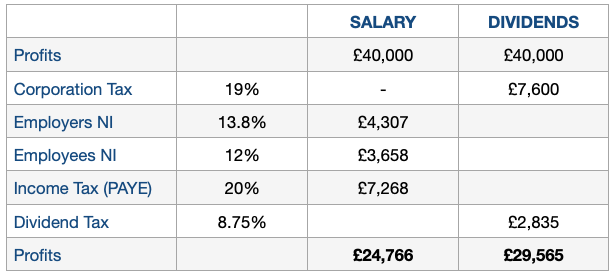

Holding property in a company means paying corporation tax on profits, currently at 19%, rising to 25% in 2023, significantly better that paying 40% or 45%. If a director then takes a dividend to access the profits, they will likely see a sizable positive difference compared to the alternative of a personal tax approach. This is because of the savings made from not paying regular income tax and national insurance.

The director is around £4,800 better off through dividend taking - currently.

Where property portfolios and existing landlords are concerned there is a rather large ‘BUT’ in regard to whether it’s actually worth transferring property into a company to realise gains through paying corporation tax and dividends. This is another key question that gets asked.

Is it worthwhile transferring my property portfolio into a company?

The answer to this question is ‘it depends’. In this case it rather depends on how many properties you have in your portfolio.

To be able to transfer a property into a company, you are essentially selling what you own to the company entity. What does this mean?

- Transferring the property into a company means that you will no longer own the property - the company will. Your ownership is indirect, through shares in your company. If you own 100% of the company, then you own 100% of the shares and therefore the shares in the properties.Problems may arise when trying to do this though, particularly if the properties are mortgaged, such as through a ‘buy-to-let’ (BLT) scheme. The problem comes about because banks won’t allow you to mortgage an asset you don’t personally own. If you do have properties mortgaged, in all likelihood, you’ll have to pay-off the original ‘personal’ mortgages and re-mortgage through a commercial mortgage scheme. Naturally, interest rates will likely be high for commercial loans. If you own the properties outright, this isn’t an issue.

- When you ‘sell’ the property(s) to your company, you’ll likely be liable for capital gains tax (CGT) on any profits you make in the sale. If you’ve had the properties for a while, this may be significant. Naturally, HMRC expects you to sell the property at a realistic market rate, so you can’t step around this by selling the property to your company ‘on the cheap’.It may be possible for you to ‘defer’ the CGT payment. If you run your BLT as a business, as opposed to ‘a source of disposable income’, you may be able to receive ‘Incorporation Relief’. This is more likely to apply to a landlord with more than a few properties though. Incorporation relief allows you to defer the CGT payment until a later date when the shares you receive in return for the properties are divested of. At the time of divesting, you’ll be liable for the CGT you would have paid originally.

- Another consideration to make before shifting your properties into a company is the fact that selling them to your company means your company will have to pay stamp duty too. If for instance, under normal circumstances, the property you are selling sells for £350K, you’ll need to pay around £18,000 in Stamp Duty (SDLT), as you’ll own more than one residential property. If you have a number of such properties to transfer, you may be able to claim ‘multiple dwellings relief’. The benefit in this is that rather than apply SDLT to each property transaction based on the price paid, the purchase of multiple properties is considered as a single transaction. So, rather than calculating SDLT on the total price of all properties purchased, SDLT is calculated based on the average price paid for each property. This is likely to reduce overall SDLT payable.

- There are other costs associated with running a property business, that as an individual, you’ll not pay. You’ll need to use an accountant like TaxAgility to assist with your business tax returns and other statutory requirements. On a monthly basis, you’ll likely need your bookkeeping done so as to keep track of rent payments, and the general costs associated with running a residential property portfolio. All this adds up.

- Please note: While the above implications for CGT and stamp duty apply in most circumstances, mechanisms do exist where it is possible to legitimately avoid both capital gains tax and stamp duty. How this is achieved does depend on your unique circumstances and we would need to discuss this with your directly so that this could assessed and explained in detail.

Call us today on 020 8108 0090 to find out more.

In summary, transferring a property portfolio into a company is not a step that can be taken lightly. All the financial implications with moving a property portfolio into a company suggest that it’s wise to prepare a complete financial model showing before and after projections of any likely cost savings. Remember that any benefit that arises will arise from the longer term tax savings through corporation tax and dividend tax, if you take the profits in that way. When considering the transfer costs identified above, reaching breakeven may take a few years. The scale of your business though, may still make this an attractive proposition.

Moving a property portfolio into a company isn’t straightforward for many portfolio owning landlords, there’s a lot to consider and numbers to work through. Starting a property portfolio though using a company, is a different matter, as all of the costs associated with transferring properties won’t exist, making the decision more attractive to make.

TaxAgility can advise and assist landlords with property portfolios make the right tax choices

Whatever circumstances you find yourself in, we'd like to reassure you that TaxAgility are specialists in assisting landlords and ‘High Net Worth Individuals’ (HNWI) with personal property portfolios, to make the best decisions. We’ll walk through the thinking and the calculations with you transparently, so you can decide if moving a property portfolio into a company is the right thing to do.

No matter what you decide, we’ll be here to help you manage your portfolio in the most tax efficient manner based on your unique circumstances.

Call us today on 020 8108 0090 and find out how we may be able to significantly improve the tax outlook for property letting business.

Please note: The information contained in this article should not be treated as either tax advice or investment advice, it is for information only. You should always contact a tax or investment professional who can assess your personal circumstances before making important financial decisions.

Landlords, are you maximising your profits?

We’ve noticed that some landlords forget that they actually run a business, particularly if they only have one other property and receive a reasonable stream of monthly rental. However, just like any business, there are claims you can make that will maximise your tax position and maximise your after tax profits. We are going to review these in this article.

The bottom line is simple, you are allowed to make certain expense claims associated with owning and operating a rental property. These are known as ‘Allowable Expenses’. These can be deducted from your business profits before your tax liability is calculated. The more expenses you claim, the lower your tax bill. One does need to be careful here as it’s easy for HMRC to scrutinise your claims. If HMRC has any reason to believe that you may be using expenses in a fraudulent manner, such as claiming expenses that are not truly related to running your business and therefore artificially lowering your tax liability.

The bottom line is simple, you are allowed to make certain expense claims associated with owning and operating a rental property. These are known as ‘Allowable Expenses’. These can be deducted from your business profits before your tax liability is calculated. The more expenses you claim, the lower your tax bill. One does need to be careful here as it’s easy for HMRC to scrutinise your claims. If HMRC has any reason to believe that you may be using expenses in a fraudulent manner, such as claiming expenses that are not truly related to running your business and therefore artificially lowering your tax liability.

So, understanding what you can and cannot claim is a great starting point in helping you revisit your expenses, making the most out of any deductions and maximising your rental income profits.

Understanding the ground rules - is it revenue or is it capital

As you might expect, HMRC are very good at creating rules that help distinguish whether any work you do on your rental property could be allowed as an expense. In this case one needs to consider if work you undertake is a capital investment or part of maintaining your revenue stream. Put another way, is the work you are doing on the property a repair or an improvement?

This is an area where landlords can make mistakes. It’s not unreasonable for the average landlord to think that refurbishing a rental property may be considered as an expense, so as to maintain revenue flow. HMRC are quite hot on this and you must think carefully as to how to apportion the expenses you incur.

When refurbishing, it’s critical you maintain accurate records showing what work constituted ‘repairs to the property’ and that which constituted ‘improvements’. For instance; painting and decorating would be an allowable expense as you are keeping the property in a rentable condition and probably honouring contractual obligations ensuring the property is fit for purpose. However, if as part of the work you decide to make alterations to the property’s configuration - perhaps make a room bigger, or add a loft room skylight, this would be classified as improvement work and therefore ‘capital’ and not an allowable expense.

If you are not able to show the split between repairs and improvement, HMRC will consider all work as capital and tax accordingly.

Capital expenses

Understanding what HMRC considers capital expenditure can help clarify what you can and cannot claim for.

When starting out for instance, it is typical for the owners to think that they could claim the cost of bringing a ‘distressed property’, probably purchased at a reduced rate, into a fit state for letting. This isn’t an allowable expense. You may however, be able to set this against capital gains allowances if you sell the property in the future. So, keep accurate records.

What is a capital expense?

If something is to be used by a business over a long period of time, they will most likely be capital expenses. For instance, where property is concerned:

- Make an addition to a property

- Improve or upgrade and existing part of the property

- Replace something with one of a higher specification

So, some expense examples that would not be allowed include:

- Extending the property

- Adding security system

- Replacing a bathroom suite with one of a higher specification

So, what can you legitimately claim for beyond the more obvious repair work?

Allowable property expenses

We arranged these in stages related to the scope of the expense.

Before you rent out a property

- Redecorating prior to a new tenant

- Replacing broken items, such as hot water systems, kitchen surfaces (as long as it’s not an improvement)

- Roof repairs

- Replacing items with their nearest modern equivalent provided the improvement is coincident to the repair.

- Replacement of items with a short useful life and of low value - soft furnishing, cutlery and crockery for instance.

- Replacement of fixtures and fittings. For instance baths, toilets, etc. just so long as they are like-for-like replacements and not improvements.

- Insurance policies for landlord, buildings and contents, public liability

- Legal fees, accountant fees

- Management and letting agent fees

- Direct costs related to advertising for new tenants, such as advertisement fees (creating and running them), telephone costs, etc.

While your property is let out

- Costs associated with garden maintenance, cleaners, etc.

- Utilities and council tax if you pay for these yourself and not the tenant

- General maintenance and repair

- Costs associated solely with running you car for business

- Fees you have to pay that are not passed on to the tenant, such as rent payments if you are subletting, ground rents and service charges.

- The interest element of any mortgage you pay on the property. This is not directly tax deductible for individuals. Instead 20% of the interest amount is allowed as a tax reducer. If the property is owned by a limited company, the full interest charge is corporation tax deductible.

What allowances are available to landlords?

Note that these are different from allowable expenses.

You have a choice; you can claim the “Property Allowance” and receive £1000 a year tax-free. However, if you claim this, you cannot then claim for your other expenses. It makes sense to use this allowance if your allowable expenses are less than £1,000.

When you rent out a residential property - a dwelling, you may be able to claim a deduction for the replacement of certain domestic items. This Income Tax relief is only available for expenses incurred from April 6 2016. It covers items such as:

- Movable furniture

- Soft furnishings and floor coverings

- White goods and other appliances

- Kitchenware

This relief can only be claimed if:

You’re letting out residential homes (dwellings)

You’re replacing an old no longer serviceable item for a new domestic one and it is only for the use of the lessee in this dwelling house and the old item is withdrawn from service and no longer available to the lessee.

You cannot have claimed Capital allowances on the expenditure

When can’t you claim this relief

- When the property is a furnished holiday let. Capital allowances will still apply though

- Rent-a-room schemes

- The costs of initial domestic items for the residential property under let

What happens if I have to buy an improved version of something?

Sometimes we have no choice but to replace something with a new and improved item. HMRC defines an improvement as:

- Not being the same or substantially the same as the old item

- Its functionality has changed - as often happens with new white goods

- It represents a material upgrade to the quality of an item - replacing. Plastic worktop with a granite one, for instance

In these circumstances you can only claim a deduction based on the cost of the old one. So for instance, if an improved replacement item costs £200 and an equivalent to the old one would have cost £150, then you can only claim for the £150.

When calculating the deduction, you should also take into account:

- The cost of the replacement item

- Any costs relating to buying it

- Disposal costs if any

Then you must deduct any income received from disposing of the item - for instance if you sold it for scrap.

In conclusion

It’s not always obvious what you can claim for and what you can’t claim for, or even how to claim, especially if you report your income through your SA100.

If you make a mistake and HMRC makes a challenge, the situation could become expensive as you may have to hire an accountant to help you.

TaxAgility has assisted many clients with their residential lettings businesses. So, it doesn’t matter if you’re running a lettings business or are an individual with a single property under let, we can help you identify your legitimate expenses, make the appropriate claims, ensure you take full advantage of any allowances, so as to maximise your rental profits. Helping individuals and small businesses maximise tax efficiency is at the heart of what we do - the clue is in our name - TaxAgility!

Call us today on 020 8108 0090 and find out if we can help your residential lettings business improve its bottom line!

We’ve updated our accountants for commercial property owners page

With the assistance of our expert tax and accounting services, commercial property owners across London can trust us to manage their business affairs.

Investing in commercial property in the UK is a financially rewarding venture as the yields on commercial property are often higher than residential property. If you are planning to buy a commercial property in London and receive income by letting it, then it is best to work with one of our specialist commercial property accountants and let us help you with tax and accounting.

At TaxAgility, we understand that as commercial landlords, your focus is on growing your portfolio. Naturally, you want someone you can trust to help you manage the tax and accounting side, areas that are often complex, time-consuming, and best left to specialists who know what they are doing.

This informative page covers:

- Business rates

- Stamp Duty Land Tax

- VAT

- Commercial property and Inheritance Tax Relief

- Commercial property and pensions through SIPP

- Making Tax Digital

With years of helping commercial landlords in London, we can advise on:

- Business structure to manage your commercial property

- Corporate tax planning

- Your personal tax planning, how to minimise your tax liability legitimately

- VAT matters

- Legitimate expenses that can be offset against rental income

- How to maximise capital allowances on the acquisition of a commercial property

Of course, we can also assist on:

- Accounts and bookkeeping

- Company secretary

- Corporate services

- Management consultancy

- Tax investigations

Let our accountants for commercial property owners help you

At TaxAgility, we’re passionate about accounting for commercial property. We have a team of experts who understand each and every financial rule that applies to commercial property. If you’re a commercial property owner or are planning to invest in commercial property in London, talk to one of our commercial property accountants at TaxAgility first.

Our advice is always clear and honest, plus we also offer an initial Free consultation which will allow us to understand your situations first. Contact one of our specialist accountants for commercial property owners today on 020 8108 0090. Alternatively, you can send us a message via our Contact Form.

We’ve updated our accountants for landlords page

It’s common to see news relating to London property market grabbing headlines. One day you may come across an article claiming house prices have fallen but the next day another reporter may claim otherwise.

While the property market can be unpredictable, one thing is certain: you can always count on our experienced and trusted landlord accountants if you receive an income through renting out your property.

Whether you’re someone who is looking to enter the property market or is already a veteran, you may not have the time and commitment to keep up with tax changes that can affect your rental income. This is why we have updated our accountants for landlords page by giving it a sharper focus. On the page, you can find out about:

- Rental housing prospects in London

- Financial considerations as a residential landlord

- Shifting tax regulations

- Making Tax Digital for landlords

Contact TaxAgility for landlord accountants today

We’re specialist landlord accountants in London that will go above and beyond to help you manage your accounting responsibilities, deal with shifting tax regulations and more. Get in touch with one of our specialist accountants for landlords today. Give us a call on 020 8108 0090 or send us a message via our Contact Form.

Property Tax

Tax is a complicated subject and property tax is no exception. If you own a property or planning to own one, tax planning becomes important because buying, selling or renting out your property is likely to expose you to some form of property tax. In this article, our specialist tax accountants explain:

Tax is a complicated subject and property tax is no exception. If you own a property or planning to own one, tax planning becomes important because buying, selling or renting out your property is likely to expose you to some form of property tax. In this article, our specialist tax accountants explain:

- Stamp Duty Land Tax

- Capital Gain Tax

- Tax on rental income

Stamp Duty Land Tax

When you buy property, you must pay Stamp Duty Land Tax (SDLT). The amount you pay depends on several factors such as if you’re replacing your main residence, buying an additional property, buying a non-residential property, and if the property is freehold or leasehold.

If you are a first-time buyer, then you don’t pay SDLT on properties up to £300,000, and only 5% SDLT on anything between £300,001 and £500,000. If your property is worth more than £500,000 then you will be taxed as though you had already bought a home.

A common question relating to SDLT is if one can reduce the SDLT liability by using a company to purchase a property. The answer is generally no because HMRC applies a 15% SDLT on residential properties costing more than £500,000 if bought by a company, although there are conditions where the 15% rate does not apply, such as when the company acts in its capacity as a trustee of a settlement and purchases a chargeable interest in a residential property. To find out how you can reduce your SDLT liability legitimately, it’s best to discuss your situation with one of our experienced Tax Accountants.

Capital gains tax on property

Whenever you sell a property that has appreciated in value, you may be taxed on the profit that you make. This is capital gains tax and it typically applies to property that’s not your main home, such as buy-to-let property, business premise, land and inherited property. If you sell your home or if you live abroad, different rules will apply.

Like other taxes, there are situations where you can get a tax relief or don’t have to pay capital gain tax on property. For example, you do not need to pay tax on assets you give to your spouse or a charity as a gift.

In the event that you are liable for capital gains tax, how much you need to pay depends on how much capital gains tax allowance you have in that financial year. The good news is, the amount of annual capital gains tax allowance, aka the annual CGT exemption, has been increased by the government over the years and for the 2019/2020 tax year, you can make tax-free capital gains of up to £12,000 and couples who jointly own assets can combine this allowance.

Get in touch with us if you would like to understand more about capital gains tax and the relief associated with it.

Tax on rental income

In its simplest sense, you pay income tax on the profit you make from renting out your property. Additionally, you can also deduct finance cost (mortgage interest, interest on loans to buy furnishings, overdrafts) from rental income, but HMRC has begun to restrict this from 2017 with a mixture of old and new rules and from the tax year 2020-2021 onwards, as a residential landlord, you will get a flat rate of 20% deduction of these costs from your tax liability. The upshot of this is you will be paying more tax and receiving a smaller net profit from your rental income, particularly if you’re a landlord who already has a higher income.

One legitimate tax-efficient way to handle tax on rental income is to set-up a limited company and take advantage of corporation tax rates and dividend tax rates, which are lower than income tax and capital gains tax rates.

Contact the experts

Property tax is immensely complicated and there are numerous reliefs subject to specific conditions which may not be obvious to a property owner. At TaxAgility, our tax accountants excel in personal tax planning, and we’re always available to discuss income tax, trusts and estates, inheritance tax and capital gains tax with you.

Get in touch on 020 8108 0090, or contact us via our Online Form.

This post is intended to provide information of general interest about current business/ accounting issues. It should not replace professional advice tailored to your specific circumstances.

Buy-to-Let Landlords: Four Reasons to Hire a Specialist Accountant

The changing landscape of buy-to-let regulation demands specialist attention this year. Landlords are beginning to feel the effects of the government’s cut in mortgage tax relief and the abolition of wear and tear allowance while lending criteria around mortgages are stricter than in past years and interest rates are rising. 2018 is no doubt a confusing time for those investing in the private rental sector, so there’s never been a better time to turn to an accountant for help.

The changing landscape of buy-to-let regulation demands specialist attention this year. Landlords are beginning to feel the effects of the government’s cut in mortgage tax relief and the abolition of wear and tear allowance while lending criteria around mortgages are stricter than in past years and interest rates are rising. 2018 is no doubt a confusing time for those investing in the private rental sector, so there’s never been a better time to turn to an accountant for help.

There are numerous benefits to working with an accountant specialising in landlords, and here are four reasons to hire one this year:

Expertise

Accountants who concentrate on offering services to landlords are well-versed in knowing what taxes you need to pay, how you need to report your rental earnings to HMRC, and the best way to keep track of your accounts, be it using Xero, Quickbooks, or Free Agent. Whereas general accountancy firms might miss essential aspects of your responsibilities as a landlord, you can consult specialist landlord accountants with particular questions. You can also expect to hear impartial and tailored advice based on many years of experience.

Legislation changes

No matter what tax changes the future throws at landlords, specialist accountants will be ready to tackle them. Significant changes might be easy to follow on your own but the effects of seemingly small additions might catch landlords off guard and surprise them down the line. Accountants for landlords will make sure no sneaky tax changes slip into effect without you knowing. This is undoubtedly one of the most liberating advantages of hiring a specialist landlord accountant.

Accounts

No property owner can operate without having their books in order; they should be kept up to date and in line with the law. This is especially important if you have multiple properties as it can be easy to lose track of your rental accounts every month, resulting in missed rent and lost receipts and bills. An accountant will have a clear view of your rental accounts at all times. The importance of accurate record keeping is perhaps the most apparent during an HMRC investigation.

Tax relief

Your accountants can file your taxes for you, knowing exactly what tax relief you’re eligible for. In 2017 the government began reducing the available tax relief to landlords with the aim of gradually restricting it further by 2020. This means that it’s currently difficult to know just what you can or cannot expect when you file your tax return. A specialist landlord accountant will make sure you get the most from your investment.

Planning for the future

You may not want to stay a landlord forever and although it’s not on your mind now, you might sell your property in the future. A specialist accountant will plan for such eventualities and have advice for you when you’re ready.

No more confusion

Get all of the above specialist financial advice from TaxAgility and we’ll make your accounts fly. We have a team of landlord experts with specialist resources that will save you time and money. Speak with a professional accountant and discuss our unique accountancy packages for residential property owners (landlords).

Get in touch with us via our contact page to arrange a complimentary, no obligation meeting or call us on 020 8780 2349.

The Benefits of Working with an Accountant Specialising in Property Owners

Property owners (both residential and commercial) and estate agents know that there’s an enormous number of different financial areas to consider when buying, selling, or renting out property.

Property owners (both residential and commercial) and estate agents know that there’s an enormous number of different financial areas to consider when buying, selling, or renting out property.

From having to contact HM Revenue and Customs (HMRC) to let them know you’ll be receiving rental income, to knowing what business rates you or your tenants will have to pay when moving into a new commercial property, there’s a lot to keep track of in order to ensure you stay on the right side of the law.

For this reason, there are a lot of benefits to working with an accountant specialising in the accounts of both residential property owners (landlords) and commercial property owners. Just a small number of these benefits are as follows:

We know our stuff

Here at TaxAgility, we have been working with property owners for YEARS/DECADES. For this reason, we know exactly what taxes you need to pay if you just bought a commercial property, or indeed we know exactly how you need to report your rental earnings to HMRC if you have started out renting residential properties for the first time.

Other accountancy firms that don’t specialise in this area will take up your valuable time by having to look these things up, and potentially even miss them altogether, which could be very costly to you.

We keep an eye on tax changes that may affect you

Equally important to knowing our stuff is our willingness to keep an eye on all and every change to the tax codes and legislation that may affect how much you, as a property-owning accountancy client of ours, is liable to pay.

Though it’s rare for a large, overarching tax change to be enforced under the radar, smaller changes can often come up that catch out property owners who are tasked with dealing with their own accounts, or indeed these changes can even catch out accountants who are not well versed in the complexities of property ownership taxes.

We provide a full-service accountancy experience

Here at TaxAgility, we provide a full-service accountancy experience to all of our property owner (both residential and commercial) and estate agent clients.

We understand the problematic tax implications of owning, buying, or renting property, and we take it upon ourselves to ensure you only pay the tax liabilities owed to you, nothing more, while keeping your books up to date and in line with the law. No property owner can operate without having their books in order - we make sure you’re always operating both legally and efficiently.

Experienced Accountants for Property Owners

To speak with a professional accountant to discuss our unique accountancy packages for residential (landlords) and commercial property owners, contact us today on 020 8780 2349 or get in touch with us via our contact page to arrange a complimentary, no obligation meeting.

What is The Help to Buy ISA?

The Help to Buy ISA (Individual Savings Account) is an ISA designed to help first time buyers get onto the property ladder by allowing them to save up to £200 a month into the ISA, with the promise that once you purchase a property (worth up to £450,000 in London, and £250,000 outside the capital) the government will increase your ISA savings by 25 percent, up to a total of £3,000.

The Help to Buy ISA (Individual Savings Account) is an ISA designed to help first time buyers get onto the property ladder by allowing them to save up to £200 a month into the ISA, with the promise that once you purchase a property (worth up to £450,000 in London, and £250,000 outside the capital) the government will increase your ISA savings by 25 percent, up to a total of £3,000.

This means if you save a total of £12,000 into your Help to Buy ISA, the government will top this up by the full £3,000 to give you a total of £15,000. You may make an initial deposit of £1,000 into your individual account, with your deposit also qualifying for a 25 percent government boost.

It should be noted that the Help to Buy ISA is only available to individuals 16 years old and above, and it’s only payable to those purchasing a property within the UK. Purchases of overseas properties do not qualify under the scheme. The Help to Buy ISA cannot be used if the property is to be rented (let) out.

Couples’ Advantage

One thing which makes the Help to Buy ISA especially tempting to couples and partners, married or not, is that they’re available on a one per person basis, rather than a one per home basis. This means that you and your spouse can both pay into your own Help to Buy ISA, saving a total of £24,000 between the two accounts, and receiving a total of £6,000 from the government.

This applies not just to romantically involved individuals, but also to friends and family members who are purchasing a home together.

When’s it Available, and for How Long

The Help to Buy ISA is available through banks and building societies across the UK from this Autumn (2015). New accounts will only be available for four years, but once you’ve opened an account there’s no limit on how long it can be held.

In terms of the ISA itself there is no minimum monthly deposit, but your bonus can only be collected (upon purchase of a home) once your qualifying savings reach the minimum amount of £400, meaning you have saved a total of £1,600, with the government topping this up to £2,000.

Under the scheme’s rules of saving a maximum of just £200 a month, it will take you just over four and a half years to qualify for the maximum bonus of £3,000, should you wish for it. If you and your partner, friend, or family member also have a Help to Buy ISA you may choose to ‘cash in’ sooner.

Experienced Personal Accountants

To speak with a professional accountant to discuss the Help to Buy ISA, and whether it’s a good scheme for you to partake in, contact us today on 020 8780 2349 or get in touch with us via our contact page to arrange a complimentary, no-obligation meeting.