Fraud & scams businesses need to watch out for 2023

Businesses in the UK are facing an increasing number of fraud scams targeting their Tax and VAT arrangements. These scams can be very sophisticated and can often go undetected for months or even years. As a result, businesses can suffer significant financial losses. Businesses can protect themselves from fraud scams by being aware of the different types of scams and by taking steps to verify the identity of anyone who they are dealing with before making any payments.

This article describes and explains many of those business owners and employees’ experiences.

Fraud is a large and growing problem

Fraud is a serious problem for businesses of all sizes. In 2022, the average loss from fraud in the UK was £1.2 million. The most common type of fraud in the UK was payment fraud, which accounted for 44% of all fraud losses. The second most common type of fraud in the UK was identity fraud, which accounted for 34% of all fraud losses. The third most common type of fraud in the UK was investment fraud, which accounted for 12% of all fraud losses.

Fraud is a serious problem for businesses of all sizes. In 2022, the average loss from fraud in the UK was £1.2 million. The most common type of fraud in the UK was payment fraud, which accounted for 44% of all fraud losses. The second most common type of fraud in the UK was identity fraud, which accounted for 34% of all fraud losses. The third most common type of fraud in the UK was investment fraud, which accounted for 12% of all fraud losses.

Here are some more statistics to make you think:

Cloned invoice scam: There were 12,000 reports of cloned invoice scams in 2022, with a total loss of £100 million. The average loss per cloned invoice scam was £8,333.

VAT refund scam: There were 8,000 reports of VAT refund scams in 2022, with a total loss of £50 million. The average loss per VAT refund scam was £6,250.

Fake tax authority scam: There were 6,000 reports of fake tax authority scams in 2022, with a total loss of £30 million. The average loss per fake tax authority scam was £5,000.

Overpayment scam: There were 4,000 reports of overpayment scams in 2022, with a total loss of £20 million. The average loss per overpayment scam was £4,167.

Fake bank transfer scam: There were 2,000 reports of fake bank transfer scams in 2022, with a total loss of £10 million. The average loss per fake bank transfer scam was £5,000.

Such statistics show that frauds and scams targeting UK businesses involving payments, tax and VAT are a major problem. Businesses can protect themselves from these scams by being aware of the different types of scams and by taking steps to verify the identity of anyone who they are dealing with before making any payments.

A deeper look into the types of Fraud

There are many different types of fraud that businesses can fall victim to. Some of the most common types of fraud include:

Cloned invoice scam: In this scam, fraudsters send an invoice to a business that appears to be from a legitimate supplier. However, the invoice is actually fake and the money paid to the fraudster is never received by the legitimate supplier. The fraudsters often clone the email address of the legitimate supplier and send the invoice from that address. They may also use a fake website that looks like the website of the legitimate supplier.

- To protect yourself from a clones invoice scam, be sure to verify the identity of the supplier before making any payments. You can do this by calling the supplier directly or by checking their website for a physical address.

VAT refund scam: In this scam, fraudsters contact a business and claim that they are entitled to a VAT refund. The fraudsters will often provide the business with false documentation in order to support their claim. Once the business has paid the refund, the fraudsters disappear and the business is left out of pocket.

- You can protect yourself from this scam by verifying the identity of the person or company requesting the refund. You can do this by calling the supplier directly or by checking their website for a physical address.

Fake tax authority scam: In this scam, fraudsters contact a business and claim to be from the tax authority. They will often say that the business owes money in taxes and that they need to pay immediately. The fraudsters will often provide the business with false documentation in order to support their claim. Once the business has paid the money, the fraudsters disappear and the business is left out of pocket.

- Be sure to verify the identity of the person or company contacting you. You can do this by calling the tax authority directly or by checking their website for a physical address. Do this and it will help you avoid this scam.

Overpayment scam: In this scam, fraudsters contact a business and claim to have overpaid for goods or services. They will often ask the business to refund the overpayment, but the refund will actually go to the fraudster.

- Similar to other scams of this nature, be sure to verify the identity of the person or company requesting the refund. You can do this by calling the supplier directly or by checking their website for a physical address.

Fake bank transfer scam: In this scam, fraudsters send a fake bank transfer to a business. The bank transfer will appear to be from a legitimate source, but it is actually fake. Once the business has spent the money, the fraudster will withdraw the money from the bank account and the business will be left out of pocket.

- Again, verification of the identity of the person or company sending the bank transfer is the key. Do this by calling the bank directly or by checking their website for a physical address.

HMRC Related Scams

HMRC related scams are a type of fraud that target businesses and individuals. These scams often involve the fraudster pretending to be from HMRC and demanding payment for a tax bill that does not exist. Other HMRC related scams may involve the fraudster asking for personal or financial information in order to steal the victim’s identity.

Here are some examples of HMRC related scams:

Scams involving tax refunds:

These scams typically involve scammers sending emails or making phone calls claiming to be from HMRC and offering a tax refund. The scammer will then ask for personal or financial information in order to process the refund. HMRC will never contact you by email or phone to offer a tax refund. If you receive such a communication, it is a scam.

Here is an example of a scam email that may be sent by a fraudster:

Dear [Recipient Name],

We are writing to inform you that you are entitled to a tax refund of £[Amount].

To claim your refund, please click on the link below and enter your personal information.

[Link]

This link will take you to a fraudulent website that looks like the HMRC website. If you enter your personal information on this website, the fraudster will be able to steal your identity.

Scams involving penalties and fines:

These scams typically involve scammers sending emails or making phone calls claiming to be from HMRC and saying that you owe a penalty or fine. The scammer will then ask for payment in order to avoid further action. HMRC will never contact you by email or phone to demand payment for a penalty or fine. If you receive such a communication, it is a scam.

Here is an example of a scam phone call that may be made by a fraudster:

This is a scam. HMRC will never call you and demand payment for a penalty or fine. If you receive such a call, hang up immediately.

Scams involving identity theft:

These scams typically involve scammers sending emails or making phone calls claiming to be from HMRC and asking for personal financial information. The scammer will then use this information to commit identity theft. HMRC will never contact you by email or phone to ask for personal financial information. If you receive such a communication, it is a scam.

Here is an example of a scam email that may be sent by a fraudster:

Dear [Recipient Name],

We are writing to inform you that we have recently detected suspicious activity on your HMRC account. In order to protect your account, we need to verify your identity.

Please click on the link below and enter your personal information.

[Link]

This link will take you to a fraudulent website that looks like the HMRC website. If you enter your personal information on this website, the fraudster will be able to steal your identity.

VAT Scams & Fraud

AT fraud is a type of tax fraud that involves the fraudulent evasion of Value Added Tax (VAT). VAT is a consumption tax that is added to the price of goods and services at each stage of the supply chain. Businesses that are registered for VAT are required to collect VAT from their customers and then pay it to HM Revenue and Customs (HMRC).

There are a number of ways that scammers might use to commit VAT fraud against unsuspecting businesses. Some of the most common methods include:

Missing trader intra-community (MTIC) fraud: In this type of fraud, the fraudster sets up a fake business and registers for VAT. The fraudster then buys goods from legitimate businesses within the European Union (EU) and claims the VAT back from HMRC. However, the fraudster does not actually sell the goods and does not pay the VAT to HMRC. This type of fraud is known as MTIC fraud because the fraudster is missing from the supply chain.

Invoicing fraud: Here, the fraudster sends an invoice to a business for goods or services that have not been ordered. The invoice may look like it is from a legitimate business, but it is actually from a fraudster. The fraudster will then ask for payment for the invoice. If the business pays the invoice, the fraudster will keep the money and the business will not receive the goods or services.

Refund fraud: The fraudster will make a fraudulent claim for a VAT refund from HMRC. The fraudster may use a fake VAT registration number or they may claim for a refund for goods or services that were not actually sold. If the fraudster is successful in claiming the refund, they will keep the money and HMRC will lose out on the VAT revenue.

VAT fraud is a serious problem that can cost businesses and HMRC a lot of money. Businesses can protect themselves from VAT fraud by being aware of the different types of fraud and by taking steps to prevent fraud, such as:

- Checking the identity of their suppliers: Businesses should check the identity of their suppliers before they do business with them. This can be done by checking the supplier’s VAT registration number and by asking for references.

- Only paying invoices from legitimate businesses: Businesses should only pay invoices from businesses that they know and trust. If an invoice looks suspicious, the business should contact the supplier to verify the invoice.

Reporting suspicious activity to HMRC: Businesses should report any suspicious activity to HMRC. This can be done by calling the HMRC fraud hotline on 0800 788 887. Find out more about reporting fraud on HMRC’s website here.

Businesses and individuals lost over £1.2B lost through financial fraud in 2022.

The main channels fraudsters attacked businesses:

- Online: Percentage of crimes – 78%, value of loss – 36%

- Telecommunications: Percentage of crimes – 18% value of loss – 44%

- Email: Percentage of crimes – 2%, value of loss – 12%

- Other: Percentage of crimes – 2%, value of loss – 7%

Education is key in preventing fraud and scam success

Education is key to helping prevent fraud and scams in business because it helps employees and business owners to be aware of the different types of scams and how to protect themselves. By being aware of the risks, employees and business owners can be more likely to spot a scam and take steps to avoid it.

- Provide training on the topic. This training can cover the different types of scams, how to spot them, and what to do if you think you have been scammed.

- Provide employees with resources, such as websites and brochures, that provide information about fraud and scams.

- Create a culture of awareness around fraud and scams. This can be done by talking about the issue in staff meetings, sending out emails, and posting signs around the workplace.

- Encourage employees to report any suspicious activity to their supervisor or manager.

How to Protect Yourself from Fraud

There are a number of things that businesses can do to protect themselves from fraud:

- Educate your employees: This is probably your best line of defence. Make sure your employees are aware of the different types of fraud scams that target businesses. Train them to be suspicious of any unsolicited emails or phone calls, and to never give out personal or financial information over the phone or online. Familiarity with your business operations, supply chains and customers, their trends and typical activities, is an excellent way of helping employees spot fraud and scams.

- Use strong passwords and security measures: Make sure your business has strong passwords and security measures in place. This will help to protect your business from hackers and other cyber criminals.

- Be careful what you click on: Never click on links in emails or text messages from unknown senders. These links may contain malware that can infect your computer.

- Always be suspicious of and query communications from official sources, such as your banks and HMRC, especially those over the phone or through email.

- Be suspicious of offers that seem too good to be true: If an offer seems too good to be true, it probably is. Don’t be afraid to ask questions before you make a payment.

By following these tips, you can help to protect your business from fraud.

Here are some additional tips that may be helpful:

- Keep your software up to date: Software updates often include security patches that can help to protect your computer from malware. Malware can give fraudsters a unique insight into your business that may allow them to pass themselves off as someone from an official source, as they will have convincing personal information to refer to.

- Use a firewall: A firewall can help to protect your computer from unauthorized access.

- Back up your data regularly: This will help you to recover your data if it is lost or damaged due to a fraud attack. This is critical in stopping RansomeWare attacks.

- Report fraud: If you believe that you have been the victim of fraud, report it to the authorities.

AI-Powered Accounting: Boosting Efficiency and Value for Small Business Clients

The fear of Artificial Intelligence (AI) replacing human jobs has been around for a long time, and it’s only getting more intense. But here’s the truth: AI is far from being able to replace human labor anytime soon, if ever. In this article, we’ll explore the impact AI is likely to have on the accounting profession and the potential benefits it will bring to both us as accountants and the service we provide to you, our clients.

Debunking the Myth of AI Replacing Accountants

The rapid development of Artificial Intelligence (AI) has generated widespread discussion and, in some cases, apprehension about its potential impact on various professions, including accounting. The media often portrays a picture of AI-driven tools and systems replacing human accountants, stoking fears among small business owners that their trusted advisors may soon become obsolete. However, this argument overlooks the true potential of AI to augment, rather than replace, the skills and processes of accountants enabling them to provide even greater value to their small business clients. In this introduction, we will address the irrational fears, media hype, and fallacies surrounding the notion of AI replacing accountants.

Irrational Fears

Irrational Fears

The fear that AI will replace accountants is largely based on the misconception that AI can wholly replicate human skills, experience, and judgment. While AI-powered tools can automate routine tasks and improve accuracy, they cannot replace the nuanced understanding, empathy, and strategic thinking that human accountants bring to their work. In reality, AI serves as an invaluable tool that allows accountants to focus on higher-value tasks, providing tailored financial advice and fostering deeper relationships with their clients.

Media Hype

Sensationalist headlines and media reports often contribute to the misconception that AI is poised to replace accountants. However, this narrative tends to focus solely on the automation aspect of AI, ignoring the broader benefits of AI-augmented accounting. By understanding the true capabilities and limitations of AI, small business owners can better appreciate the complementary role that AI plays in enhancing the services provided by their accountants.

Fallacies in the Argument

The argument that AI will replace accountants is based on several fallacies:

AI can fully replicate human expertise:

While AI has made remarkable advancements, it is not capable of replicating the full range of human skills and expertise. Accountants possess years of education, experience, and professional judgement that AI systems cannot easily replicate.

Automation equals job loss:

Automation is often equated with job loss, but in the case of accounting, AI-driven automation allows accountants to focus on value-added tasks, improving their efficiency and quality of service.

AI will eliminate the need for human interaction:

Despite the increasing use of AI-driven tools, the importance of human interaction in the accounting profession remains paramount. Clients value the personal touch and trusted advice provided by their accountants, which cannot be replaced by AI.

The Advent of AI in Accounting

With a clear understanding of the irrational fears, media hype, and fallacies surrounding the notion of AI replacing accountants, we can now explore how AI is poised to augment the skills and processes of accountants enabling them to provide even greater value to their small business clients.

In the following sections, we will delve into the specific benefits AI-driven tools can bring to businesses with relevant and practical examples. We’ll look at how AI can enhance the capabilities of accountants including automating routine tasks, improving accuracy, enhancing fraud detection, streamlining tax compliance, and providing customised financial insights.

Automating Routine Tasks

One of the most significant ways AI can augment the skills of accountants is by automating repetitive and time-consuming tasks. Examples include data entry, transaction categorisation, and invoice processing. By automating these processes, accountants can spend more time focusing on providing strategic financial advice and analysis, ultimately offering small business clients a higher level of service and financial insight.

Practical example:

A small retail business generates numerous transactions daily, including sales, expenses, and payroll. An AI-powered accounting software can automatically categorise these transactions, eliminating the need for manual data entry. For instance, the software could identify a transaction from a supplier, match it with the corresponding purchase order, and update the accounts payable accordingly. This automation saves the accountant time and reduces the risk of data entry errors, allowing them to focus on more value-added tasks for their client.

Improving Accuracy and Reducing Errors

Human errors are inevitable, and accounting mistakes can be costly, especially for small businesses. AI algorithms can analyse large data sets with remarkable speed and accuracy, identifying discrepancies and potential errors. This increased precision helps accountants ensure their clients’ financial records are accurate, reducing the risk of costly mistakes and allowing small business owners to make well-informed decisions.

Practical example:

A small technology manufacturing company may struggle with inventory management, leading to errors in cost of goods sold calculations. An AI-driven accounting solution could analyse historical inventory data and automatically flag discrepancies, such as unusually high or low inventory levels. By identifying these potential errors early, the accountant can address the issue before it leads to inaccurate financial statements or tax filings.

Enhancing Fraud Detection and Prevention

Fraud and financial irregularities can severely impact small businesses. AI-driven accounting software can analyse vast amounts of data to detect unusual patterns, flagging potential fraudulent activities. By leveraging machine learning, these systems can continuously improve their detection capabilities, providing accountants with a powerful tool to protect their small business clients from financial fraud and potential legal issues.

Practical example:

A small creative consulting firm might be vulnerable to expense reimbursement fraud, where employees submit false or inflated expense claims. An AI-powered expense management system could analyse historical expense data and detect patterns that suggest fraudulent activity, such as unusually high expense claims from specific employees or locations. By alerting the accountant to these anomalies, the system can help prevent financial losses and protect the business’s reputation.

Streamlining Tax Compliance and Planning

Tax compliance is a critical aspect of accounting, and AI-powered tools can help accountants stay up to date with constantly changing tax regulations. By automating tax calculations and identifying potential deductions, AI allows accountants to optimise tax planning strategies for small business clients. This can result in significant cost savings, reduced risk of penalties, and more efficient tax preparation processes.

Practical example:

A small software development company needs to comply with various tax regulations, such as VAT and Corporation Tax. An AI-driven tax software could automatically calculate the company’s tax liabilities based on real-time financial data, ensuring that the accountant files accurate and timely tax returns. Additionally, the software could identify tax-saving opportunities, such as R&D tax credits, helping the business minimise its tax burden and optimise its financial planning.

Customised Financial Insights

AI-driven accounting software can provide accountants with in-depth financial analytics and forecasting capabilities. By analysing historical financial data and identifying trends, AI can help accountants offer tailored financial advice to small business clients. This personalised guidance can support better decision-making, enabling small businesses to optimise their financial performance and plan for future growth.

Practical example:

A small UK-based restaurant owner seeks advice on expanding their business. The accountant uses AI-powered financial forecasting software to analyse historical sales data, customer demographics, and seasonal trends. By identifying patterns and potential growth areas, the accountant can provide personalised advice on the optimal time and location for opening a new restaurant, helping the business owner make well-informed decisions based on data-driven insights.

How AI could benefit both accountants and their clients

- “AI serves as an invaluable tool, allowing accountants to focus on higher-value tasks and fostering deeper client relationships.”

- “By automating routine tasks, AI empowers accountants to deliver a higher level of service and value to small businesses.”

- “AI-driven accounting software can detect unusual patterns, flagging potential fraudulent activities and protecting small businesses.”

- “Streamlining tax compliance with AI allows accountants to optimise tax planning strategies, resulting in cost savings and reduced risk.”

- “AI can provide tailored financial advice based on data-driven insights, enabling small businesses to plan for future growth.”

- “AI augments the capabilities of accountants, revolutionising the accounting industry and supporting small businesses’ growth and success.”

Conclusion

Artificial intelligence is transforming the world of accounting, offering numerous benefits to both accountants and their small business clients. By automating routine tasks, improving accuracy, enhancing fraud detection, streamlining tax compliance, and providing customised financial insights, AI empowers accountants to deliver a higher level of service and value to small businesses.

As AI technology continues to advance, we can expect even more innovative solutions to emerge, further revolutionising the accounting industry and supporting small businesses’ growth and success. The practical examples provided, relevant to the UK market, illustrate the immense potential of AI-driven accounting solutions in enhancing the capabilities of accountants and delivering tangible benefits to small business clients.

2023 trends businesses can embrace in the search for competitiveness

Developing or adjusting your business plan for the coming year, will likely take into account many of the broader economic factors that may affect you, such as the economic outlook, inflation, interest rates, supply chain issues and money supply. However, businesses are also affected by trends, such as customer expectations, enabling or disruptive technologies, working patterns, and societal values. These are more intangible, but nevertheless can have a significant impact on a business’s success. In this article we will look at some of the prominent trends in 2023.

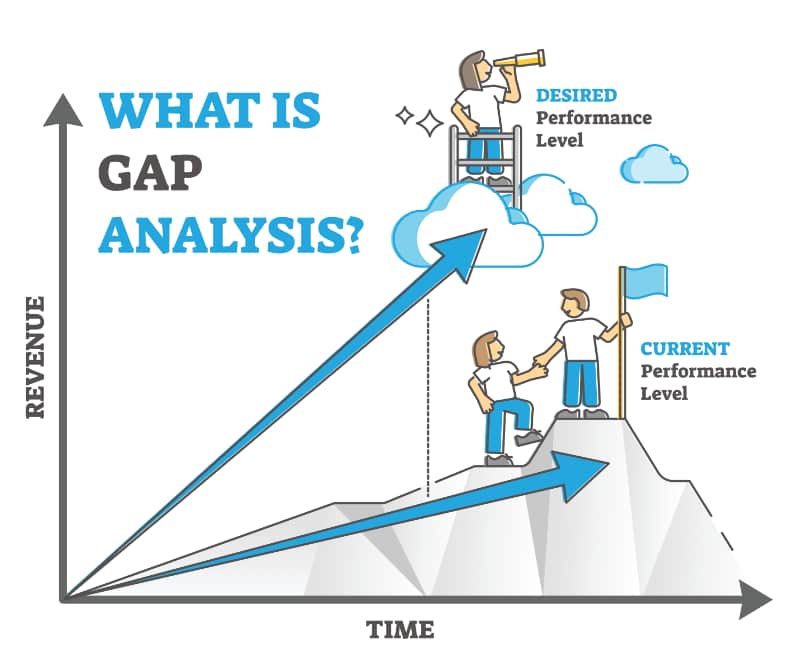

Identifying trends and revisiting the GAP Analysis

Trends are powerful market signals that shouldn’t be ignored. However, understanding exactly how they may apply to your business can be a little more difficult to interpret, as they may or may not have an impact on many areas of your product or service, or even how your business operates or is perceived from a brand perspective by your customers and market in general. This is where a little bit of analysis and a tool called GAP analysis comes in handy.

A GAP analysis is a simple tool that takes data and observations from your customers, market and competitors and makes sense of where others may be focused or not. It allows a business manager to spot where competition is especially strong and why, and therefore probably best to avoid. It also shows where competitors may be weak, perhaps from the perspective of a whole product or down to specific features. Weakness may be because of a lack of customer interest or market demand, but for the savvy business person, it might be because the area or niche may not have been explored or developed yet. This is where monitoring trends is especially powerful, as it may point to an opportunity to leverage a trend to develop an area of business others may have ignored because of market weakness.

A GAP analysis is a simple tool that takes data and observations from your customers, market and competitors and makes sense of where others may be focused or not. It allows a business manager to spot where competition is especially strong and why, and therefore probably best to avoid. It also shows where competitors may be weak, perhaps from the perspective of a whole product or down to specific features. Weakness may be because of a lack of customer interest or market demand, but for the savvy business person, it might be because the area or niche may not have been explored or developed yet. This is where monitoring trends is especially powerful, as it may point to an opportunity to leverage a trend to develop an area of business others may have ignored because of market weakness.

Performing a GAP analysis in concert with a regular review of your market and competitors, is a powerful way to spot opportunities that others may have missed. Smaller businesses simply can’t be everywhere at once and so tend to focus on specific areas of their market or certain features of a product that customers really like. As time goes by, trends will likely force small businesses to shift focus, sometimes subtly, other times though, quite significantly. As with the impact of Covid, some businesses had to fundamentally change the way they managed and engaged with the clients. This showed a lot of businesses new ways to be successful. However, many couldn’t meet the challenge and closed.

Where does the data to power a GAP Analysis come from?

There are different ways to conduct a gap analysis, one is to look at your business strategy and goals and where you’d like to be in the future, then identify the aspects of the business that you need to achieve your goal that currently are not in place. Another is to examine the strengths and weaknesses of a product and service compared to your competition and perceived market demand, or more importantly when considering trends - future market demand.

Essentially though, the analysis requires you to break down your product or service’s main features, pricing, distribution capabilities and other aspects of your business that contribute to market success. Then do the same for each of the main competition products. As you do this, rate them from 1 to 10 in terms of strength or attractiveness.

It requires some pretty extensive research, even maybe a little covertly as you try and peer into your competitor’s operation. Eventually though, you’ll start to see aspects of your product or service that either outperform, under perform or are completely missing from your’s or their offering. Add in the consideration for current and upcoming trends, and you’ll start to see areas where maybe you could outperform your competitor (or market), by acting early. You may even realise that your competitor is already doing this!

There are many sources of data for this research, examples are:

- Search engine searches around products, features, and capabilities will yield a fair amount of information.

- Independent market analysis reports that highlight company and product capabilities.

- Product comparison sites set products or services against each other and may also tear down products to examine how they are built.

- Annual reports, shareholder reports, investor analysis.

- Buy some of your competition’s products and test them yourself.

What are some of the trends small businesses will likely experience in the company year that businesses can explore and potentially plug into a GAP analysis?

Sustainability and brand responsibility

Consumers are becoming more sensitive to sustainability issues in their purchasing habits. While many are seeking to minimise the purchase of products that employ single use plastic, others are looking deep at the products themselves, for instance, once they have outlived their useful life, can they be reused for something else. Or, if they break, can they be repaired? Many products are simply not worth sending back to a manufacturer for repair, but just like used cars, some products can find repair solutions from third party providers.

As time marches forward, more and more consumers will give more credence to the reliability and durability of products. While affordability must remain a priority for businesses, the old adage of ‘cheap and cheerful’ is less likely to apply. However, given the economic hardship many are experiencing, the challenge for businesses is to deliver affordable sustainability.

Sustainability also requires businesses to look at where their product components originate from. Are those manufactures using materials that have been sustainably sourced?

In short, consumers, or indeed other businesses (B2B), increasingly expect a business to demonstrate responsibility throughout their business practices, for environmental issues.

Immersive experiences

As technology delivers new ways to experience and interact in our daily lives, expectations on the consumer front also grow. Introducing new ways for your customers to experience your products or services before buying is a growing trend. Technologies such as augmented reality and virtual reality, provide ways for businesses and clients to interact in new ways, whether that be at the customer service level, or in being able to experience or examine a product without actually being in contact with it, or even in the store.

As technology delivers new ways to experience and interact in our daily lives, expectations on the consumer front also grow. Introducing new ways for your customers to experience your products or services before buying is a growing trend. Technologies such as augmented reality and virtual reality, provide ways for businesses and clients to interact in new ways, whether that be at the customer service level, or in being able to experience or examine a product without actually being in contact with it, or even in the store.

As sustainability concerns grow, more customers will want to know a lot more about your product and the processes and materials used to bring it to market. The use of augmented or virtual visualisation technologies, will enable customers to ‘up close and personal’ to a product in the comfort of their own homes or at their leisure in a store.

A fully immersive experience, such as through virtual reality headsets, will enable a business to personalise their customer’s experience of their brand. This is especially important for higher value purchases, such as homes, cars, investments, leisure, travel, hospitality, design services, etc.

Ethical consumer spending and your ESG strategy

Consumer ethics have been shifting for some time, but over the past couple of years concern for the environment has accelerated. The pressure is now considerable for brands to do more than just talk about the ethical issues, they now have to live and breathe them.

Enter the subject of ‘Environmental, Social, and Governance’ strategy. An ESG strategy sets out your understanding as to how your business impacts the world it operates within and how your business is responding to help mitigate any negative consequences, or to eliminate them altogether.

By focusing on ESG, one also becomes aware of the potential for a growing raft of legislation around sustainability issues to impact the business. One can therefore put better plans in place to embrace these changes, and even identify new opportunities.

Popular terms have arisen that cast doubt on a brand’s commitment to ecologically sensitive practices, workforce welfare and labour exploitation in overseas supply chains. No brand is above this and one only has to look at a huge list of companies called out for ‘greenwashing’: Volkswagen, BP, ExxonMobil, Coca-cola, Nestlé, IKEA, Starbucks . . . the list goes on.

Popular terms have arisen that cast doubt on a brand’s commitment to ecologically sensitive practices, workforce welfare and labour exploitation in overseas supply chains. No brand is above this and one only has to look at a huge list of companies called out for ‘greenwashing’: Volkswagen, BP, ExxonMobil, Coca-cola, Nestlé, IKEA, Starbucks . . . the list goes on.

While this sounds like a problem for the big brands, it actually affects all businesses. If a smaller business wants to attract clientele from its local community, one way to stand out is through promoting the ethicality and sustainability aspects of the business. Most communities want to support the local businesses amongst them, but full support falters when the business can’t tell customers the source of their products and services, or provide inaccurate information in doing so. As an example, fresh produce providers, such as one’s local butcher or baker go to great lengths to promote factors such as ‘locally’ sourced, organic feed, hormone free, etc. But many others either don’t go to such length, or simply don’t understand or care.

The same ethical standards apply to any business, even if it’s a matter of the working practices, from where basic materials are sourced, employee welfare, recycling, energy use, outsourcing strategy and controls, etc.

Having a well documented and publicised ESG strategy is becoming crucial to even smaller firms and will help businesses in highly competitive markets to differentiate. It shows that your business is not just ‘talking-the-talk’, but is also ‘walking-the-walk’.

ECO sensitive supply channels

Given the discussion in this article’s previous two topics, ensuring your business adopts the same principles with your supply chain would appear obvious. However, ‘greening’ the supply chain can be seen by businesses as “somebody else’s problem”. While you can’t dictate how the businesses in your supply chain go about their business, it is still your problem, as you have a choice as to the companies you work with.

It’s important then, not to overlook the greening issue when reviewing your suppliers, whether this is simply office supplies or a more extensive supply issue within a manufacturing process. Put simply, any ESG strategy you have needs to audit those upon whom you rely on to complete your product or service offering.

The plus side of working with other firms committed to greener businesses, is that you know they are committed to providing a more sustainable service to you. This helps you future proof your own business!

Ongoing digital transformation

Streamlining your business processes through the use of new technologies that integrate and automate multiple areas of your business’s processes, creates a wealth of ways to enhance efficiency. Much of this is discussed on our services page on Digital Enablement and some benefits further discussed in our article on how digital enablement can help reduce fraud.

Digital enablement activities within businesses are set to accelerate over the coming year. For larger firms this may be part of a broader digital transformation strategy. For smaller firms, the activity may centre around consolidating functional areas and applications, and creating greater integration between previously disparate systems. On the simplest level, digital enablement may just mean adopting more online applications as a way to improve financial management information, for example Xero, or increase connectivity and communication around job functions or customer management.

Digital enablement activities within businesses are set to accelerate over the coming year. For larger firms this may be part of a broader digital transformation strategy. For smaller firms, the activity may centre around consolidating functional areas and applications, and creating greater integration between previously disparate systems. On the simplest level, digital enablement may just mean adopting more online applications as a way to improve financial management information, for example Xero, or increase connectivity and communication around job functions or customer management.

One thing is for sure though; successful businesses in the future are going to be using the digital applications and services available to improve their own efficiency so as to maintain competitiveness. And, such efficiencies also play a strong role in supporting and achieving a company’s ESG goals.

Spend a little time considering how these and, no doubt a host of other trends, could be used in concert with a GAP Analysis, to look at new ways to not only build a stronger form sustainable business, but to find new ways in which to differentiate your business longer term.

Working with TaxAgility can improve the chances of your business’s long term success

As a firm of accountants and business professionals, we’ve had the privilege of working with many clients, helping them grow and understand how to make their business operate more efficiently. The challenges facing businesses today seem endless and often quite daunting. The crises businesses have faced recently haven’t helped either. Your business can benefit greatly by having a partner, like TaxAgility, both advise and support in helping your business become more efficient and grow successfully over the coming years.

Why not give us a call today and see how we can help you. Just call 020 8108 0090

How to find a good accountant in London

If you hadn’t noticed, the business landscape has fundamentally changed and the part your accountant plays in helping you cope is essential to this. Finding a London accountant that thinks about your business and how to improve it, as opposed to just crunching your numbers and filling VAT and tax returns, should be a high priority for your business. After all, it’s another resource your obliged to pay for to meet regulatory demands, so why not get the best ‘bang-for-your-buck’ you can?

Recent time have seen significant changes in how businesses operate, driven by a pandemic and the need to adjust business models to suit new working practices and employee expectations. Also, supply chain uncertainties due to the pandemic have somewhat overshadowed the main protagonist that was expected to introduce business issues, i.e. Brexit. All in all, it’s been a pretty tough time for firms in the UK.

What should you be looking for in a good accountant?

Start by considering that it’s quite a competitive market in the finance and account space. It’s always been dominated by the larger accounting practices. However, these are not always suitable for small to medium sized businesses, as these benefit from a more personal touch.

Attitude is key. A truly great accountant is going to do two things when you begin to engage with them. The first is, they are going to initially access whether your business is a good fit for them and set out expectations on both sides. This is important, because some accountants may just take on your business, not really caring if they understand it or not. And that’s not good for you!

The second thing they will do, is to understand what is important to you. They will want to get to know your business - not a casual quick chat to try to reassure you, but arrange to sit down and dig a bit deeper.

By seeking to understand your business plan or even help you create a better one, is a sure sign that you’ve found a decent accounting firm. Central to this is being able to build a solid relationship with an accountant at the firm. However, like anything, the ‘proof of the pudding is in the eating’. Initial enthusiasm interest for your business should continue and not be a one off. You should arrange to have meetings on say a quarterly basis to help understand how your business is working and if there are efficiencies in your financial operations that can be made.

If you business is based in London or the greater London area, such as the outlying districts of Richmond, Putney, Wimbledon, Hammersmith, etc., you’ll likely benefit from finding a more personalised service from a local London accountant, like Tax Agility. They re also likely to be a bit cheaper that central London accountants, while still retaining a level of personalised service. Tax Agility are also well placed to assist businesses in Surrey too.

What services should a good accountant offer?

A well-rounded accountant offers services that can address the current and future needs of your business, which can include but not limited to:

- Company secretary services

- Corporate tax planning and advice

- Accounting and bookkeeping

- Payroll services

- VAT

- Cash flow forecast

- Short and long-term strategies

Essentially, you are looking for someone to take over the administrative work (like bookkeeping and PAYE) as well as someone who can help review your numbers and make sound recommendations so that your business has the best chance to succeed.

Every business is unique too. Perhaps you have just launched a start-up which is in need of funding, a contractor who struggles with IR35, a small business owner whose business is experiencing consistent growth, or you may be looking for an exit strategy – this is why the accountants at Tax Agility are divided to teams that specialise in companies, small businesses and individuals in Central and Greater London and also in Surrey. Having expert knowledge in your area means we can provide relevant accounting and tax advice that help you manage and grow your business.

How do I check a London accounting firm's qualifications?

While most people find their business accountant through word-of-mouth referrals, it is always worth checking if they are ICAEW (Institute of Chartered Accountants in England and Wales) accountants.

Guided by strict codes of conduct, ICAEW accountants uphold the highest standards of professional conduct and business ethics. At Tax Agility, we are ICAEW chartered accountants and we follow these principles:

- Integrity

- Objectivity

- Professional competence and due care

- Confidentiality

- Professional behaviour

This means that as our client, you will receive honest answers from our knowledgeable accountants who keep abreast with the latest developments in practice, legislation and techniques. We also act diligently and respect confidentiality. With us working alongside you, you know you are in good hands.

Top key traits of a good accountant

- Attitude. It's amazing what a good set of interpersonal skills can do for a relationship and this starts with the attitude expressed towards you and your business.

- Knowledge and skills – A good accountant should be able to assist you in areas that you need.

- Listen to you – Only by understanding your situation first, then your accountant can come up with ideas that will make an impact to your business.

- Excellent communication skills – Having the ability to interpret data and convey the information in a meaningful way to you.

- Adaptable – Your needs evolve and how a good accountant assists you should evolve too.

- Honesty – A good accountant should provide honest answers, as well as excellent work without any hidden charges.

- Efficient – A good accountant will make sure that your financial records are managed efficiently, so you can concentrate in other aspects of your business.

- Transparency of fees.

At Tax Agility, our fees are transparent – most of our clients pay a fixed monthly fee with no hidden charges. In the event that you have additional projects that need our attention, we will discuss the work and cost with you upfront.

What can Tax Agility do?

At Tax Agility, our accountants specialise in companies, small businesses and individuals across London and Surrey.

Our standard accounting services include but not limited to:

- Annual compliance with Companies House

- Maintenance of statutory books

- Bookkeeping

- Management accounts

- Accounts payable and receivable

- Cash flow

- Sales reporting

- Tax returns

- Tax planning

- VAT returns

- PAYE registration

- PAYE administration

- Pensions

We have offices in three locations – Putney, Cavendish Square (Central London) and Richmond. We are also well placed to assist businesses in the county of Surrey.

For more information on our services, talk to us on 020 8108 0090 today or use our enquiry form to get in touch.

If you liked this post, you might also like:

- The complete guide to buying a small business

- Planning the future of your business

- 10 things to avoid when starting a business

This post is intended to provide information of general interest about current business/ accounting issues. It should not replace professional advice tailored to your specific circumstances.

This post was updated on Jan 11 2022

Companies House is stopping paper reminders

With Companies House stopping paper reminders, directors of LTDs and partners of LLPs can opt for email reminders instead.

In the past, Companies House sent out paper reminders to limited companies and limited liability partnerships, informing them that their accounts and confirmation statement were due for filing. This process cost Companies House £1.2 million in 2019. Aiming to improve efficiency, Companies House is stopping paper reminders.

Companies House also makes it clear that it is the directors’ responsibility to file a company’s information on time. If you are working with our team at Tax Agility, then you already know that we file your accounts on schedule.

Email reminders

For directors and partners who have been relying on paper reminders, you can take this opportunity to switch to email reminders instead. The email reminder service is free and it allows you to:

- Choose up to four email recipients to receive a reminder (including your agent)

- File your document immediately from a link within the reminder

In essence, email reminders should be more convenient for business owners, while also cutting paper waste and helping Companies House to become a fully-digital organisation.

To sign up for email reminders, sign in to the Companies House online filing service, select ‘Get email reminders’ from your company overview screen, click ‘Add an email address’ and continue to add (up to four email addresses). After that, Companies House will send you an email asking you to validate your email address, which you need to follow to join the email reminder service successfully.

Company House takes filing seriously – directors who do not file company accounts on time face penalties. In addition, failure to file confirmation statements and accounts is a criminal offence which can result in directors being fined personally in the criminal courts. At Tax Agility, we take deadlines seriously too, which is why we file your accounts on time if you are a client of ours.

We can also assist with the confirmation statement on your behalf, should you choose to.

Contact our friendly Small Business Accountants today on 020 8108 0090. We’re always here to help and safeguard your business interests.

An update on COVID-19 support available to small businesses

As the daily number of people tested positive for COVID-19 continues to rise across England, many businesses and self-employed individuals are bracing for tighter restrictions.

(Updated on 7 November 2020)

On Friday (30 October), as the Furlough Scheme was coming to an end, we wrote this blog to talk about the Job Support Scheme (JSS) and other measures. But a day later, Prime Minister Johnson announced the second lockdown in an attempt to slow down the spread of Coronavirus. Accordingly, we have updated this post to reflect the latest support available to small business owners.

The Furlough Scheme is extended

Introduced in March, the Furlough Scheme (also known as the Coronavirus Job Retention Scheme or CJRS) was supposed to end on 31 October 2020, but as the second lockdown is set to begin on 5 November 2020, the scheme will be extended until March 2021. Essentially, it allows you to furlough your staff full-time, or ask them to work on a part-time basis and furlough them for the rest of their usual working hours. You will have to cover their wages for the hours worked, as well as National Insurance and employer pension contributions. You will be able to claim either shortly before, during or after running your payroll.

Employees who are being furloughed will receive 80% of the current salary for hours not worked, up to a maximum of £2,500 per month. All of the 80% is fully funded by the government – this is in contrast to how the scheme was administered previously. Before November, the scheme required affected employers to pay 20% and the government paid 60% to make up 80% of the salary.

Employee eligibility: You can claim for employees who were on your PAYE payroll on 30 October 2020. You must have made a PAYE Real Time Information (RTI) submission to HMRC between 20 March 2020 and 30 October 2020, notifying a payment of earnings for that employee. If employees were on your payroll on 23 September 2020 (i.e. notified to HMRC on an RTI submission on or before 23 September) and were made redundant or stopped working for you afterwards, they can also qualify for the scheme if you re-employ them. Neither you nor your employee needs to have previously used the Furlough Scheme.

For employers, the first task is to check if your employees are eligible for the scheme, based on the information above. Then talk to your employees so they know if they are being furloughed fully or part-time, and agree working hours if applicable. Keep the records that support the amount of the furlough grant you claim, in case HMRC needs to check it. You can view, print or download copies of your previously submitted claims by logging onto your CJRS service on GOV.UK

Other forms of support

Before the announcement of the second lockdown, local councils have different levels of support to help businesses based on the COVID alert level of the area. But as the second lockdown is affecting the whole of England, the government has announced the followings:

- If your premises is forced to closed, you will get £1,334 per month (for properties with a rateable value of £15k or under), £2,000 per month (for properties with a rateable value of £15k to £51k), and £3,000 per month (for properties with a rateable value of more than £51k).

- £1,000 for every furloughed employee kept on until at least the end of January.

- £1,500 for every out-of-work 16-24 year-old given a "high quality" six-month work placement.

- £2,000 for every under-25 apprentice taken on until the end of January, or £1,500 for over-25s.

Job Support Scheme (JSS)

The Job Support Scheme (JSS) aims to help employers retain their employees if they are struggling or when they are required to close. The JSS, which was scheduled to come in on 1 November, has now been postponed.

Professional services grant

In July 2020, the government announced £20 million in new grants to help small and medium-sized businesses recover from the effects of this pandemic. The scheme will offer grants between £1,000 to £5,000 to these businesses, helping them purchase new technology and equipment, as well as paying for professional services (legal, financial, HR and other qualified services).

The schemed is administered through the Local Enterprise Partnership (LEP) and each LEP has a minimum of £250,000 to get the program going.

For businesses in London, you can access the businesshub.London page for more information.

Deferral of VAT

Back in March, the government announced that VAT-registered companies could opt-in to defer their VAT payments (between 20 March 2020 to 30 June 2020) and pay them by 31 March 2021. This scheme is now closed, but those who have opted-in have the option in pay in smaller payments until 31 March 2022 instead, a much longer period than previously announced.

Self-Employment Income Support Scheme (SEISS)

Introduced in March 2020, the SEISS allows self-employed individuals whose businesses had been adversely affected by the pandemic to claim a taxable grant. To be eligible, you must have:

- Traded in the tax year 2018 to 2019 and submitted your Self Assessment tax return on or before 23 April 2020 for that year

- Traded in the tax year 2019 to 2020

- The intention to continue to trade in the tax year 2020 to 2021

- Trading profits less than £50,000 and at least equal to your non-trading income (if you are not eligible based on the 2018 to 2019 Self Assessment tax return, HMRC will look at the previous tax years)

The first SEISS grant ended on 13 July 2020 and the second grant ended on 19 October 2020. On 5 November 2020, the chancellor Rishi Sunak confirmed that a third grant – and a more generous one – will be made available to help self-employed individuals. The third grant will cover 80% of profits for November, December and January, up to a total limit of £7,500. Applications will be open from 30 November 2020. Details for the fourth grant, covering three months from February 2021 to April 2021, will be announced later.

Deferral of second payment on account

Self-employed individuals are aware of the two payments on account taking place each year, with the first one due on 31 January during the tax year and the second one on 31 July following the end of the tax year. The second payment on account for the 2019/20 tax year was supposedly due by 31 July 2020, but taxpayers with up to £30,000 of Self Assessment liabilities could defer the second payment (due July 2020) to 31 January 2021. In September 2020, the government further announced that you could pay instalments (by entering into a Time to Pay arrangement) if you couldn’t pay in full by 31 January 2021 – this means you could stretch the final payment to January 2022.

Other things to be aware of

Before the announcement of the second lockdown, the government had already encouraged companies to allow employees to work from home if they can carry out their normal duties without going to the office. Now people are told to stay at home, except for education, work (if cannot be done at home), exercise, medical reasons, shopping for food and essential items, or to care for others.

If an employee must self-isolate (either they have tested positive or been in contact with someone who has tested positive), the business owner must not knowingly allow the employee to come into the office or attend meetings elsewhere. Violating this provision is an offence with fines starting at £1,000 for the first offence, rising to £10,000 for the fourth and subsequent offences.

Be careful of COVID-19 scams

The pandemic has already affected millions of people across the UK, yet scammers are still actively targeting small business owners, their employees, as well as self-employed individuals. Apart from criminals pretending to be government agencies ‘phishing’ for information, some of us have also received emails from supposedly company server informing us of unread messages – but taking us to a phishing site instead.

Members of the public have also seen texts informing them of tax rebate from ‘HMRC’ and encountered fraudulent products, anything from hand sanitisers to COVID-19 swabbing kits. Remain vigilant is key, and report the scams to Action Fraud (0300 123 2040 or online).

Disclaimer

The information contained in this newsletter is of a general nature and no assurance of accuracy can be given. It is not a substitute for specific professional advice in your own circumstances. No action should be taken without consulting the detailed legislation or seeking professional advice. Therefore, no responsibility for loss occasioned by any person acting or refraining from action as a consequence of the material can be accepted by the authors or the firm.

Summary of government support available

We highlight some guidance and advice the government has for employers and self-employed individuals.

We highlight some guidance and advice the government has for employers and self-employed individuals.

At TaxAgility, we continue with business as usual, although operating remotely until further notice. We are contactable by email at taxsupport@taxagility.com or on our landline 0208 780 2349.

The government has announced numerous measures in the past week and has now updated their guidance for employers and self-employed individuals. The following is a summary of some of the measures available.

Coronavirus Job Retention Scheme (furlough guidance)

This scheme is aimed to encourage employers to retain staff through these unprecedented times. Where employees are no longer required to perform work duties due to the coronavirus impact, the employer can make a claim for a grant from the government amounting to 80% of their furloughed wages and employer’s national insurance up to a maximum of £2,500 per employee per month.

These employees are termed furloughed. You must notify your staff that they are being furloughed formally in writing. HMRC are working as quickly as possible and anticipate to have the online portal ready by the end of April 2020 for claims to be made by the business.

The salary used to compute the funding for furloughed employees would be based on the February 2020 payslip.

As an illustration, if your gross salary was £719 in February 2020 you could receive funding of £575.20 for any months in which you were officially furloughed. At present, the measure is in place for three months but may be extended.

As a director of a limited company, you may be able to apply for the Coronavirus Job Retention Scheme if you are being paid a salary through a PAYE scheme. Directors can be furloughed in the same way as other employees. The furloughed employee must not undertake work for the company during this time.

Deferring VAT payments

HMRC are supporting businesses by offering to defer your VAT payments for 3 months if your VAT payment is due between 20 March 2020 and 30 June 2020. HMRC will not charge interest or penalties on any amount deferred as a result of the announcement. You will still need to submit your VAT returns to the HMRC on time. Refunds will be paid by the HMRC as normal.

If you choose to defer your VAT payment it will need to be paid up by 31 March 2021. You do not need to tell the HMRC you are deferring your payment.

It is your responsibility to cancel your VAT direct debit which you can do by contacting your bank or you can cancel the direct debit payment online which will prevent your VAT liability from being automatically paid when your VAT return is submitted.

VAT payments after the deferral payment will need to be paid as normal within the normal time frame which you will need to do manually as your direct debit will have been cancelled.

Deferring Income Tax payments

For Income Tax Self-Assessment, payments due on the 31 July 2020 may be optionally deferred until 31 January 2021. You do not need to be self-employed to be eligible for the deferment. This is an automatic offer with no applications required. No penalties or interest for late payment will be charged if you defer payment until January 2021.

HMRC Time to Pay Scheme

If you can’t pay any other taxes due to the impact of Coronavirus a payment plan can be negotiated through calling the HMRC Payment Support Service line on 0300 200 3835, open Monday to Friday, 8am to 4pm.

Self-employment Income Support Scheme

The Self-employment Support Scheme has been announced and expected to be made available in June 2020. HMRC will contact individuals who are eligible to apply for the scheme. You may only be eligible for this scheme if you’re self-employed or a member of a partnership and you have traded in the 2019-20 tax year and have lost trading/partnership trading profits due to Coronavirus.

You must have submitted your self-assessment tax return for the year ended 5 April 2019, if not this needs to be submitted by 23 April 2020. HMRC will use this data to determine eligibility for the scheme and they will invite you to the scheme if you qualify, you cannot apply for the scheme.

This scheme is only available to individuals who have a trading profit of less than £50,000. The grant will be 80% of the average trading profit from the last 3 tax years and it will be up to a maximum of £2,500 per month. The initial scheme is available for three months.

Please note the Self-employment Support Scheme is not available to directors of limited companies who draw a salary and dividend income. Directors who take a salary may be eligible for the Job Retention Scheme as mentioned above.

Statutory Sick Pay relief packages for SME businesses

SME businesses and employers can reclaim Statutory Sick Pay (SSP) paid for sickness absence due to Coronavirus. The refund will cover up to 2 weeks’ SSP per eligible employee who has been off work because of Coronavirus. It is available to businesses with less than 250 employees claiming SSP due to Coronavirus.

12 Month Business Rate holiday for retail, hospitality and leisure businesses

Properties that will benefit from the relief will be occupied properties that are wholly or mainly being used as shops, restaurants, cafes, drinking establishments, cinemas and live music venues for assembly and leisure and for hospitality, as hotels, guest & boarding premises or self-catering accommodation.

Cash Grants for retail, hospitality and leisure businesses

The Retail and Hospitality Grant Scheme provides businesses in the retail, hospitality and leisure sectors with a cash grant of up to £25,000 per property.

Businesses in these sectors with a property that has a rateable value of up to £15,000 may be eligible for a one-off grant of £10,000 to help meet their ongoing business costs.

Businesses in these sectors with a property that has a rateable value of between £15,000 and less than £51,000 may be eligible for a grant of £25,000.

Coronavirus Business Interruption Loan Scheme (CBILS)

This temporary Loan Scheme supports SMEs with access to loans, overdrafts, invoice finance and asset finance of up to £5 million and for up to 6 years.

The government will cover the first 12 months of interest payments and any lender-levied fees, so smaller businesses will benefit from no upfront costs and lower initial repayments. The loans will be guaranteed by the government up to 80%.

These loans are accessed through the bank used by your business. If you have an existing loan with monthly repayments, you may want to ask for a repayment holiday to help with cash flow.

As of 3 April 2020, the government has made several changes to the scheme. It is now applicable to businesses regardless if they have been refused a loan on commercial terms. It also aims to help larger firms (with revenues between £45m and £500m) by offering government-backed loans of up to £25m.

Scams

Please be aware of scams relating to any of the above. If someone texts, calls or emails claiming to be from HMRC, saying that you can claim financial help or are owed a tax refund, and asks you to click on a link or to give information such as your name, credit card or bank details, it is a scam.

More information can be found at this link:

If you have any questions, please get in touch.

Please keep safe.

TaxAgility Chartered Accountants

Disclaimer

The information contained in this newsletter is of a general nature and no assurance of accuracy can be given. It is not a substitute for specific professional advice in your own circumstances. No action should be taken without consulting the detailed legislation or seeking professional advice. Therefore, no responsibility for loss occasioned by any person acting or refraining from action as a consequence of the material can be accepted by the authors or the firm.

Helping small businesses during this COVID-19 pandemic

The UK government has announced measures to support companies affected by the Coronavirus COVID-19 pandemic, learn what the measures are and how you can get assistance.

Many countries in the world have announced drastic stimulus measures to keep companies afloat and help people stay employed. In the UK, the government has also announced a string of measures. Quite a few of these announcements are made in a hurry with an attempt to abate fear first, while the exact processes are being worked out. As a result, the announcements have caused confusion among business owners. In this article, we aim to discuss what we know so far.

Government to pay up to 80% of wages

Known as Coronavirus job retention scheme, this measure is applicable to all UK employers who would otherwise have to lay off their workers during this crisis. A few important points are:

- The government plans to have the grant available by the end of April, although the grant can be backdated to March.

- You (the employer) must first classify the affected employees as furloughed workers and inform your employees accordingly.

- Once the government portal is made available, you can submit the information of your furloughed employees and their wages.

- HMRC will then reimburse 80% of wages of these furloughed workers, up to a cap of £2,500 per month.

Coronavirus Business Interruption Loan Scheme

You probably have heard from small business owners who are worried that they have to shut their business down because they do not have enough short-term cash flow to keep it going. If you are in this situation, explore the temporary Coronavirus Business Interruption Loan Scheme first.

- There are 40 accredited lenders (including major banks) offering this scheme.

- You can access to loans, overdrafts, invoice finance and asset finance of up to £5 million and for up to 6 years.

- While you must repay the loans, the government will cover the first 12 months of interest payments and any lender-levied fees to help small businesses.

- To be eligible, you must be a UK-based business with a turnover of less than £45 million per year. Your business must also meet the other British Business Bank eligible criteria.

- To apply, talk to your bank now. Alternatively, talk to one of the accredited lenders available on the British Business Bank website.

Deferring VAT

This is an automatic offer with no applications required. If your business is VAT-registered, you can defer VAT from 20 March 2020 to 30 June 2020, meaning you do not need to make a VAT payment during this period. This is applicable to all UK businesses. Please note that it doesn’t mean you don’t have to pay VAT, you are simply delaying the payment.

Deferring Income Tax payments

This is an automatic offer with no applications required. If you are self-employed, your Income Tax Self-Assessment payments (originally due on 31 July 2020) will be deferred to 31 January 2021. No penalties for late payment will be charged during the deferral period.

Statutory Sick Pay relief

Applicable to UK-based small and medium-sized businesses (with fewer than 250 employees as of 28 February 2020), this relief covers up to 2 weeks’ Statutory Sick Pay (SSP) per eligible employee who has been off work because of COVID-19. How it works is that you (the employer) will have to reclaim expenditure for any employee who claimed SSP as a result of COVID-19. The process to which you can reclaim is still being developed.

Small business grand funding of £10,000 for all business in receipt of small business rate relief or rural rate relief

If you own a small business that pays little or no business rates, your local authority will provide a one-off grant of £10,000 to eligible businesses to help meet their ongoing business costs.

- Your business must already receive Small Business Rate Relief and/or Rural Rate Relief.

- Your local authority will write to you if you are eligible for this grant.

- This will only happen when your local authority has received the money from the government, which is likely to be after 1 April 2020.

A 12-month business rates holiday for all retail, hospitality, leisure businesses in England

If your business is in the retail, hospitality and/or leisure sector, your next council tax (April 2020) should automatically exclude the business rate charge and it should continue to the 2021 tax year. You can estimate the business rate charge you will no longer have to pay this year using the business rates calculator.

Grants for retail, hospitality and leisure businesses

If your business is in the retail, hospitality and/or leisure sector, you can get a cash grant.

- For businesses in these sectors with a property that has a rateable value of £15,000 and under, you can get a £10,000 cash grant.

- For businesses in these sectors with a property that has a rateable value between £15,000 and £51,000, you can get a £25,000 cash grant.

- Your local authority will write to you if you are eligible for this grant once they have received the money from the government. Any questions, contact your local authority accordingly.

Support for nurseries

Nurseries that pay business rates will be eligible for a business rate holiday, which your local authority will re-issue your bill to exclude the business rate charge. Nurseries that will benefit from the relief are:

- Occupied by providers on Ofsted’s Early Years Register

- Wholly or mainly used for the provision of the Early Years Foundation Stage

Time to Pay Scheme

If you have unpaid taxes and your business is struggling due to COVID-19, you can call HMRC on 0800 0159 559 to discuss a payment plan. Please note that HMRC will review each case independently. If you are worried about a future payment, please call HMRC nearer the time.

For more information, check out this gov.uk page. Alternatively, email us on taxsupport@taxagility.com if you are worried about VAT, bad debt, and the cash-flow in your business. We are London’s small business accountants and have helped countless entrepreneurs and small business owners to get their finances right. We can help you too.

This blog is a general summary. It should not replace professional advice tailored to your specific circumstance.

A message from our Managing Director

In light of the current global health concern, our Managing Director has a message for customers.

In light of the current global health concern, our Managing Director has a message for customers.

As per government advice, our staff are working remotely, therefore, our office has temporarily closed. Our team will continue to work as normal and can be contacted via email or mobile phone. If you do not have their email address to hand or are a new client looking to use our services, please email us on taxsupport@taxagility.com.

Although we can’t offer face-to-face meetings at present, we are operating conference calls and therefore can proceed as normal be it at a distance. We are monitoring all post that comes into the office as normal and ensuring this is distributed and actioned accordingly.

Keeping up-to-date with COVID-19 information

We are monitoring all news and government guidance very closely to ensure that our team have the latest knowledge. Government information for the public about COVID-19 can be found here:

- https://www.gov.uk/guidance/coronavirus-covid-19-information-for-the-public

- https://111.nhs.uk/covid-19

For COVID-19 guidance and support for businesses and employees, please read the following pages:

- https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses

- https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-guidance-for-employees

Many thanks for your understanding during this time.

Sincerely,

Donovan Crutchfield FCA BFP

This page was first published on 18 March 2020 and updated on 23 March 2020.

Planning the future of your business

Your small business can flourish through business planning, continuous improvement and strategic advice.

Turning a business vision into reality requires entrepreneurs to navigate through a river called planning that is full of twists and turns, with rapids as well as areas of calm-moving water. Before launching a business, most entrepreneurs need to analyse their business idea and their appetite first, asking tough questions such as:

- Are you ready to take on the challenges of being an entrepreneur?

- Do you have the skills needed to run your business successfully?

- Is your business idea viable?

- Is there a market for your services or the products you intend to sell?

- Is it worth investing your time and money into it?

After the analysis, it is time to put your thoughts down into a very important piece of paper called the business plan. Do not dismiss this step because a business plan sets you up for success when you first start, and it goes on to help you adapt as your business grows. Yes, you read that right – a business plan is not just for fresh-faced entrepreneurs who are eager to launch a business, it is also for seasoned small business owners who want to expand and grow. In this article, our small business accountants at Tax Agility put together what we have learned from working with small business owners throughout London over the years into tips that can help you plan for your business.

We cover:

- What is a business plan and why is it vital to both start-ups and also established businesses looking to grow?

- Business growth planning

- Exit strategy planning

- Business debt planning

- How our small business consultants can help in each of the above situations

Let’s talk about business plan

In our line of work, it is common to meet entrepreneurs who trust their gut feeling more than a business plan. There is nothing wrong with it if you know how to translate your gut feeling into a series of actionable items and manage to assemble a team and sell your vision based on your gut feeling alone. In most cases though, gut feeling isn’t enough and this is where a business plan can help:

- It helps to prioritise – By defining your business objectives, your business plan gives your business direction, maps out strategies to achieve your goals and helps you to manage possible challenges along the way. If you are already in business, use your business plan to recalibrate your objectives and set out plans to adapt to the changing market.

- It gives you control over your business – Your business plan requires you to study the business landscape and know your competitors and other factors that may affect your success. If you are already in business, it is time to take a step back and review because your business plan should evolve based on your experiences – both successes and failures. A good rule of thumb is to review your business plan once in every six months.