Is it better to lease a car or buy one outright?

Buying a new car, especially if it is a personal purchase, is likely to be the second most expensive purchase you’ll make, after your home. It’s not surprising then that it makes sense to explore the options you have in acquiring such an asset. If you're buying a car for your company to use, then there are a range of considerations to make too.

Typically, whether the car is a business purchase or personal, one can either buy a car outright or look at the various lease schemes available from car dealers. Of course, how you choose to fund an outright purchase also makes a difference, such as cash from your business’s profits, personal savings if buying for yourself, or a bank loan.

Typically, whether the car is a business purchase or personal, one can either buy a car outright or look at the various lease schemes available from car dealers. Of course, how you choose to fund an outright purchase also makes a difference, such as cash from your business’s profits, personal savings if buying for yourself, or a bank loan.

In this article, we’ll look at both personal car purchases, since we assist individuals with their own tax and wealth management issues, and a company car purchase, to highlight some of the main pros and cons between outright purchase and a lease hire arrangement.

If you are in the market for a new car, here are a few questions to consider first:

- Will it be a company car or for private use only?

- Will it be a conventional petrol or diesel engine, or will it be electric?

- Will you be buying it or leasing it?

- If it’s a private vehicle purchase, will you want to use it for business purposes?

The answer to these questions will help shape the importance and relevance of the information we aim to share in the following article.

Let’s consider purchasing a new car for personal use as many of the financing options are relevant to those available if you are buying a car for a business, However, if you are buying a car for business, then it would be a good idea, in addition to the company car section in this article, for you to read our article on:

“Is it worth buying an electric company car?”

This article explores the business advantages and taxation associated with electric vehicles for company use. It also discusses some of the benefit-in-kind (BiK) issues that surface where company cars are concerned.

What is the basic difference between owning and leasing a car for personal use?

There are two basic routes to putting a new car on your driveway:

Personal contract hire: This is the most typical method of leasing a vehicle, but you never actually own the car.

Outright purchase: You own the vehicle outright or at the end of any financing agreement.

What is personal contract hire?

Personal contract hire or PCH, is a long-term leasing arrangement with a car leasing company. It’s a convenient way to enjoy the experience of a new car without having to stump up the high cost of purchasing one outright. The monthly payments are typically much lower than the financing costs associated with a purchase. This is because you don’t get to keep the car at the end of the agreement period. If you buy a car outright, when you come to sell the vehicle, there will be a resale value to help recoup some of the costs or ownership. So with PCH you are essentially just renting the vehicle and will simply hand it back at the end of the term - assuming it has been well looked after. Also, there may be restrictions on how many miles you can drive in a year.

The other potential benefit of PCH is that some packages include servicing and maintenance. Sometimes they may throw in tax and insurance too, so shop around!

What options exist for outright purchase

By outright purchase, we simply mean that at some point during your financing arrangements, you actually own the car, as opposed to just renting it as with PCH.

First though, why would you want to own your own car?

Most people buy their own car because they are likely not buying a new car. There are many great deals to be had for cars that are just a year or so old, as new cars tend to suffer high depreciation in the first few years. So, you get to enjoy many of the benefits of a relatively new and up-to-date model and a much lower cost*.

Owning your own car means you get to do what you like. You’re not worried about how many miles you drive it or any additions you may make. And, you get to decide whether to keep it for life or sell it the next day. You're not locked into any contracts.

Owning your own car means you get to do what you like. You’re not worried about how many miles you drive it or any additions you may make. And, you get to decide whether to keep it for life or sell it the next day. You're not locked into any contracts.

Also, a personal purchase is just that - personal. Buying outright means you’ll have complete freedom as to what vehicle you can buy, as not all models are available for PCH schemes. This opens up the door to more unusual or exotic options, if that’s what your budget or taste demands.

Lastly, you own it, nobody else, it’s yours. For some, that’s a very important factor and an experience that sets you apart from others, if that’s important to you.

There are a number of ways you can finance the car ownership experience.

A cash purchase

If you buy a new car with cash, you may be able to negotiate on price with a dealer, especially if new models are close to hitting the streets.

The main disadvantage is that your purchase will most probably depreciate in value. When you come to sell it, you’ll likely get a lot less back.

The other aspect to consider is ‘cost of ownership’. Buying a car and owning one are two different matters. When you own a car, you have to service it, maintain it, tax it, and insure it. These costs can be considerable each year. Then there’s the actual cost of fuel, but then all cars have that cost.

A loan from the bank

It can be a good option for some, especially if you have a good credit rating and interest rates are favourable. You may also be contributing to the cost of the vehicle, which means you may not need to finance the entire cost of the vehicle. Personal loans are typically unsecured, in other words, they don’t require collateral to loan against. In the case of financing a car, the purchase itself becomes the collateral, i.e. if you don’t pay, they’ll take it away!

The main cost associated with a bank loan is the interest payments. At the end of the loan period, you will have actually paid substantially more than the list price of the vehicle; but then, that’s the price of convenience.

Hire purchase - HP

Hire purchase is probably one of the most recognisable forms of financing. HP is probably what got most families through the 60’s and 70’s. HP allows you to spread the cost of the purchase over an agreed timeframe with regular monthly payments - the longer that is the lower the payments. However, you’ll also be paying interest, which increases the total amount paid. There’s usually also an initial deposit and likely a small fee to pay at the end to take ownership of the vehicle. You’re then free to do with it as you will, such as selling it to recoup some of the costs and perhaps buying another vehicle.

Personal contract purchase or PCP

This is a somewhat different form of hire purchase. Both schemes share an initial deposit and the ability to pay in monthly installments over an agreed financing period. The main difference with PCP is that you are only funding the predicted difference between the purchase price of the vehicle and the residual value at the end of the term. This means that the payments will be a lot less, but then you don’t own the car. However, PCP gives you an option at the end of the term:

- Make a final ‘balloon payment’ at the end of the period and take outright ownership, or

- Hand the car back, make a new agreement and buy another car, or walk away.

The cheapest option, if you have cash, is to use cash. The downside is that the ‘liquid’ assets you may need at some point are now reduced. If you need cash in the future, you may have to sell the car quickly and take a hit but not get the best deal.

If you don’t want to use your cash, keeping that for a rainy day, the convenience of low payments, and the option of ownership at the end of the term, PCP may be a good choice. However, if you want to own your car, HP is likely a cheaper option as you are actually contributing to the cost of the purchase over a potentially longer or convenient period

What is the difference between owning and leasing a car for company use?

At some point or another company owners, especially those of smaller firms, give thought to the possibility of buying a new car through their company. After all, why not? Let the company use its profits that you’ve worked long and hard for rather than your taxed dividends or salary. Sounds simple, but of course, the government has thought of that too and so it’s really not that simple. How you plan to use the vehicle in your business has major tax implications for the business and potentially for you too.

Main considerations

For most businesses, cash flow is the lifeblood of the organisation's operation. Without a ready supply of cash to finance day-to-day operations, the company will fail. As such, how the company finances the purchases of its assets is of paramount concern. Of course, cash-rich companies can consider outright cash purchases, especially if the asset is likely to have a reasonable residual trade value. With cars though, ownership is not the goal, sensible financing is.

Leasing, loans, and tax relief

For most companies though, leasing a car is the preferred option. A vehicle lease represents fixed monthly payments over an agreed term. The packages may also include all maintenance and servicing. At the end of the term, the vehicle is simply returned and another one is provided if the contract is continued.

When leasing a vehicle, a business can reclaim VAT back on 50% of the monthly payments, depending on how it is used.

Some companies may still prefer to buy a vehicle. As such, when you take out a loan to finance the vehicle, you can get tax relief of up to 45% on the interest. However, if the car is used for both business and personal use, the amount of relief will be reduced proportionally.

Other allowances

However you decide to finance the purchase of a company car, how you use the vehicle will dictate how you will be taxed and what relief you can claim back.

An important point to note is that under section 38B of the Capital Allowances Act 2001, the cost of a car does not qualify for the AIA. If the car is for business use though, you can use the Write Down Allowance or WDA to deduct a portion of the cost from your company profits.

How will the vehicle be used?

It’s important to point out right away that VAT on company cars can only be claimed back if the car is a genuine pool car and not used for personal use in any way. You’ll have to go to some lengths to prove this too.

VAT aside, a company car purchase represents an asset. As such there are costs you can reclaim each year.

1. Write down allowance (WDA): WDA allows you to claim a percentage of the cost of an asset such as a car each year against profits over a number of years. How much depends on how ‘green’ your car is. In other words, CO2 emissions.

If your car is used as a pool vehicle and has CO2 emissions of less than 110g/km, then it qualifies for an 18% relief as part of the main rate pool allowance.

If your car is above 110g/km, then the rate applied is 8%.

Single asset pool

If the vehicle is a pool vehicle but is also used for both business and personal use, then it has to be allocated to a “single asset pool”. Depending on the CO2 emissions, it will be allocated at a rate of eight 8% or 18%. However, because the vehicle is used for personal use, this rate will be reduced to reflect the percentage of personal vs business use.

Furthermore, the personal use of the vehicle means that an employee is receiving a benefit in kind (BiK).

2. The running costs of a company pool car can be claimed. These include:

- Fuel

- Servicing

- Maintenance

- Road tax

- Insurance

Talk to TaxAgility about the purchase of your next company vehicle

Buying a new car for personal use is simply a matter of choosing the finance method most suited to your finances. If you plan to use your vehicle for business use too, then there’s a clear path as to how you can claim back expenses associated with this, such as mileage claims. We can assist you at the time of your tax return preparation and ensure you are claiming the correct amounts.

Where we can really assist is when you want your company to purchase a vehicle for business use. It’s here that we can discuss your needs and what you hope to purchase, and then what allowances may be available and other claims you could make. We can also advise on the implication of you as a director using the vehicle for personal use, along with the associated implication of it being a ‘benefit-in-kind (BiK).

So give us a call today on 020 8108 0090, and find out how we can help with the next purchase of a company car.

*Note: due to disruption in world trade and the supply of essential parts such as semiconductors and raw materials caused by the Covid pandemic and the Ukraine conflict, many manufacturers have had difficulty in producing new vehicles at the rates previously enjoyed. This has led to a significant increase in the price of second-hand vehicles. For some luxury brands where waiting lists are normal, the cost of a relatively new second-hand vehicle can often be more than the list price of a new vehicle.

Buyers of such vehicles should therefore be aware that should trade and manufacturing return to near normal levels, i.e. pre-covid, then it is likely that their ‘expensive’ second-hand purchase may depreciate as quickly as a new vehicle might.

Tapered pensions annual allowance - what is it and does it affect me?

Each year individuals can make a tax free contribution to their pension pot. Presently, for most regular tax payers, this is a maximum of £40K per year. However, the closer your income gets to £240,000 per annum, the closer the attention you’ll need to pay, as the amount you can contribute in each year starts to ‘taper off’, hence the term “pensions tapering”.

Every year, we like to make sure that our clients fully maximise their opportunity to contribute to their pension pot in a tax efficient manner. With recent changes in the pensions tapering rules and the lowering of the minimum allowance, we thought we would review the current state of affairs in regard to tax efficient pensions contributions and pensions allowance tapering.

What is the pension annual allowance?

This is simply the maximum amount that you are allowed to contribute to your pension pot and still receive tax relief.

Currently, this stands at £40K. However, if you are a higher tax bracket earner, this may be significantly reduced through the tapering of your annual pension contribution allowance, depending on your level of income within the tax year in question.

Does tapered pensions annual allowance apply to me?

We should point out immediately that if your net income is less than £200,000 and you’re unlikely to break this barrier through the addition of other sources of income, then it is highly unlikely you will be affected by tapering of the annual pensions allowance. Typically this only affects high earners and high net worth individuals (HNWI).

That said, if your regular income is significantly less than this, but for one reason or another find that you have an unexpected gain, perhaps through the sale of a second home, maturity of an insurance policy, you may find that tapering for the year the event occurs applies to you. This is why it is critical that you speak to a specialist accountant like Tax Agility, prior to any such event, so we can assess your individual situation and advise on a strategy to mitigate any undesirable and legally avoidable tax liabilities.

I am close to the £200K income level, how do I calculate a tapered allowance?

To correctly ascertain if you are impacted by pensions allowance tapering, there are four terms that need to be understood, so as to gain an accurate assessment of your actual income any payments made to pensions plans is concerned.

Net Income in the tax year in question. To be clear here, ‘net’ doesn’t simply mean ‘after tax’. In this case net means all taxable income less deductions. The deductions we are interested in here are those related to member’s contributions paid into any UK registered pension schemes. Add up any personal contributions made to employer pensions schemes - those that fall under a ‘net pay’ agreement. The add up any contributions you may have made personally through a ‘relief-at-source’ arrangement - these schemes typically accept pensions payments made net of tax and then within the pensions scheme are grossed up to the basic rate of tax. Once you have done this deduct these amounts from your total income, including any taxable overseas income (worldwide income).

Net Income in the tax year in question. To be clear here, ‘net’ doesn’t simply mean ‘after tax’. In this case net means all taxable income less deductions. The deductions we are interested in here are those related to member’s contributions paid into any UK registered pension schemes. Add up any personal contributions made to employer pensions schemes - those that fall under a ‘net pay’ agreement. The add up any contributions you may have made personally through a ‘relief-at-source’ arrangement - these schemes typically accept pensions payments made net of tax and then within the pensions scheme are grossed up to the basic rate of tax. Once you have done this deduct these amounts from your total income, including any taxable overseas income (worldwide income).

Threshold income. This is the income you have just calculated - i.e. net of any pension payments. If your threshold income is over £200,000, you will be subject to pensions tapering.

Adjusted income. This is the total figure for your income including your pension payments. If your adjusted income is more than £240,000, you will be subject to pensions tapering.

What is the difference between threshold income and adjusted income?

The basic difference represents the £40,000 pensions contribution allowance. If your threshold income starts to exceed £200,000, your contribution allowance will naturally reduce. For example, If you receive £210,000 in income, your allowance will reduce to £30,000.

How is pensions allowance tapering applied when I exceed an adjusted income of £240,000?

Once you exceed the adjusted income threshold of £240,000, a tapered allowance formula kicks in. For every £2 your adjusted income exceeds £240,000, your annual allowance for the year in question, reduces by £1.

Here are some examples to show how this works in practice.

Scenario 1 - a reduced allowance

Bob has calculated his adjusted income as £290,000 for the tax year concerned. This exceeds the adjusted income threshold by £50,000. Applying the 2 for 1 rule, his pension contribution allowance therefore is reduced by £25,000, i.e £40,000 standard allowance minus the £25,000, leaving a £15,000 tapered allowance.

Scenario 2 - minimum allowance tapering

Alice had a good year and earned £350,000. This exceeds the adjusted income threshold by £110,000. Her allowance should therefore be reduced by £55,000, more than that available. In this case the government introduced a minimum annual allowance that the tapering would allow - this is £4,000. Therefore Alice’s new annual allowance is just £4,000, not nil.

Scenario 3 - over payment and carry forward entitlement

In scenario 2, Alice had benefited from pension contributions of £40,000. Her actual allowance had been tapered to £4,000. Therefore, Alice had an excess of £36,000. Ordinarily, this amount would be added to Alice’s taxable income (net of pensions payments made by her personally). As such Alice would have to pay income tax on this amount at the prevailing tax rate for her situation. This should be declared on her Self Assessment return.

However, this was an extraordinary year for Alice. In previous years, she did not make full use of her pensions allowance. The government allows you to carry forward up to three years of entitlement up to a maximum of 100% of her earnings. As Alice has more than £36,000 in unused allowances, this will offset any income tax liability.

Why high income earners and high net worth individuals should consider Tax Agility

It can be very easy to forget the complicated issues surrounding tax implications and pensions payments. There’s nothing worse than having a great year only to find out that the tax man is hammering on the door for additional payments or even a fine because you mis-reported your actual earnings on your self assessment form.

The Tax specialists at Tax Agility work with our high income / net worth clients to ensure that they have a clear view of potential pitfalls associated with issues like pensions payments and allowances. We will advise you of any possible issues that may arise because you’ve had a significant pay rise, moved into a higher paying job, the sale of stocks and shares or other such taxable event.

In short, our tax planning services can help minimise your tax liabilities and allow you to plan and mitigate future events that may have a significant impact.

Contact Tax Agility today on 020 8108 0090 and let us help you maximise your pensions contributions!

Disclaimer. This article is for information purposes only and should not be considered tax advice under any circumstances, as individual circumstances are unique. You should always contact a tax professional if you think the scenarios described in the article may relate to you. This way we can assess your personal situation and provide accurate tax advice.

Trust Registration Service - Rules extension and deadline

Changes in trust registration requirements - act now!

Did you know that you have until September 1st 2022 to register a trust with the Government’s Trust registration Service (TRS), even if you previously didn’t have to?

Until recently, only thrusts that had a UK tax liability, had to register. This included off-shore trusts, but where they still had a UK tax liability. Now, all Express Trusts need to be registered.

Recent changes in Trust Registration Requirements

The new requirements to register a trust were introduced in 2020. Those trusts created on or before October 6 2020, have until September 1 2022 to register or be faced with a fixed penalty fine of £100 or up to 5% of any tax due (or £300, whichever is greater).

Trusts created after this date must be registered within 90 days of creation.

It is estimated that because of this change, there may be around one million trusts in the UK that are still to be registered before the September 1st deadline.

What trusts now need to be registered?

The Government instructs that the the following types of trust now need to register:

- All UK express trusts — unless they are specifically excluded

- Non-UK express trusts, like trusts that:

- acquire land or property in the UK

- have at least one trustee resident in the UK and enter into a ‘business relationship’ within the UK

By way of example, trusts that now require registration include those where:

1. A trust holds an offshore or onshore investment that was set up by a financial advisor. Most commonly these include:

- discounted gift trusts

- loan trusts

- gift and loan trusts

2. Property is held and a beneficiary exists but where there was no taxable income or capital gains and therefore no need, up to now, to register with HMRC.

3. Trusts that hold shares in a private company. This includes:

- a trading company,

- a family investment company (FIC)

- a personal investment company (PIC)

4. Any other trusts that hold other assets where a tax liability has not arisen.

Trusts that do not have to be registered.

While the extension of the TRS requirements covers many trusts that previously didn’t have to register, there are a number that remain exempt. A full list of exemptions can be found on the Government’s ‘register a trust page’ here. Remember, that this only applies if the trust is not liable to UK taxes.

How Tax Agility can help

While you can do this yourself through your own Government Gateway account, it’s really important that you get it right the first time. Mistakes in any reporting to HMRC can be very costly. This is why Tax Agility offers a simple service to ensure your Trust is reported correctly. First, we will make sure your trust isn’t exempt. Then we will ensure the correct information is reported through the TPS service and that it is up to date - another requirement, even if you have previously registered your trust.

Contact Tax Agility today on 020 8108 0090 and enlist our assistance in registering your Trust - time is running out.

All you need to know about transferring a property portfolio into a limited company

If you already have a property portfolio or are considering building one, should you do this in your name or within a company. Also, if you have a portfolio, is it worth transferring it into a company rather than holding it in your own name?

Professional and amateur landlords are finding themselves entering stormy waters. Recent press headlines tell stories of long time landlords with sizable property portfolios considering calling it a day. Why?

Enter Section 24. This has gradually been phased in since 2015, but was in full force by 2020. Section 24 of the Finance Act 2015 restricts mortgage interest relief at whatever tax bracket you found yourself in - say 40%, to the basic rate of 20%. This means that for some BTL landlords, their tax bills have doubled. For some, in higher tax brackets, it’s significantly more.

While Section 24 reduces tax relief on mortgage interest payments, it still allows a raft of other ’operational’ expenses to be set against profits before tax.

Furthermore, recent changes in Section 21 laws mean that landlords can no longer simply evict tenants for ‘no-fault’. This makes renting much more risky.

Naturally, these changes are making many landlords think twice about either continuing with their portfolios or entering the market. However, for those more hardy landlords or still aspiring investors still looking to build a property empire, one incorporating all the legal challenges currently surfacing, this may represent a great opportunity to pick up rentals other landlords are looking to dispose of. The question arises - should a property portfolio be held in an individual’s name or within a corporate entity?

Should I transfer my rental property portfolio in to a company?

Why does this question arise? Quite simply - because of personal tax issues and potential benefits of lower corporation tax.

Landlords who run a property rental business, perhaps built through buy-to-let mortgage schemes, report income from their lettings business in their own personal tax return - the SA100, more specifically the SA105 Supplementary pages. In other words, a landlord could find themselves in a higher tax bracket - 40% or 45%.

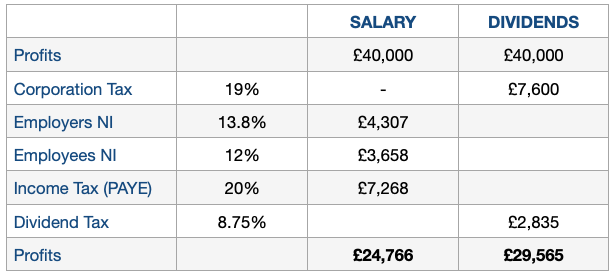

Holding property in a company means paying corporation tax on profits, currently at 19%, rising to 25% in 2023, significantly better that paying 40% or 45%. If a director then takes a dividend to access the profits, they will likely see a sizable positive difference compared to the alternative of a personal tax approach. This is because of the savings made from not paying regular income tax and national insurance.

The director is around £4,800 better off through dividend taking - currently.

Where property portfolios and existing landlords are concerned there is a rather large ‘BUT’ in regard to whether it’s actually worth transferring property into a company to realise gains through paying corporation tax and dividends. This is another key question that gets asked.

Is it worthwhile transferring my property portfolio into a company?

The answer to this question is ‘it depends’. In this case it rather depends on how many properties you have in your portfolio.

To be able to transfer a property into a company, you are essentially selling what you own to the company entity. What does this mean?

- Transferring the property into a company means that you will no longer own the property - the company will. Your ownership is indirect, through shares in your company. If you own 100% of the company, then you own 100% of the shares and therefore the shares in the properties.Problems may arise when trying to do this though, particularly if the properties are mortgaged, such as through a ‘buy-to-let’ (BLT) scheme. The problem comes about because banks won’t allow you to mortgage an asset you don’t personally own. If you do have properties mortgaged, in all likelihood, you’ll have to pay-off the original ‘personal’ mortgages and re-mortgage through a commercial mortgage scheme. Naturally, interest rates will likely be high for commercial loans. If you own the properties outright, this isn’t an issue.

- When you ‘sell’ the property(s) to your company, you’ll likely be liable for capital gains tax (CGT) on any profits you make in the sale. If you’ve had the properties for a while, this may be significant. Naturally, HMRC expects you to sell the property at a realistic market rate, so you can’t step around this by selling the property to your company ‘on the cheap’.It may be possible for you to ‘defer’ the CGT payment. If you run your BLT as a business, as opposed to ‘a source of disposable income’, you may be able to receive ‘Incorporation Relief’. This is more likely to apply to a landlord with more than a few properties though. Incorporation relief allows you to defer the CGT payment until a later date when the shares you receive in return for the properties are divested of. At the time of divesting, you’ll be liable for the CGT you would have paid originally.

- Another consideration to make before shifting your properties into a company is the fact that selling them to your company means your company will have to pay stamp duty too. If for instance, under normal circumstances, the property you are selling sells for £350K, you’ll need to pay around £18,000 in Stamp Duty (SDLT), as you’ll own more than one residential property. If you have a number of such properties to transfer, you may be able to claim ‘multiple dwellings relief’. The benefit in this is that rather than apply SDLT to each property transaction based on the price paid, the purchase of multiple properties is considered as a single transaction. So, rather than calculating SDLT on the total price of all properties purchased, SDLT is calculated based on the average price paid for each property. This is likely to reduce overall SDLT payable.

- There are other costs associated with running a property business, that as an individual, you’ll not pay. You’ll need to use an accountant like Tax Agility to assist with your business tax returns and other statutory requirements. On a monthly basis, you’ll likely need your bookkeeping done so as to keep track of rent payments, and the general costs associated with running a residential property portfolio. All this adds up.

- Please note: While the above implications for CGT and stamp duty apply in most circumstances, mechanisms do exist where it is possible to legitimately avoid both capital gains tax and stamp duty. How this is achieved does depend on your unique circumstances and we would need to discuss this with your directly so that this could assessed and explained in detail.

Call us today on 020 8108 0090 to find out more.

In summary, transferring a property portfolio into a company is not a step that can be taken lightly. All the financial implications with moving a property portfolio into a company suggest that it’s wise to prepare a complete financial model showing before and after projections of any likely cost savings. Remember that any benefit that arises will arise from the longer term tax savings through corporation tax and dividend tax, if you take the profits in that way. When considering the transfer costs identified above, reaching breakeven may take a few years. The scale of your business though, may still make this an attractive proposition.

Moving a property portfolio into a company isn’t straightforward for many portfolio owning landlords, there’s a lot to consider and numbers to work through. Starting a property portfolio though using a company, is a different matter, as all of the costs associated with transferring properties won’t exist, making the decision more attractive to make.

Tax Agility can advise and assist landlords with property portfolios make the right tax choices

Whatever circumstances you find yourself in, we'd like to reassure you that Tax Agility are specialists in assisting landlords and ‘High Net Worth Individuals’ (HNWI) with personal property portfolios, to make the best decisions. We’ll walk through the thinking and the calculations with you transparently, so you can decide if moving a property portfolio into a company is the right thing to do.

No matter what you decide, we’ll be here to help you manage your portfolio in the most tax efficient manner based on your unique circumstances.

Call us today on 020 8108 0090 and find out how we may be able to significantly improve the tax outlook for property letting business.

Please note: The information contained in this article should not be treated as either tax advice or investment advice, it is for information only. You should always contact a tax or investment professional who can assess your personal circumstances before making important financial decisions.

Landlords, are you maximising your profits?

We’ve noticed that some landlords forget that they actually run a business, particularly if they only have one other property and receive a reasonable stream of monthly rental. However, just like any business, there are claims you can make that will maximise your tax position and maximise your after tax profits. We are going to review these in this article.

The bottom line is simple, you are allowed to make certain expense claims associated with owning and operating a rental property. These are known as ‘Allowable Expenses’. These can be deducted from your business profits before your tax liability is calculated. The more expenses you claim, the lower your tax bill. One does need to be careful here as it’s easy for HMRC to scrutinise your claims. If HMRC has any reason to believe that you may be using expenses in a fraudulent manner, such as claiming expenses that are not truly related to running your business and therefore artificially lowering your tax liability.

The bottom line is simple, you are allowed to make certain expense claims associated with owning and operating a rental property. These are known as ‘Allowable Expenses’. These can be deducted from your business profits before your tax liability is calculated. The more expenses you claim, the lower your tax bill. One does need to be careful here as it’s easy for HMRC to scrutinise your claims. If HMRC has any reason to believe that you may be using expenses in a fraudulent manner, such as claiming expenses that are not truly related to running your business and therefore artificially lowering your tax liability.

So, understanding what you can and cannot claim is a great starting point in helping you revisit your expenses, making the most out of any deductions and maximising your rental income profits.

Understanding the ground rules - is it revenue or is it capital

As you might expect, HMRC are very good at creating rules that help distinguish whether any work you do on your rental property could be allowed as an expense. In this case one needs to consider if work you undertake is a capital investment or part of maintaining your revenue stream. Put another way, is the work you are doing on the property a repair or an improvement?

This is an area where landlords can make mistakes. It’s not unreasonable for the average landlord to think that refurbishing a rental property may be considered as an expense, so as to maintain revenue flow. HMRC are quite hot on this and you must think carefully as to how to apportion the expenses you incur.

When refurbishing, it’s critical you maintain accurate records showing what work constituted ‘repairs to the property’ and that which constituted ‘improvements’. For instance; painting and decorating would be an allowable expense as you are keeping the property in a rentable condition and probably honouring contractual obligations ensuring the property is fit for purpose. However, if as part of the work you decide to make alterations to the property’s configuration - perhaps make a room bigger, or add a loft room skylight, this would be classified as improvement work and therefore ‘capital’ and not an allowable expense.

If you are not able to show the split between repairs and improvement, HMRC will consider all work as capital and tax accordingly.

Capital expenses

Understanding what HMRC considers capital expenditure can help clarify what you can and cannot claim for.

When starting out for instance, it is typical for the owners to think that they could claim the cost of bringing a ‘distressed property’, probably purchased at a reduced rate, into a fit state for letting. This isn’t an allowable expense. You may however, be able to set this against capital gains allowances if you sell the property in the future. So, keep accurate records.

What is a capital expense?

If something is to be used by a business over a long period of time, they will most likely be capital expenses. For instance, where property is concerned:

- Make an addition to a property

- Improve or upgrade and existing part of the property

- Replace something with one of a higher specification

So, some expense examples that would not be allowed include:

- Extending the property

- Adding security system

- Replacing a bathroom suite with one of a higher specification

So, what can you legitimately claim for beyond the more obvious repair work?

Allowable property expenses

We arranged these in stages related to the scope of the expense.

Before you rent out a property

- Redecorating prior to a new tenant

- Replacing broken items, such as hot water systems, kitchen surfaces (as long as it’s not an improvement)

- Roof repairs

- Replacing items with their nearest modern equivalent provided the improvement is coincident to the repair.

- Replacement of items with a short useful life and of low value - soft furnishing, cutlery and crockery for instance.

- Replacement of fixtures and fittings. For instance baths, toilets, etc. just so long as they are like-for-like replacements and not improvements.

- Insurance policies for landlord, buildings and contents, public liability

- Legal fees, accountant fees

- Management and letting agent fees

- Direct costs related to advertising for new tenants, such as advertisement fees (creating and running them), telephone costs, etc.

While your property is let out

- Costs associated with garden maintenance, cleaners, etc.

- Utilities and council tax if you pay for these yourself and not the tenant

- General maintenance and repair

- Costs associated solely with running you car for business

- Fees you have to pay that are not passed on to the tenant, such as rent payments if you are subletting, ground rents and service charges.

- The interest element of any mortgage you pay on the property. This is not directly tax deductible for individuals. Instead 20% of the interest amount is allowed as a tax reducer. If the property is owned by a limited company, the full interest charge is corporation tax deductible.

What allowances are available to landlords?

Note that these are different from allowable expenses.

You have a choice; you can claim the “Property Allowance” and receive £1000 a year tax-free. However, if you claim this, you cannot then claim for your other expenses. It makes sense to use this allowance if your allowable expenses are less than £1,000.

When you rent out a residential property - a dwelling, you may be able to claim a deduction for the replacement of certain domestic items. This Income Tax relief is only available for expenses incurred from April 6 2016. It covers items such as:

- Movable furniture

- Soft furnishings and floor coverings

- White goods and other appliances

- Kitchenware

This relief can only be claimed if:

You’re letting out residential homes (dwellings)

You’re replacing an old no longer serviceable item for a new domestic one and it is only for the use of the lessee in this dwelling house and the old item is withdrawn from service and no longer available to the lessee.

You cannot have claimed Capital allowances on the expenditure

When can’t you claim this relief

- When the property is a furnished holiday let. Capital allowances will still apply though

- Rent-a-room schemes

- The costs of initial domestic items for the residential property under let

What happens if I have to buy an improved version of something?

Sometimes we have no choice but to replace something with a new and improved item. HMRC defines an improvement as:

- Not being the same or substantially the same as the old item

- Its functionality has changed - as often happens with new white goods

- It represents a material upgrade to the quality of an item - replacing. Plastic worktop with a granite one, for instance

In these circumstances you can only claim a deduction based on the cost of the old one. So for instance, if an improved replacement item costs £200 and an equivalent to the old one would have cost £150, then you can only claim for the £150.

When calculating the deduction, you should also take into account:

- The cost of the replacement item

- Any costs relating to buying it

- Disposal costs if any

Then you must deduct any income received from disposing of the item - for instance if you sold it for scrap.

In conclusion

It’s not always obvious what you can claim for and what you can’t claim for, or even how to claim, especially if you report your income through your SA100.

If you make a mistake and HMRC makes a challenge, the situation could become expensive as you may have to hire an accountant to help you.

Tax Agility has assisted many clients with their residential lettings businesses. So, it doesn’t matter if you’re running a lettings business or are an individual with a single property under let, we can help you identify your legitimate expenses, make the appropriate claims, ensure you take full advantage of any allowances, so as to maximise your rental profits. Helping individuals and small businesses maximise tax efficiency is at the heart of what we do - the clue is in our name - TaxAgility!

Call us today on 020 8108 0090 and find out if we can help your residential lettings business improve its bottom line!

Cryptoassets - what are they and what are the tax implications?

Many ordinary people and businesses, and by that we mean people who don’t usually engage in financial trading, have tried their hand at investing in crypto currencies. Some have fared well, but many over the past year have suffered significant losses, due to recent crashes in this space. As with any traded asset one may make a financial gain or a loss, but the question arises as to how one reports such gains or losses to HMRC. This is especially poignant if as an individual you’re not usually reporting via an SA100, as maybe the case with employees on PAYE, or perhaps exploring their use in your business.

This article explores the world of cryptocurrencies (and NFTs) and explains how HMRC treats them, how to report them to HMRC and what taxes you’ll be expected to pay.

Cryptocurrencies in the news

Over the past few years cryptocurrencies have made the headlines, sometimes because of meteoric price rises and at other times catastrophic crashes. Some have been caught out in what appeared as the new ‘gold rush’ - investing heavily and initially seeing significant gains, but then very quickly watching the currency crash, wiping out almost everything. In short, if you invest in cryptocurrencies you need a strong stomach as you’re in for a wild ride.

Over the past few years cryptocurrencies have made the headlines, sometimes because of meteoric price rises and at other times catastrophic crashes. Some have been caught out in what appeared as the new ‘gold rush’ - investing heavily and initially seeing significant gains, but then very quickly watching the currency crash, wiping out almost everything. In short, if you invest in cryptocurrencies you need a strong stomach as you’re in for a wild ride.

That doesn’t deter everyone though, to the point where significant numbers of people not accustomed to financial trading have put their toe in the crypto ocean - and it’s a very large ocean indeed. By March 2022 there were over 18,000 different cryptocurrencies in existence.

What is a cryptocurrency?

The definition given by Wikipedia is this: “A cryptocurrency, crypto-currency, crypto, or coin is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.”

But why is there such an interest in cryptocurrencies? Here is a summary of the main reasons:

- It is not a ‘fiat’ currency. This means that it is not a currency controlled by a government - i.e. legal tender, like the Dollar, Pound or Euro. This of course means that because it isn’t backed by a government institution like the Bank of England, its value can vary wildly, as indeed it has recently, just like stock prices. This is why it is considered a more risky form of investment, and some would say a form of gambling. So, in short - it’s owned by everyone and no one: it is decentralised. HMRC refers to cryptocurrency as “DeFi” - Decentralised Finance.

- It is almost impossible to manipulate or forge. Unlike centralised ‘fiat’ currencies, which can be forged and manipulated because of a ‘centralised ledger’, crypo’s decentralised basis means there is no central ledger, as it is ‘distributed’, in fact, it’s part of each transaction.

- The power of the Blockchain. It’s worth spending a little time understanding the blockchain if you’re considering investing in crypto currencies. A good summary can be found here. In short though, the blockchain is a powerful piece of mathematics that encrypts and keeps track of each transaction. Every transaction has a unique code called a ‘hash’ and forms a ‘block’ of information. The block is added to the chain, which is the public database where all blocks are stored. Blocks are added to the chain chronologically and distributed worldwide among millions of computers. This is why it is almost impossible to forge or manipulate, because someone would have to control a majority of those computers in order to change the blockchain. This would also take an enormous amount of computer resources. The bigger the block chain becomes over time, the harder it is to crack.

- Privacy. While cryptocurrencies use mathematics to track transactions between parties, powerful encryption keeps personal information private, in this case the identities of the parties crypto ‘wallets’. This is one reason why cryptocurrencies have drawn bad press because it is the favoured currency of criminal gangs, money launderers and extortionists.

- Reduced reliance on the banking network. We’ve all experienced at one time or another, the problems traditional financial institutions have. This ranges from account access issues to network outages, hacked accounts and of course, bank failures, although thankfully less common. Basically, banks are a single point of failure in a system millions of people rely on daily. Cryptocurrencies were intended as a way to move away from this centralisation, making the transaction between two parties, just between the two parties - no middle men. This is another reason why governments and banks are concerned about the rise of crypto.

- Money transfer. Sending money to somebody internationally can be a real pain. Even though it is an electronic exchange processed in milliseconds, the institutions still want to charge an ‘arm and a leg’ for the service. Once you understand the process, crypto transfers are very smooth, and you don’t have anyone looking over your shoulder at the amounts or where they came from - no freeze on funds while the bank checks authenticity or reports high value fund moments to the government.

This all makes cryptocurrencies look like fantastic monetary vehicles, and they are, but they’re not without downsides. The main ones are these:

- It’s still early days and governments still have the ability to impose regulations over their use.

- If you lose your virtual wallet or accidentally delete your currency, game over. For instance the story in the press about a man whose hard drive with £210 million worth of cryptocurrency ended up in the local landfill.

- Volatility. The value of a crypto currency can change dramatically quickly.

- There’s no regulation in the crypto market, e.g. the FCA and therefore no comeback if a currency disappears or is withdrawn. Your investments are like stocks, can go up or down and are not insured like money in the bank.

- The crypto exchanges - the places where currencies are bought and sold, are not immune from hackers. Wallets stored online (hot wallets) can be lost. This is why many investors prefer ‘cold wallets’ - those stored offline - like the man in the press.

- Crypto currencies are often the target of scams on social media, with fraudsters trying to trick people into investments using crypto - precisely because they can be traced.

What are NFT’s and are these the same as crypto currency?

We won’t go into detail here as NFT’s are another deep subject to explore, but here’s a quick answer to this question.

NFTs or ‘non-fungible’ tokens are digital assets. This asset represents a real-world object, such as an image, a video, a music file. The digital files that carry the ‘work of art’ are encoded using the very same technology as crypto currencies, but that’s where the similarity ends - they are not currencies. NFTs use crypto currencies to facilitate the sale and purchases of the assets.

Fungible vs non-fungible

Simply put, fungible assets are divisible and non-unique. Cryptocurrencies like BitCoin are fungible as they can be sold in increments. Non-fungible assets are unique items and can’t be divided, like image or video or digital artwork.

NFT’s can be bought and sold just like any other form of investment asset and through exchanges just like crypto currency. Buying and selling NFT’s will however be treated the same way for tax purposes as cryptocurrency.

Should you invest in crypto currencies?

Firstly, Tax Agility is not an investment advisor and so no guidance should be inferred here, what follows is just for interest. The relative newness of crypto makes some nervous about significant investments. That said, some of those who dipped their toes in early in this market made absolute fortunes. There are still a lot of opportunities to potentially experience significant gains (and losses), sometimes in the 000’s of percent.

However, like any investment strategy, one should maintain a healthy spread of investments to help offset losses in any one asset. Crypto could be a part of a broader investment strategy, perhaps your more risky investments with potential for high upsides and losses. In short, make sure your eyes are wide open when considering this investment.

The other key point to make here and the original reason for this post, are the tax implications of cryptocurrencies. If there’s a sudden rise or fall in a crypto asset and you decide to exit, you’ll be liable for any gains made. Depending on the value of the crypto asset, this could seriously impact your personal tax circumstances. While this is also true of assets in the form of stocks and shares, the extreme volatility experienced in crypto markets is less frequent in regular investments and so allows for at least some planning or recovery time, and generally allows you to plan a more regimented exit with tax planning considerations. Dumping a large crypto asset in panic, simply because there’s little history in this market, is potentially a different proposition for some.

How are cryptocurrencies and crypto based assets taxed in the UK?

The government’s Cryptoassets Manual provides very clear guidance as to how taxes will apply depending on the circumstances and whether it’s a business or individuals involved.

At the core of this is whether or not a ‘trade’ is being carried on. Profits arising from cryptocurrency asset transactions will be considered as either income or capital gains or for a business, a chargeable gain.

HMRC’s Cryptoassets manual can be found here.

Cryptoasset taxation for individuals

Income from cryptocurrency trading

HMRC makes it clear that only in exceptional circumstances would individuals buying and selling cryptocurrency tokens (such as BitCoin) be considered trading. This would mean that an individual would need to be trading at considerable frequency and be using a degree of sophistication in the tools they use. This is more akin to a financial trading company than an individual, although some day traders may fall into this bracket.

HMRC’s Business Income Manual outlines how it determines if a trade is being carried on or not - referred to as ‘Badges of Trade’.

If the individual can prove that they are indeed trading, then the profits arising from the activity would be considered ‘trading profits’ and be considered as regular income, and therefore subject to income tax.

Most scenarios involving crypto currency trading are likely to be treated similarly to a trade in shares (investments) and therefore profits arising would be treated as capital gains and incurring capital gains tax.

In what other situations would crypto assets be considered as personal income?

Cryptoassets earned through employment

If an employee receives crypto assets as employment income, HMRC considers this as “money’s worth”. As such, this income is subject to both income Tax and National Insurance Contributions based on the value of the assets.

What happens if the employee then sells the asset acquired as employment income?

Profit arriving from the disposal of a cryptoasset token is treated as a capital gain(or loss) and subject to Capital Gains Tax.

Tokens earned through mining activities

Yes, you read that correctly - ’mining’. BitCoin, for instance, has to be ‘dug up’ or mined. This is way beyond the scope of this article, but in simple terms: each ‘coin’ is based on a unique identifier ID derived from a complex mathematical calculation. It’s rather like looking for prime numbers, the bigger they are the harder they are to find and the more computing power it takes to find them. Crypto miners invest significant sums of money in mining equipment - basically very fast, powerful computers used to crunch the numbers. These are not only expensive, but power hungry too and so the rarer a coin - such as BitCoin which has a finite number of 21 million coins (not reached yet), the greater the potential value.

However, many private individuals have tried their hand at crypto mining and need to understand how profits from this activity may be taxed.

As stated earlier, even if you consider your mining activities as ‘carrying on a trade’ and expecting profits to be treated as income rather than capital gains, HMRC will look closely determine this based upon a range of factors, including:

- Degree of activity

- Organisation

- Risk

- Commerciality

In reality, to show that a trade is being carried on, you’ll need to show significant investments in computing equipment and organisation around it, rather than the activity being based on your home computer being used in its spare time for mining activities.

If you can show a reasonable basis for trading, then any profits will be treated as regular income, otherwise CGT will be applied.

How do you report profits made from the sale of Cryptoassets?

For individuals, this will be reported through the SA100 Self Assessment tax return, specifically supplementary pages SA108 which is used to report capital gains.

Cryptoasset taxation for businesses

Even though cryptoassets may be referred to as ‘currencies’, HMRC does not regard them as such. Instead, HMRC treats cryptocurrency as a traditional asset for tax purposes.

Whether or not the sale of a crypto asset is deemed profit from a trading activity or simply a chargeable gain (or loss) from the sale of an asset, will depend on how HMRC views your firm’s activities. So, the same ‘badge of trade’ tests will be applied.

To trade or not to trade

HMRC’s Business Income Manual outlines how it determines if a trade is being carried on or not - referred to as ‘Badges of Trade’.

For most businesses, it’s likely that the sale of a cryptoasset will be treated as a chargeable gain (or loss), just like regular assets, rather than income from a trade. As such, any expenses associated with the asset may be set against the profit, or indeed any losses incurred in the sale.

More information can be found in the Government’s Cryptoassets Manual for businesses.

Reporting gains made from the sale of cryptoassets is exactly the same as that of the sale of a regular asset and would be shown in your year end company accounts as such.

Whether you’re an individual selling crypto assets or a business trading in business assets, Tax Agility can help

The tax regimes around cryptoassets are still in relative infancy. HMRC, as indeed are many tax authorities around the world, is continually reviewing the development of this new area of finance. If and when HMRC begins to treat cryptocurrency like other fiat currencies is anyone’s guess.

For many, how investments like crypto are taxed can be a little confusing, but rest assured that if you have made investments in crypto, either as an individual or a business, and have received profits or losses from trading them, Tax Agility can help you in reporting them in the correct manner. Just give us a call today on 020 8108 0090 to discuss how we may assist.

Thinking about selling your business? Here’s how we can help

There comes a time with any business, large or small, when the owners decide they want to move on and sell their business. There can be many reasons for this, often it’s because they want to retire or maybe because they have just had enough and want to reap the benefits by selling on the business. There’s a well worn path to follow when selling a business, a process Tax Agility has been part of with businesses in the Richmond, Putney and surrounding London areas. However, as the saying goes “the devil is in the detail”. Key aspects of any business sale need to be carefully prepared so as to provide a fair representation of the business’s health and outlook that can be presented to prospective buyers.

This article takes a look at some of the specific areas that Tax Agility pays close attention to when supporting the sale and how we can help businesses create a package of information ready for presentation to a prospective buyer. We can even assist with the presentation of the material in a professional manner too.

What’s my business actually worth?

Quite understandably, a business owner’s first thought and maybe that which prompted thoughts of selling in the first place, comes down to their perceived value of the business. Emotions can run a little high and lead to over optimistic expectations, especially with smaller businesses. This is why it is important to have professionals on hand who can review your business’s operating position and provide a fair view on market value.

Quite understandably, a business owner’s first thought and maybe that which prompted thoughts of selling in the first place, comes down to their perceived value of the business. Emotions can run a little high and lead to over optimistic expectations, especially with smaller businesses. This is why it is important to have professionals on hand who can review your business’s operating position and provide a fair view on market value.

The process of valuing a business is multifaceted. There are simple ‘rule-of-thumb’ guides that can help you. Often though, these are only suited to companies that have an established track record. One in particular is P/E (price/earnings ratio), or multiples of profit or EBITDA to arrive at an enterprise value. The multiple used depends on the market conditions and desirability of the sector the business is in. The other simple way to value a business is simply to assess its ‘assets minus liabilities’.

However, these are just snapshots of the business and don’t take into consideration a host of other factors, such as the business’s prospects going forward, or what the current owners plan to leave in the business, such as cash and other assets. Plus, of course, sellers have a number of ways in which they can make a business look more attractive than it actually is. An example here would be the timing of the sale where seasonal cash flow variations in working capital can influence the value of the business on first glance.

Areas where Tax Agility can assist

To present as fair a view as possible of the business’s financial operating position, it’s important to establish some baselines - or ‘normalisations’. These are essentially financial views that try and iron out variations that could cause significant shifts in aspects such as working capital.

In assisting the business sale process, we focus on:

- Acting for vendors and purchasers of businesses.

- Reviewing your business records to ensure they are in the best possible shape for due diligence by the buyer.

- Assistance with the drafting of normalised earnings schedules to determine your true underlying earnings on which to base the valuation.

- Assistance with the drafting of net debt schedules, which are required in cash free, debt free valuations of businesses.

- Assistance with the drafting of normalised working capital. This is necessary to ensure the valuation is accurate and that there is sufficient cash headroom in the business.

- Management accounts while the business is being sold. Monthly management accounts may be required to give potential suitors crystal clear visibility, affording them the confidence in presenting their bids.

- Although we are not solicitors we will review the legal mechanisms in sale and purchase agreements and the accounting representations and warranties, which should be reviewed by a suitably skilled accountant.

- We explain to vendors the different ways a company can be sold and the underlying tax implications of each. This includes a sale of the shares of the company the vendor owns, or as a sale of the assets and liabilities of the company, leaving the cash shell of the company in the vendor possession.

Will your business records stand up to due diligence?

Any potential buyer is going to want a full view of your company and as such, if they are really serious about buying (or investing) in your firm, they will want to conduct a due diligence audit as part of the sale closure process. This can be an extensive process, depending on the size and scale of your business. Nevertheless, undertaking one should be seen as a positive sign, but you must have prepared for this.

What will the due diligence process involve?

The simple answer is, everything, literally - from the business itself, its commercial and legal contracts, its assets and its people.

The type of company involved will of course dictate where the process may spend more time. For example, if you are a technology development company, focus may lie with ongoing development contracts, overseas facilities or contracts, ownership rights to key technology IP, technical competence in the company in the form of key personnel, etc. Generally though, the typical areas that detailed information will be requested on are:

- Operations - typically everything from your products and services, manufacturing processes, product warranties, ongoing contracts with suppliers and other third parties, pricing, client contracts, profit margins and the company’s infrastructure, such as IT, software, etc.

- Financials - cash flow statements, P&L, balance sheet, shareholdings, share valuations, expenses, debt, equity, depreciation and financial projections.

- Asset base - from property, fixed and variable, equipment and Intellectual Property.

- Compliance - financial returns, e.g. tax and VAT, insurances, any licences, any environmental issues.

- Human Resources - company structure, external consultants / employees, executive and board bios, employee salaries, employee handbook, benefits, pension plans / policies, disputes, etc.

- Sales and marketing - current programs and performance, budgets, etc.

This list is only meant to provide a perspective on what types of information will likely be requested. Based on your business type, Tax Agility will take a thorough look at the information that will likely be requested. We will work with you to ensure information pertaining to all the areas of interest are available and presentable.

Drafting of normalised earnings schedules

During a financial year there can be many financial events that impact a company’s apparent earnings. While there may be regular income from client contracts and investments, there can also be non-recurring exceptional income events, such as an asset disposal. On the flip side, there can be one-off non-recurring expenses such as a directors bonus payment, or the settlement of a legal claim. Furthermore, the nature of the business may be seasonal, meaning at any given time, the earnings position of the company may appear artificially high or low because most orders come through during a particular time of year or that suppliers may not have been paid. This variability makes it hard for potential purchasers to get a real feel for the business’s earnings over a year.

Normalisation, therefore, seeks to remove income or expenses that are exceptional or unusual, in other words, events that the new owners may not reasonably expect to pay. The process of doing this helps smooth out the effects of those events, presenting a normalised trend to purchases giving greater accuracy towards projecting future earnings and therefore the potential enterprise value of the company

TaxAgility will work through your operations and accounts to identify such events and produce a normalised earnings schedule (adjusted) showing earnings over the current year and usually two preceding years.

Drafting of net debt schedules

The amount of debt a company carries affects cash flow, as interest expense flows into a company’s income statement. The debt balance appears on the balance sheet and the repayments the business makes on the principal sums owed flows through the cash flow statement. It’s therefore essential to make sure the debt a company carries and its impact on the company’s operations is clear to any prospective purchaser. This is where a debt schedule is key.

Many businesses are sold on a cash free, debt free basis, meaning the enterprise value of the business is calculated by computing enterprise value and deducted net debt.

Enterprise value is computed by multiplying sales or earnings or EBITDA by a suitable multiple (sales multiple, earrings multiple or an EBITDA multiple).

Adding the net cash in the business or deducting the net debt, from the enterprise value, to reach a net consideration for the share capital of the company.

Types of debt that is shown in the debt schedule include:

- Loans

- Leases

- Bonds

- Debentures

Tax Agility will assist in creating a Debt Schedule. This seeks to provide a realistic view of a company’s debt position, It shows debt based on its maturity and helps a prospective purchaser construct their own cash flow forecast and to structure the sale in the most sensible way.

Drafting of normalised working capital

Working capital, or rather ‘net working capital’, is the money relating to stock, accounts receivable and accounts payable left in your business, excluding Net Debt items.

Cash flow shows the ‘ebbs and tides’ of money coming in and going out relating to earnings, working capital movements, investments and disposals, shareholders withdrawals and injections and movements in net debt, over a specific period.

If your business income suffers a setback, such as losing a major client or through a wider economic downturn, it’s the cash or cash-like assets that you’ll need to turn to in order to ride out the problems. This is your working capital.

Normalising your net working capital takes into account the typical day-to-day fluctuations in levels of working capital the business experiences so as to provide a fair view. A business may experience seasonal swings in working capital too, this is also factored in. A normalised view can then be used when valuing the business. If this isn’t done, then irregularities can occur, such as the temptation by a seller to over value working capital by delaying certain payments. This would artificially increase cash equity value.

Tax Agility will walk through your working capital requirements and trends to produce a fair view taking into consideration all of the factors (and more) discussed above.

Management accounts while the business is being sold

The sale of a business can take some time depending on the size and scale of the business concerned. Meanwhile, normal business activities continue. It’s essential during this period to maintain a tight management view on the business’s operations, so as not to impact the due diligence audit taking place unduly, or as a tools to inform them of any important changes taking place, such as supplier or client changes, unforeseen cash or capital expenditure, perhaps due to unscheduled maintenance needs.

Management reports are a key part of any business’s reporting mechanism. They show a period by period (weekly, monthly, etc) snap-shot of changes in the business financial status. A typical management report can include:

- Executive summary

- Profit & Loss

- Budget variance

- Balance sheet

- Aged receivables

- Aged payables

- Cash summary

You can read more about the importance of management accounts and reporting in our article here:

How can management accounts be used effectively?

Check out our other article on exiting a business here.

Conclusion

The process of selling a business is a multifaceted operation, one that can distract a business from its normal day to day activities. It’s essential to be prepared well before any potential suitors begin their due diligence process. In this way, you will minimise the impact on the business and make the due diligence process proceed faster and more efficiently. Resolving any deficiencies can increase the value you realise for your business by unlocking its true underlying value.

At Tax Agility our goal is exactly this - to prepare your business for sale and assist in making the due diligence process as painless as possible. Ultimately, we want to help you extract the maximum possible value out of the sale of your business as effortlessly as is realistically achievable.

Call Tax Agility’s business sale specialists today on 020 8108 0090 and discuss how we can help in the sale of your business.

Super deductions - how to maximise your business’s tax efficiency

Most business owners understand that it is important to ‘capitalise’ certain company assets. These ‘fixed assets’ can be used to reduce your corporation tax bill. However in April 2021, the Government increased the usual 100% deduction to 130% until April 2023. Read on to find out how you could benefit from this increase.

What is a super deduction?

Over the years, successive governments try to find ways to incentivise industry or stimulate areas of business. This is especially true during troubled times, such as the financial crisis of 2008 and more recently the problems brought on by the Covid pandemic.

Over the years, successive governments try to find ways to incentivise industry or stimulate areas of business. This is especially true during troubled times, such as the financial crisis of 2008 and more recently the problems brought on by the Covid pandemic.

Reducing broad ranging tax rates, such as reducing corporation tax, VAT, capital gains, etc, introduce problems of their own, most often political, as they can appear to favour selective groups in society, so governments look for more niche methods to achieve their aims. The ‘super deduction’ is one of them, as this applies purely to businesses that qualify for corporation tax. It’s also limited in its range, as it can only be applied to new plant and machinery that ordinarily qualify for the 18% main pool rate of writing down allowances.

How does this affect the Annual Investment Allowance?

Essentially, it compliments it. Since January 1 2019, companies have been able to annually invest up £1 million in qualifying assets, these already benefit from 100% relief. This is known as the ‘Annual Investment Allowance’. Prior to 2019, the AIA was set at £200,000.

The £1 million limit has been extended to March 31 2023. The Introduction of an extra 30% deduction is, therefore, a most attractive additional incentive for owners to invest in their businesses - or even start new ones.

What is the SR Allowance that was also announced?

Along with the Super Deduction, the Government also introduced the SR Allowance.

Not all purchases can qualify for the super deduction, such as those that qualify for the 6% write down allowance rate - typically long life assets such as those associated with buildings and property. To incentivise this industry, the Government has introduced a ‘special rate for first year allowance’ - the SR allowance. This affords new plant or machinery in this bracket with a 50% first year allowance.

What businesses qualify for Super Deduction?

This benefit is only available to those entities who qualify for corporation tax. In other words, it is not applicable to those in business as individuals, sole traders, or partnerships.

What purchases qualify for the Super Deduction?

There are a wide range of asset types that can take advantage of the SD beyond the most obvious forms of fixed assets, such as computers, IT systems, manufacturing equipment and the like. In short, most purchases that contribute to the operation and functioning of your business should be treated as an asset, rather than an expense, and capitalised accordingly.

However, there are other less obvious expenditures that can close be capitalised and gain SD relief. The most common of these include:

Development costs: Under FRS 102 costs associated with bringing a system into working condition, such as those attributed to the development, can be classified as tangible fixed assets. For example, developing a new website or piece of software, could be treated as such and gain the SD allowance benefit.

Borrowing costs: When developing a new product or building a new manufacturing plant or product line, a business may be required to finance the operation. The costs of borrowing may be capitalised.

Hire purchase: Assets on hire purchase or similar purchase contracts where possession rather than ownership passes to the business can also benefit from super deduction, but only at the point where the asset began use.

The most obvious test of applying the SD benefit is that the purchased plant or machinery needs to be new and not second hand. Also, you cannot decide to capitalise something bough in prior accounting periods just to take advantage of the SD.

What happens if I don’t make a profit, can I still apply the Super Deduction?

Yes. Not all businesses make a profit each year. Indeed, some businesses may choose to capitalise equipment porches in a financial year specifically to reduce their tax bill to zero - typically smaller businesses. If you make a loss in a year where capital purchases were made, you may carry any unused deductions forward to use as losses.

Yes. Not all businesses make a profit each year. Indeed, some businesses may choose to capitalise equipment porches in a financial year specifically to reduce their tax bill to zero - typically smaller businesses. If you make a loss in a year where capital purchases were made, you may carry any unused deductions forward to use as losses.

Selling an asset that qualified for Super Deduction

It may enter the minds of some that as the government is giving away an extra 30% in the form of a tax deduction, which is true, if they quickly sold the purchase, they may benefit further. Also, there are legitimate reasons why a firm may have to sell assets that benefited from the SD. So what happens and how is this accounted for?

Naturally, the Government is going to want their ‘pound of flesh’ in this instance. You will need to carefully track any asset that benefited from the SD, so when it comes to selling the correct treatment can be applied.